Revisiting RIN Cost Pass-through Part 4 – Will the Litigation Ever End?

See other episodes in this series:

- Part 1 – Two Camps

- Part 2 – How is the RIN Tax Different From a Sales Tax?

- Part 3 – The RIN Tax Passes Through Just Like a Sales Tax

- Part 4 – Will the Litigation Ever End?

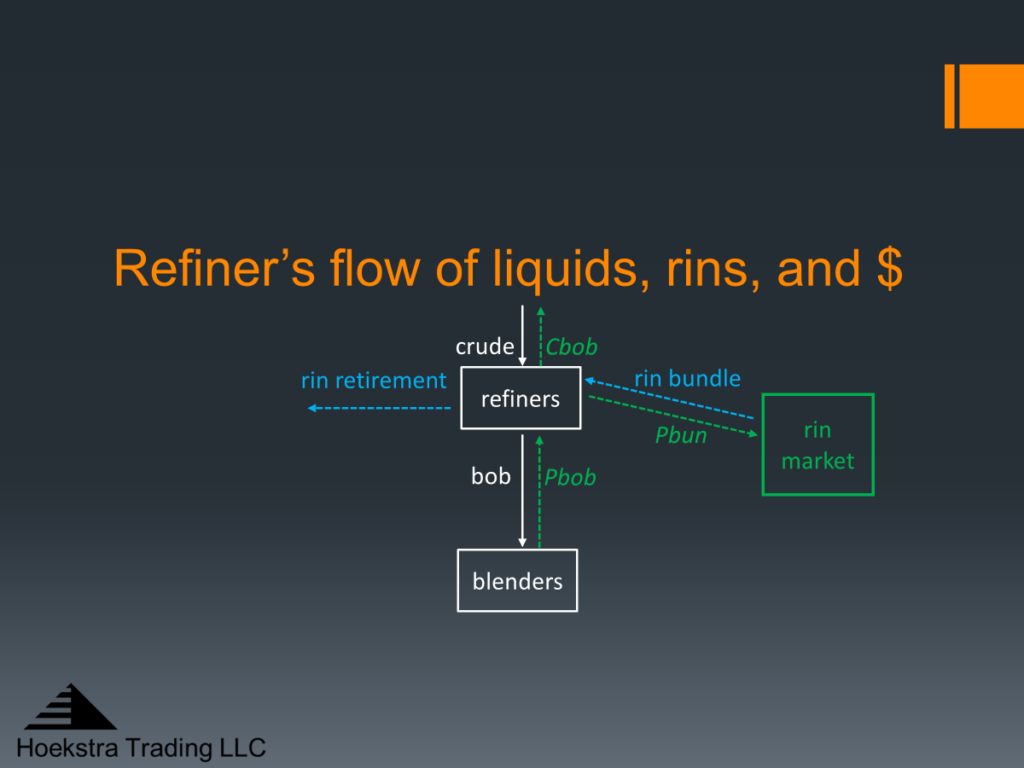

This four part blog series focuses on the flow of streams (white), RINs (blue), and dollars (green) depicted in Figure 1 below and has addressed 2 questions about it:

- How is the “RIN tax” situation pictured in Figure 1 different from a sales tax on gasoline?

- If the RIN tax (denoted Pbun in Figure 1) doesn’t go to the government, then where does it go?

The answer to the first question was given in Part 3 last week. There is no fundamental difference because the RIN tax, like a gasoline sales tax, affects all suppliers by the same per gallon amount. The RIN tax passes through and increases the equilibrium market price of BOB (denoted Pbob in Figure 1) in the same familiar way that a sales tax on gasoline passes through to us consumers. This is true even though it is the supplier who is obligated to pay the tax.

Now on to the second question, where does the RIN tax revenue go? Figure 1 shows it goes to the “RIN market”. Where does it go from there? The answer is it goes to subsidize production of biofuels that would otherwise not be economically viable.

This answer directly contradicts alternative answers claiming that it becomes a windfall profit for blenders, or integrated refiners, or retailers, or other non-obligated parties in the supply chain, at the expense of small independent refiners.

The mechanism by which the tax passes through and morphs into a subsidy is confusing. It is explained in detail in other articles published on the RBN Energy blog. But to describe that mechanism requires getting into the weeds to a degree that confuses and loses many people.

Here is an easy way to see the RIN tax indeed passes through to fund the RIN subsidy without needing to get into the weeds. Biofuels like renewable diesel are being supplied today as a direct substitute for petroleum diesel. In rough, round numbers, renewable diesel costs $5.00/gal to produce and it sells for $2.00/gal. How do renewable diesel producers make money selling a product that costs $5 for $2? This would not be possible if the RIN tax didn’t pass through the supply chain to fund a subsidy for renewable diesel, as the RIN system was designed to do, and as is predicted from economic theory.

If the RIN tax is not funding that subsidy by passing through the supply chain, then what is? And how is its value getting from point A to point B to pay producers enough to justify biofuel production?

This, and an abundance of other evidence shows plainly the RIN tax does pass through to subsidize biofuel supply, in direct contradiction to the claims that it funds windfall profits for blenders and other non-obligated parties.

This is why I call the dispute over small refiner exemptions (SRE’s) a misunderstanding instead of a disagreement. It is a misunderstanding caused by the complexity of the RIN.

Unfortunately, the misunderstanding has been relegated to the courtroom which is a notoriously nonproductive, costly place to clarify misunderstandings. It may be a suitable forum for settling otherwise irreconcilable disagreements and disputes, but not for clarifying misunderstandings. We are now in the 11th year of litigation trying to clarify this misunderstanding by a method unfit for the purpose, which, by my reckoning, is costing, in rough, round numbers, $100 million per year.

This raises a third question that I cannot answer and so must leave for someone else:

3) What is stopping the Small Refiners’ Coalition and the C-suites of its members from clearing up this misunderstanding in the boardroom instead of perpetuating a futile,11-year, billion dollar courtroom dispute being funded by their shareholders and U.S. taxpayers with no end in sight?

Recommendation

1) Get Hoekstra Research Report 10

Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market RIN prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.