Baby the RIN Must Fall Part 3 – The Odds and Timing of a Potential RIN Price Crash

An edited version of this post was published on the RBN Energy Daily Blog Aug 30, 2023. Read other blogs in this series Baby The RIN Must Fall –

- Part 1 What’s Behind The Chatter About The RIN Price Crashing To Zero?

- Part 2 Will a RIN Price Crash Make a Mess In The Renewable Diesel Market?

- Part 3 The Odds and Timing Of A Potential RIN Price Crash

- Part 4 D4 RIN Nosedives, Triggering a Flurry of Market Reactions

U.S. production of hydrogenated renewable diesel (RD), which is made from soybean oil, animal fats and used cooking oil, is growing faster than expected. That may sound like good news for the renewable fuels industry, but it comes with the fear that the rapid growth might push RD production levels well past the mandates set by the Renewable Fuel Standard (RFS), potentially triggering a sudden crash in Renewable Identification Number (RIN) prices that would rock the market. In today’s RBN blog, we estimate the likelihood and possible timing of such a market-shaking event.

As we discussed in Part 1 of this series, hydrogenated RD is a type of biomass-based diesel being produced either in greenfield facilities or in repurposed refinery units previously used to make petroleum-based diesel and gasoline. RD has quickly overtaken the other type of biomass-based diesel — FAME biodiesel — in market share. (FAME biodiesel is produced by reacting triglycerides with methanol to make oxygen-containing fuel molecules called fatty acid methyl ester, or FAME.)

In fact, RD’s rapid growth may soon bring U.S. biomass-based diesel supply beyond the mandated levels set by the Environmental Protection Agency (EPA). That would be uncharted territory for the fuels market, which has been under the grip of binding renewable fuels volume mandates for 10 years.

In Part 2 we analyzed the implications of crossing that boundary. Theoretically, it would trip a switch that would cause a decrease in the price of D4 (biomass-based diesel) RINs.

The RIN Cross-Subsidy

Recall from our Misunderstanding series that a RIN is a 38-digit number that’s generated when certain types of renewable fuels are produced. The RIN can then be unbundled and sold to producers or importers of non-renewable fuels to satisfy obligations under the RFS. If the supply of renewable fuel increases beyond the RFS mandates, prices for RINs would drop.

In other words, demand for a RIN depends on there being a shortage of biofuel supply compared to the applicable mandate, that shortage is what compels refiners to bid for that RIN, and refiners’ RIN purchases are what fund the subsidy. (This tax-and-subsidize scheme is called a cross-subsidy.)

If the aggregate supply exceeds all the necessary biofuel prescribed by the mandate, there would be no shortage and no economic demand for the RIN, and the RIN price would crash. The RIN currently provides a subsidy of $2.25 to $3.40 per gallon of bio-based diesel. If that subsidy were to wane, it could pressure the profitability of a whole block of suppliers.

As we’ve said many times in the past, a RIN is both a tax and a subsidy, and the RIN price indicates the size of subsidy needed to force renewable fuels into finished fuels. It also indicates the size of the tax needed to fund that subsidy, which is borne by petroleum fuel suppliers.

RIN Category Relationships

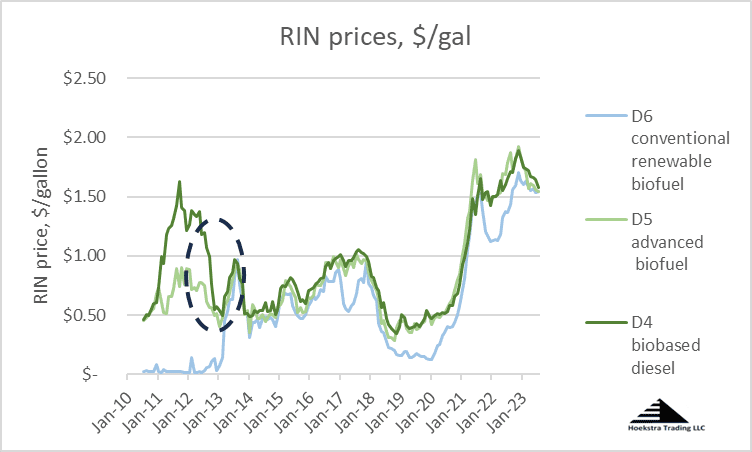

In theory, the D4 RIN price for bio-based diesel (dark-green line in Figure 1 below) should be higher than the D5 RIN for other advanced biofuels (light-green line) and than the D6 RIN for conventional renewable fuels (blue line). That’s because, by rule, a D4 RIN can satisfy the tax obligation for any of the three categories. As shown in Figure 1, this ordering of prices has generally held true, with occasional exceptions.

Figure 1. The History of RIN Prices for the Three RIN Categories Since 2010. Source: Hoekstra Trading LLC ATTRACTOR spreadsheet

The Big Bang

The left side of Figure 1 (dashed black oval) shows the huge, 100-fold increase in the blue D6 RIN price — from 1 cent/gal to $1/gal in early 2013. That occurred when the implied conventional renewable mandate increased to a level above the maximum ethanol content of E10 gasoline (which contains 10% ethanol), known as the “blend wall.” Tank cars of ink and billions of dollars have been consumed on petitions, rulings, court decisions, Ph.D. dissertations, earnings conference call transcripts, and other writings — like Parts 1 and 2 of this series and our Big Bang Theory series — about that event, which we call the ”the Big Bang.”

The fact that we have already experienced a 100-fold spike in the D6 price supports the idea that major price changes are possible in today’s market too.

Another Boundary Crossing

Another example — overshadowed at the time by the Big Bang — was the late-2012 collapse of what had been a roughly 50 cents/gal gap between the prices of D4 (dark green) and D5 (light green) RINs, indicated by elimination of the gap between the dark and light green lines within the dashed black oval. What was the crash in that spread about?

A D5 RIN is earned when any gallon of “other advanced biofuel,” such as sugarcane ethanol, is blended into finished fuel. From 2010-12, sugarcane ethanol was being imported and blended into the U.S. gasoline pool. Its role was to earn D5 RINs to fill out the mandated volume of advanced biofuels. Though home-grown corn ethanol is a cheaper alternative for use in gasoline by 50-75 cents/gal, the “advanced biofuel” status of sugarcane ethanol justified its higher delivered price to enable meeting the advanced biofuel mandate. To qualify as an advanced biofuel, the biofuel must reduce greenhouse gas (GHG) emissions by at least 50% compared to a 2005 petroleum baseline utilizing a fuel pathway under the RFS program. Also note that the pathways used for the RFS typically estimate larger GHG reductions than those used under California’s Low Carbon Fuel Standard (LCFS) program.

How does sugarcane ethanol’s role in the E10 gasoline picture explain the collapse of the 50-cent gap between the prices of the D4 and D5 RINs, which seemingly don’t pertain to gasoline? The short answer is that the peculiar features of the RFS suddenly demanded more volume of a biofuel that was both an advanced biofuel and not ethanol, and bio-based diesel was the cheapest available biofuel meeting both criteria.

So, by the workings of supply and demand, bio-based diesel squeezed sugarcane ethanol out of the lineup and took over as the incremental biofuel for all three categories. Meanwhile, corn ethanol took over as the cheapest alternative for all ethanol used in gasoline, back-filling for the rejected sugarcane ethanol, and the price of all three RIN categories converged to the D4 RIN,

That’s the short answer on the overnight collapse of the D4-D5 differential from 50 cents to zero. A valuable exercise for RIN enthusiasts is to think through exactly why and how that happened, and how similar step transitions might occur in the future.

Step transitions

The changes in price of the D6 RIN (from 1 cent/gal to $1/gal) and in the D4-D5 RIN differential (from 50 cents/gal to zero) were large and abrupt, almost step transitions, caused by the crossing of boundaries peculiar to the RFS framework. By examining how the fuel market operates within the constraints of the RFS framework, one can see how the fuel market reacts in a controlled way, but with strange consequences that make prices appear to be out of control when the market runs up against an RFS boundary.

But as wild as those shifts were, they were foreseeable and in fact were anticipated and accurately predicted by those with deep understanding of the applicable economic theory and peculiar details of the RFS.

Crossing the End Wall

Considering what we know about RINs history and why prices moved the way they did, we can assess the likelihood of an “end wall” — a collapse in the price of RINs when RD production reaches a certain higher level. And if the bio-based diesel supply volume indeed grows to exceed the applicable mandate, the likelihood is high.

Hitting the end wall would have the opposite effect of hitting the blend wall, in the sense that the blend wall was due to a shift from a market in which RFS mandates were easily satisfied and RINs were cheap, to one where the mandates required changes to the fuel market and so RIN prices rose. Hitting the end wall would entail a shift back to a regime of RIN abundance — albeit one with a blending mandate still in place — and would be accompanied, in theory, by a collapse of the applicable RINs. And just as the RFS mandates have resulted in more renewable fuels being drawn in, if and when those mandates are exceeded, and RIN prices shift lower, it could disincentivize renewable fuel production which, as we’ve noted, is higher cost than fossil-fuel-based production.

And it may just be a matter of time. The current growth rate of RD indicates the supply of bio-based diesel will exceed the mandated volume within the next three years. Beyond that threshold, the prices for D4, D5 and D6 RINs could drop precipitously.

Estimates vary as to when the end wall might be breached. That boundary sits at 4.5 billion gal/year of bio-based diesel, plus or minus 0.5 billion gal/year. The EPA projects bio-based diesel supply won’t reach that level before 2026, although two other well-informed projections suggest a breach in 2024. Second-quarter earnings calls indicate bullish attitudes toward RD investments and production expansion with no indication of concern about an end-wall mess, which favors a faster, rather than slower, rate of RD production growth. Our assessment is that an end-wall breach is likely in the next three years.

Understanding and foresight

The RFS framework and RIN economics seem complex, but they are in fact nowhere near as complicated as a typical refinery process unit or a refinery itself. As in running a refinery, it is risky to rely on intuition and fast reaction time as the means for making decisions. One of the risks is being blindsided by a sudden crisis brought about by an unexpected event. The surprise factor can be avoided with some forward planning based on fundamental understanding and good data. With those in hand, it is not difficult for someone to use their own insights and judgments to make a well-informed assessment of the likely timing of the end wall, the possible consequences and preventive steps for them. Such forward planning is a prudent practice for anyone whose financial performance depends on RIN prices.

Recommendation

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost!

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159

Happy Easter!