Comparing Theoretical and Market Renewable Identification Number Prices Part 5 – RIN Price Forecasting

ATTRACTOR is a spreadsheet application of the RIN price equation defined in this publication by Scott H Irwin, Kristen McCormack and James H Stock. Since its Release in October, 2020, ATTRACTOR has been used by Hoekstra Trading clients to calculate theoretical Renewable Identification Number (RIN) prices based on economic fundamentals and compare them to market prices.

Read other blogs in this series – Comparing Theoretical and Market RIN Prices:

- Part 1 Three Factors

- Part 2 How Well Do RIN Market Prices Track With Economic Theory?

- Part 3 Anticipating Changes in Tax Subsidies

- Part 4 Over-reacting to Regulatory Policy Changes

- Part 5 RIN Price Forecasting

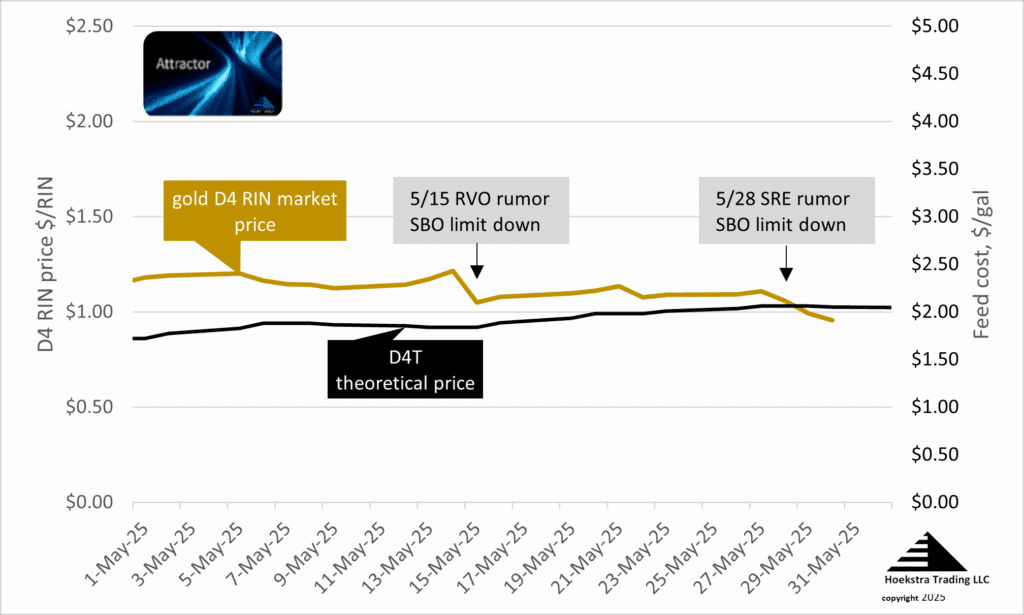

This chart shows the D4 RIN market price (in gold) and the ATTRACTOR theoretical price (denoted D4T, in black) for the month of May, 2025. D4T rose steadily in May while the market price was down.

Two events are indicated on the chart— a May 15 rumor that the renewable volume obligation (RVO) for bio-based diesel would be lower than the market was expecting, and a May 28th rumor that some outstanding Small Refiner Exemptions (SREs) might be granted by EPA.

Either of these rumored possibilities is expected to move the D4 RIN price down. Figure 1 shows the market price did move down upon release of news reports on these two rumors. Soybean oil futures also moved limit down. But the D4T theoretical price did not move down.

Why did D4T not move down?

We always know exactly what’s causing D4T to do what it does. That’s because we calculate D4T every week using current values of the variables and parameters in the equations that define it. D4T was not affected by these two rumors because rumored changes do not appear in those equations. D4T is a theoretical, not a predicted RIN price. Only actual changes in the RVOs or SREs would affect D4T.

While rumors don’t affect D4T, ATTRACTOR users can easily calculate the sensitivities of the D4 RIN value to rumored changes.

While rumors don’t affect D4T, ATTRACTOR users can easily calculate the sensitivities of the D4 RIN value to rumored changes.

During May, in addition to calculating D4T each week, we calculated how much the rumored changes in the RVO and SRE obligations would affect the D4 RIN price, according to fundamental economic theory. Those sensitivities are very useful numbers that are not guesswork, they are reliable estimates, based on economic theory that has proven to be reliable over 13 years of RIN price history. Knowing those sensitivities is a great help to anyone whose financial performance depends on future RIN prices.

Forecasting RIN prices

Hoekstra Trading does not forecast RIN prices. That requires forecasting unpredictables like the price of soybean oil, diesel fuel, and other unknowns that cannot be reliably forecasted by anyone. We treat forecasts of those unpredictables as unreliable guesswork.

Instead, our clients use ATTRACTOR to quantify the sensitivities of RIN price to different factors. Those sensitivities, like how these two rumored changes would affect the D4 RIN price, can be determined reliably based on the economic theory expressed in ATTRACTOR. Users can then make their own assessments of the unpredictable factors and use ATTRACTOR’s sensitivities to reliably predict the corresponding impacts on the future RIN price.

Separating fact and fiction

This approach separates forecasting into two parts— the predictables and the unpredictables. First, for the unpredictables (like the future price of soybean oil or the future RVO), you make an (unreliable) guess of its future value and recognize that guess is unreliable. Second, you use ATTRACTOR to make a (reliable) calculation of the implied impact of that guess on the RIN price. You can repeat this for different guesses of that unpredictable factor, and for the other unpredictables, and get ranges of the corresponding future RIN price values.

We prefer this 2-part approach for many reasons. When you separate the unpredictable effects from the predictable effects, and you recognize which are which, you get a more accurate and reliable picture of the possible future outcomes and you learn where real risks lie.

In earnings conference calls, we often hear CEO’s say their company will focus on what they control, not what they can’t control. That’s a good idea. This two-part approach to forecasting is a similar idea — first differentiate between what can and cannot be predicted. Emphasize, and place credence on what can be reliably predicted, and recognize the unpredictables for what they are.

First differentiate between what can and cannot be predicted. Emphasize, and place credence on what can be reliably predicted, and recognize the unpredictables for what they are.

Too complex?

Some say our two part approach to RIN price analysis is too complex for decision makers to understand. Really? It does involve a less familiar, more complex up-front analysis, but we have handled that complexity in ATTRACTOR, and the end result is not too difficult to understand.

I say I cannot reliably predict what the price of soybean oil will be in 2027. But if we postulate the price will be up, or down, by say 1 dollar per gallon, ATTRACTOR will reliably predict for us, based on proven fundamental economic theory, how much those changes would move the D4 RIN price up or down.

How much harder is that to understand than if I just predict the 2027 D4 RIN price using a wild guess that soybean oil will be up by some amount, or (worse) if I forecast the future RIN price without even recognizing its connection to the future price of soybean oil?

Big business

RIN price forecasting appears to be a big business. Twenty-some companies make RIN price forecasts which, I am told, are in strong demand. Those I have talked with though, including many who make and buy the forecasts, all agree they hinge on unreliable guesswork, they are “always wrong”, and then when something unexpected happens, the forecast must be re-done.

So, who is demanding and paying for these expensive forecasts that hinge on unreliable predictions of the unpredictable? I am told the demanders are more simple-minded, higher-up, gullible decision makers — like corporate directors, bankers, and rich investors, who just want a single number, or a single curve of the future price, and nothing more.

I am beginning to wonder whether these simple-minded demanders really exist. Or do the forecasts have a life of their own?

Another pitfall with such forecasts, which makes us shy away from them, is they are easily doctored to give answers those who buy them want to hear. With so much money at stake, there is little doubt that kind of doctoring would occur in the real world, especially when the factual and fictional parts are intertwined.

For those who really want to understand future possibilities, it is better to have up-front transparency on the unpredictables and address them face-to-face.

Recommendation

Maybe it’s time to try a different approach . . . Get Hoekstra Research Report 10 and the ATTRACTOR spreadsheet

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.

George Hoekstra

+1 630 330-8159