The 2024 OPIS Chicago Biofuels Forum – Top 3 Takeaways

The OPIS 2024 RFS, RINs & Biofuels Forum brought marquee names in the renewable fuels world to the platform again this year, drawing 250 delegates to Chicago. This annual conference is a good way to keep up on happenings in the biofuels industry.Below is the annual countdown of my top 3 takeaways from this year’s conference:

See the other posts in this series, Top 3 Takeaways:

Number 3) Seasonal stress

The 4th quarter brings heightened stress in the biofuels world, especially in Presidential election years. What’s causing headaches these days?

- A high bar on the cellulosic biofuel mandate

- An urgent need to register biogas players

- Tax credit uncertainties

- Renewable diesel margins

Attendees got up-to-date on all these topics through several presentations and panel sessions that examined them from all angles.

One panelist, near the end of the conference, summed things up by saying “this is a difficult place to work”.

This is a difficult place to work”

a panelist at the 2024 opis RFS, RINs, and Biofuels forum

Number 2) Cellulosic surprise?

With ethanol and biobased diesel fuels now well established businesses, what will bring the next wave of growth in biofuel use? Sustainable Aviation Fuel (SAF) has claimed that spotlight for many years. But the scale-up of SAF is playing out slower than advertised.

Is SAF stalled, and what could possibly take its place in the spotlight?

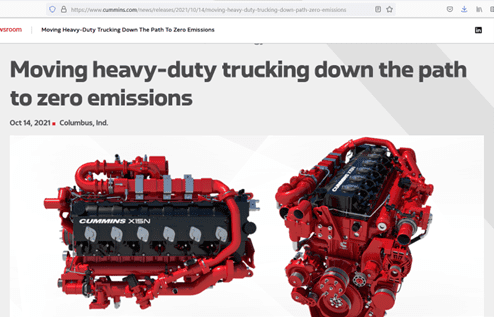

Maybe cellulosic biofuels. I was surprised to learn that Cummins has big inventories of these slick looking new natural gas-fueled engines ready and waiting to power heavy duty trucks:

And Southwest Airlines, among many others, are investing in new plants promising to cut production costs for diesel and jet fuel from cellulosic feedstocks.

The price of the D3 cellulosic biofuel RIN is causing stresses by climbing to potentially unlimited heights. How high must it climb to stimulate new cellulosic biofuel supply (which, after all, is its fundamental purpose)?

Natural gas fueled trucks are not new. Commercial truck fleets are in a competitive business that’s highly sensitive to fuel costs. With additional economic incentives from a higher D3 RIN price, they could quickly make the move to natural gas-powered vehicles.

Number 1) RIN realities

This is my highlight topic for personal reasons – because Renewable Identification Number (RIN) pricing and economics is my specialty and the only reason I work in the renewables segment of the fuels market.

This year again, I spent much time discussing RIN realities with attendees. The discussions did nothing to change my long-held view the market is seriously confused by the complexity of the primary instrument that controls its economics.

Seriously confused describes my condition four years ago when my attention was drawn to biofuels by how RIN confusion was dominating the entire U.S. fuels landscape.

But my claim the market is confused is not popular. Most ignore it, or deny it, and many adamantly reject it, even though misunderstood workings of the RIN have unquestionably caused more stress and headaches than anything else in the business.

The ATTRACTOR spreadsheet is the cure. It brings opportunity to those willing to embrace reality and master the RIN’s complexities.

Recommendation Get Hoekstra Research Report 10

It includes the ATTRACTOR spreadsheet which calculates D4T, the theoretical value of a D4 RIN, using economic fundamentals. Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market Renewable Identification Number (RIN) prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.