Breaking the chains part 3 – Late demand for Tier 3 credits drives credit price up 5-fold in 2022

If you buy premium gasoline you’ve probably noticed its price differential versus regular has been increasing. That is a sign of the rising value of octane which is the primary yardstick of gasoline quality and price. This blog series is about a new gasoline sulfur specification called Tier 3 which is causing lower octane quality of a refinery stream that makes up 40% of the US gasoline supply. In today’s 3rd and final episode of the series, we provide an analysis of a currently obscure credit trading system called the Tier 3 Sulfur Credit Averaging, Banking, and Trading (ABT) system. The price of these Tier 3 sulfur credits quintupled in 2022, which is another sign of a tight octane market that will be drawing increased attention in coming months and years.

In Part 1 of the series, we detailed how the price of octane — the primary yardstick of gasoline quality and price — has marched steadily higher over the past decade, led by a market now impacted more by demand than production costs. Just as octane demand has been increasing, however, a number of factors have been tamping down octane supply and recently spurred a run-up in the retail “price” of octane, measured by the difference between the pump prices of premium and regular gasoline, which has gone from a 20-cent differential to 90 cents per gallon.

In Part 2, we focused on a critical refinery stream called fluid catalytic cracker (FCC) gasoline. The new Tier 3 sulfur specification requires that this refinery stream, which makes up 40% of the U.S. gasoline supply, must be severely desulfurized to remove 99% of the sulfur it contains. That is necessary to meet the Tier 3 gasoline specification which requires an average of not more than 10-ppm sulfur in all finished gasoline sold in the United States. This desulfurization step is where the connection between octane and sulfur enters the picture. The problem is that such severe desulfurization reduces the octane quality of the FCC gasoline and this octane deficit causes a major problem for those who must meet both sulfur and octane specifications when blending the finished gasoline. Refiners can make capital investments to break the chains that now constrain octane production, or they can adapt to the new Tier 3 constraints with workarounds that translate into lower gasoline production and higher cost of US-spec gasoline. The workarounds and their consequences are occurring in many refineries today and they all stem from the lower octane quality of FCC gasoline caused by the need to remove 99% of its sulfur for Tier 3.

The Sulfur Credit Averaging, Banking and Trading Program

The Tier 3 Sulfur Credit Averaging Banking and Trading program allows refineries to make gasoline as high as 80-ppm sulfur if they buy credits to offset the amount their annual average sulfur exceeds the 10-ppm specification. If more octane-constrained refineries do this, they can reduce desulfurization severity and save many billions of dollars per year of octane quality that is currently being destroyed.

The Tier 3 sulfur credit system was designed to tie in with the previous Tier 2 system which had established a 30-ppm annual average sulfur and 80-ppm per gallon sulfur cap for refineries and importers beginning in 2004. The system allows compliance through intra-company and inter-company trading of credits for low sulfur fuels produced in compliance with the requirements. Beginning January 1, 2012, refiners and importers could generate gasoline sulfur credits which could be banked or transferred to other refiners and importers for compliance with either Tier 2 (through 2016), or Tier 3 (beginning in 2017). Sulfur credits are measured in ppm-gallons. For example, beginning Jan 1, 2017, a refiner or importer who produced or imported 1 gallon of gasoline containing 7-ppm sulfur could generate and bank 3 ppm-gallons of sulfur credits. A credit generator may bank credits for future use or transfer them to another refiner or importer who would use the credits if their annual average gasoline sulfur exceeded 10-ppm beginning in 2017. Tier 3 sulfur credits may only be transferred twice between refiners and importers. Credit generation is prohibited for oxygenate blenders, transmix processors, transmix blenders, butane blenders, and pentane blenders.

Refineries or importers whose annual average gasoline sulfur exceeds 10-ppm beginning in 2017 are allowed to carry-forward a credit deficit for 1 year, but at the end of the subsequent year must meet the 10-ppm standard for both years.

Analysis of sulfur credit supply, demand, and price

For a refinery considering their sulfur credit strategy, the economic analysis obviously depends on the sulfur credit price, which is determined by supply and demand. Those developing the strategy need not work in the dark. By analyzing available data it is possible to make well-informed judgements on where things are headed.

On the supply side, the sulfur credit market has now reached a condition where the only usable credits are those earned by making sub-10-ppm sulfur gasoline. The Tier 3 10-ppm specification became effective January 1, 2017 for most refineries. But the years 2017 through 2020 were special cases when it was not difficult or costly to comply with the Tier 3 rules. That’s because, in 2017, 2018, and 2019, the credit market was awash in a glut of cheap credits earned under the Tier 2 system which were, by rule, still usable against the 10-ppm sulfur specification until Jan 1, 2020.

in 2017, 2018, and 2019, the credit market was awash in a glut of cheap credits earned under the Tier 2 system which were, by rule, still usable against the 10-ppm sulfur specification until Jan 1, 2020.

That was like a loophole that allowed refiners to continue making Tier 2 gasoline (up to 30-ppm average annual sulfur) during 2017, 2018, and 2019 while complying with the Tier 3 requirement using cheap old credits, which most refiners did to avoid the Tier 3 compliance cost.

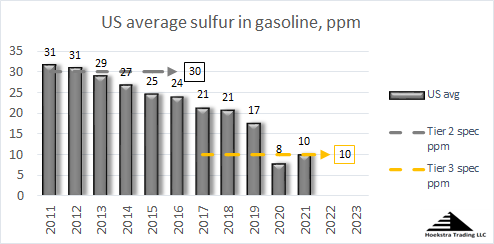

This delayed reaction to the 2017 Tier 3 implementation is seen in the data on Figure 1 which shows the U.S. average gasoline sulfur readings in 2017, 2018, and 2019 were 21, 21, and 17 ppm, far exceeding the then-effective 10-ppm maximum. In 2020, when those cheap old credits expired, the average sulfur on the physical gallons nosedived to 8-ppm, over-performing against the goal.

But 2020 was also a special case because refineries were running at pandemic lockdown-speed, which means slow, and it is easy to make 10-ppm sulfur gasoline without losing octane when running so slow. The first real test at near-full speed was 2021. That data, just released December 15, 2022, shows 56% of 2021’s gasoline was at or below 10-ppm sulfur, 44% was above 10-ppm sulfur, and the average was 10.04-ppm, hitting the target right on the nose. The data for an even more challenging 2022 won’t be publicly available for many months.

Credit supply

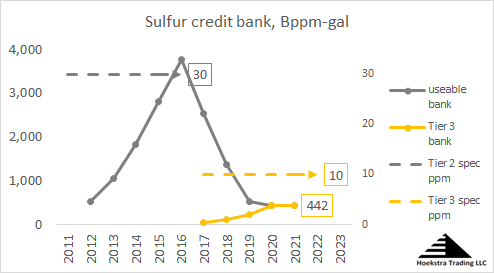

Figure 2 shows the supply of usable sulfur credits since 2012. Usable means the credits were available for use that year to offset an annual average gasoline sulfur level above that year’s specification. Credits are shown here in units of billions of ppm-gallons.

Gray denotes Tier 2, with a specification of 30-ppm in effect from 2012 through 2016, and the gray data points showing the contemporaneous bank of usable credits that had been earned against the 30-ppm specification. Gold denotes Tier 3, with the specification of 10-ppm in effect since 2017, and the gold data points showing the contemporaneous bank of new Tier 3 credits earned against the 10-ppm specification.

The gray bank balance for 2016 shows the glut of nearly 4 trillion ppm-gallons of credits that accumulated while the U.S. average sulfur was on a glide path down from 30-ppm to 20-ppm. By rule, these cheap old credits, which had been earned against the 30-ppm specification, could still be used against the 10-ppm specification until Jan 1, 2020. Figure 2 shows how this bank of cheap old gray credits was drained during 2017, 2018, and 2019 to finance a delayed reaction in meeting the new 10-ppm specification on the physical gallons. Simultaneously, from 2017 through 2019, a small balance of gold credits started forming from a small rate of production of sub-10-ppm gallons.

The current and future state is defined by the gold data. Credits can only be earned by making a sub-10-ppm annual average gasoline pool, which is a difficult and costly feat for many North American refineries. And we start with a bank of 442 billion ppm-gallons of useable credits, which is a newly-available number for 2021 (calculated from the December 15, 2022 data dump) that stands in stark contrast to a now-defunct trust fund of nearly 4 trillion credits.

Those responsible for their company’s credit strategy should be using this information on the history of aggregate credit supply to anticipate foreseeable effects of the recent step-change on the supply side of the ledger.

Credit demand

On the demand side, we still don’t know how octane-bottlenecked refiners will decide to use the new credits in the future. In theory, a supplier should buy credits when the credit price is less than the supplier’s incremental cost of compliance, and produce credits when it is the other way around. As a rule, future credit demand will therefore be determined by refiners’ Tier 3 compliance cost, and, in particular, how that cost varies across the population of suppliers. For refiners, compliance cost is mostly determined by octane destruction, which we know, from field testing, varies widely across U.S. refineries. A constantly growing data base of commercial field tests, gathered over the last 7 years, shows high octane destruction is occurring in U.S. refineries when FCC gasoline desulfurizers are pushed to make 10, versus 30-ppm sulfur product. That field test data indicates a severely bottlenecked refinery’s compliance cost can be 10 times higher than the average producer’s compliance cost, while the best-equipped refineries have compliance cost near 0. This wide range of compliance cost implies big opportunities exist today in the sulfur credit market, especially for those in the high and low cost tails of the compliance cost distribution.

Sulfur credit price

Concerning Tier 3 credit price, it increased from below $500/million ppm-gallons in 2017 to $3,500 in late 2019 when the market was awakened to the large gap between the actual and mandated gasoline sulfur level shown in Figure 1. After that whirlwind of attention in late 2019, the 2020 lockdowns caused credit demand to dry up, the credit market retreated to the background, and the price collapsed to a low of $175 in November 2020. In 2021, after some bumps up-and-down, it finished the year at $325. In 2022, demand remained sluggish until May when new buyers appeared driving the price up to $925 in June and then to $1,500 in November 2022, quintupling for the year.

Opportunities for astute refiners and traders

Discussions with dozens of North American refiners indicate most have been treating the Tier 3 specification as a hard requirement, meaning they have been focused on doing whatever it takes to meet the 10-ppm specification on their own regardless of the true cost or financial opportunity provided in the credit market. This theory is supported by credit trading data which shows a very thin market in which a small spurt of demand can double or triple the price in a matter of weeks. This credit market status is likely to change in coming months and years.

The measured wide variance in Tier 3 compliance cost implies a credit price much higher than the current price

The measured wide variance in Tier 3 compliance cost implies a credit price much higher than the current price, meaning lucrative opportunities exist today for refiners and importers with a well-informed, forward looking strategy.

Recommendation

Every refining executive should have a comprehensive understanding of the technical, regulatory, and economic aspects of Tier 3 gasoline, the sulfur credit program and how they affect your business. Those wanting a quick education on the Tier 3 issue should get the short book, Gasoline Desulfurization for Tier 3 Compliance, which will make you an industry expert in a day. Once you have become expertly informed of the problem, you can save your team years of research by buying Hoekstra Research Report 8. We saw this problem coming, gathered the required data, ran the simulations and analyzed the results so you and your team can immediately initiate well-informed strategies. The report includes detailed pilot plant and commercial field test data, full detail of sulfur credit pricing, spreadsheet models to help improve gasoline optimization, investment decisions, sulfur credit strategy and refining margin capture in the Tier 3 world.

Don’t get caught panic buying after the credits spike.

George Hoekstra

George.hoekstra@hoekstratrading.com

+1 630 330-8159