What’s Next For Cellulosic Biofuels and the D3 RIN Part 2 – The Biogas Solution

Read other posts in this series: What’s next for cellulosic biofuels and the D3 RIN?

- Part 1 – The Market That Fizzled

- Part 2 – The Biogas Solution

- Part 3 – Rewind to the Fast Crash of Kior, a Cellulosic Biofuel Company

- Part 4 – Fueling Heavy Duty Trucks With Fuel From Cows

- Part 5 – Impact of EPA’s Partial Waiver on the D3 RIN Price

- Part 6 – Quantitative Theoretical Modeling of RIN Prices

- Part 7 – D3 RIN Price – Is The Market Off By a Factor of Ten?

- Part 8 – A New Industry Emerges

- Part 9 – Tracking the D3 RIN price

A main objective of the Renewable Fuel Standard (RFS) in 2007 was to trigger development of at least 16 billion gallons/year of transportation fuel made from cellulosic biomass. Cellulosic biomass consists of non-food crops and waste biomass like corn stalks, corncobs, straw, wood, and wood byproducts.

But high costs and other barriers to large-scale production of liquid fuels from these feedstocks proved much higher than had been anticipated when the Renewable Fuels Standard was enacted. As a result, the targeted 16 billion gallons per year of cellulosic biofuel never materialized.

Waiver workaround

Because this market never got off the ground, from 2010-2022, EPA reduced the mandated minimum volume of cellulosic biofuel to a small fraction of the statutory volume and set up a special credit called a cellulosic waiver credit (CWC). The CWC was an effective workaround enabling petroleum fuel producers to comply with the cellulosic biofuel volume mandate despite there being very little cellulosic biofuel production.

See Part 1 of this series for an explanation of the CWC including details on how its price set up an interplay with the advanced (D5) RIN and the cellulosic (D3) RIN, and for how the suspension of the CWC has caused new stresses in the biofuels world.

Biogas

Meanwhile, while efforts to grow cellulosic liquid fuels fizzled, there was growth in production of compressed natural gas and liquefied natural gas (CNG/LNG) derived from biogas that comes from landfills, sewage and waste treatment plants, and animal manure digesters.

That biogas is mostly methane that, in the past, has been flared, used to produce electricity, or emitted from landfills and animal waste to the atmosphere as a source of greenhouse gas emissions.

In response to input from industry and other sources, EPA added a pathway for CNG/LNG derived from biogas coming from landfills, municipal wastewater treatment facility digesters, agricultural digesters, and separated municipal solid waste digesters, as well as biogas from the cellulosic components of biomass processed in other waste digesters, to generate cellulosic biofuel (D3) RINs to the extent that CNG/LNG is used as transportation fuel.

As things developed over time, this route to making CNG/LNG from biogas became the dominant way to generate D3 RINs.

Today, 95% of cellulosic RINs are generated by production of biogas from landfills. There are over 2000 landfills in the United States that could theoretically produce biogas, to be upgraded to pipeline quality natural gas, that would be eligible to earn D3 RINs.

D3 RINs are also generated by producing biogas from anaerobic digestion of animal manure. Large dairy firms are the top source of this biogas. That business is also ripe for expansion. Aemetis, Inc., California’s largest biofuel producer, has a business segment producing and transporting dairy biogas from a network of 9 dairy farm digesters. This business segment started producing positive cash flow in the 2nd quarter of 2024 and is expecting to realize substantial increase in cash flow in 2025.

Aemetis has aggressive long term plans to expand this network to capitalize on subsidies from California’s low carbon fuel programs, the federal producer tax credit and RINs in coming years, supported by United States Department of Agriculture loan guarantees.

D3 RIN price

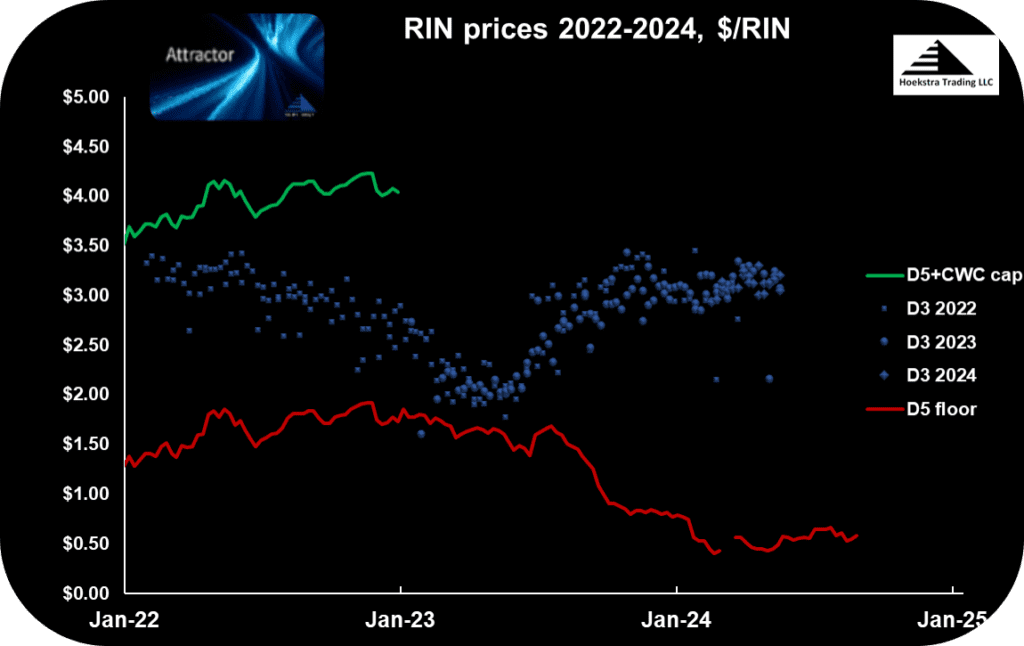

As described in Part 1 of this series, the expiration of the CWC has now changed the game for pricing of the D3 RIN. Figure 1 shows the recent interplay between the prices of the D5 RIN (red), a theoretical minimum, the D3 RIN (blue), and the sum of the prices of the D5 RIN and the currently suspended CWC (green), a theoretical maximum, for the D3 RIN.

As things stand, if the rate of cellulosic biofuel production is below what’s required to meet the cellulosic volume mandate, then, in theory, the D3 RIN price will increase to stimulate increased production until the production rate of cellulosic fuels reaches the rate required to meet the mandate. In the near term, it seems that biofuel volume will come in the form of CNG/LNG produced from landfills and dairy farms.

And the most likely place for it to be used for transportation is in natural gas fueled heavy duty vehicles, which is the topic of the next blog in this series.

Recommendation Get Hoekstra Research Report 10

Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market Renewable Identification Number (RIN) prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.