Comparing Theoretical and Market Renewable Identification Number (RIN) Prices Part 4 – Over-Reaction to Regulatory Policy Changes

Read other blogs in this series – Comparing Theoretical and Market RIN Prices:

- Part 1 Three Factors

- Part 2 How Well Do RIN Market Prices Track With Economic Theory?

- Part 3 Anticipating Changes in Tax Subsidies

- Part 4 Over-reaction to Regulatory Policy Changes

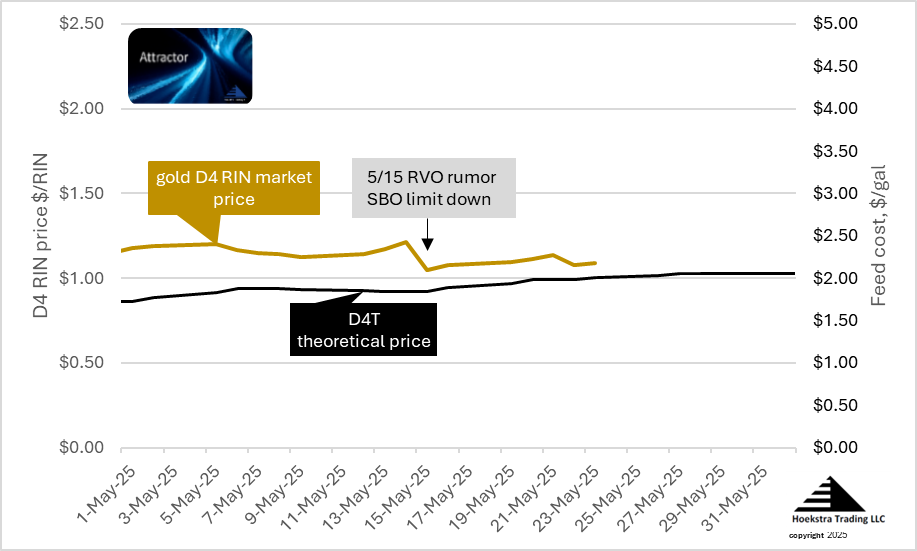

A May 15, 2025 rumor said the Renewable Volume Obligation (RVO) levels for biobased diesel for years 2026 and following would be set at less than 5 billion gal/y, at a time when the market was expecting it will be a higher number. That drove the price of soybean oil futures down by the daily limit (because soybean oil is a feedstock for making biobased diesel).

The gold data in Figure 1 shows the market price of the D4 RIN also fell on May 15, and it has not yet recovered to its pre-rumor high.

The black line shows the D4T theoretical price rising through May. That rise is driven by the rising cost of biobased diesel feedstocks.

This quote from Part 1 of this blog series could be in play here:

In five years analyzing theoretical vs. market RIN prices once each week, we have discovered a consistent bias toward the market over-reacting to announcements of regulatory policy changes, while under-reacting to other changing factors that affect RIN prices. This has happened many times, with near 100% reliability.

This occurred again recently in the case of the D3 RIN. In the case of the D4 RIN, the market price has historically over-reacted to announcements and rumors about the biobased diesel RVO level, and under-reacted to changing fundamental economic factors. That has been the case again through 2025.

Recommendation Get Hoekstra Research Report 10 and the ATTRACTOR spreadsheet

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.

George Hoekstra

+1 630 330-8159