Comparing Theoretical and Market Renewable Identification Number (RIN) Prices – 3 Factors

Why are Hoekstra Trading’s theoretical RIN prices (D4T and D3T) different from the D4 and D3 RIN market prices?

Read other blogs in this series – Comparing Theoretical and Market RIN Prices:

- Part 1 Three Factors

- Part 2 How Well Do RIN Market Prices Track With Economic Theory?

- Part 3 Anticipating Changes in Tax Subsidies

We ask ourselves that question every week.

We propose many possible reasons why the theoretical and market prices could be different. Using a fundamental theoretical model, the ATTRACTOR spreadsheet calculates the implications of those possibilities – that is, we quantify the sensitivities of RIN price to each possibility, to see each possibility’s explanatory power to explain the difference.

Here are three examples of price sensitivities that are relevant today:

Factor 1: The RIN Time Value Factor

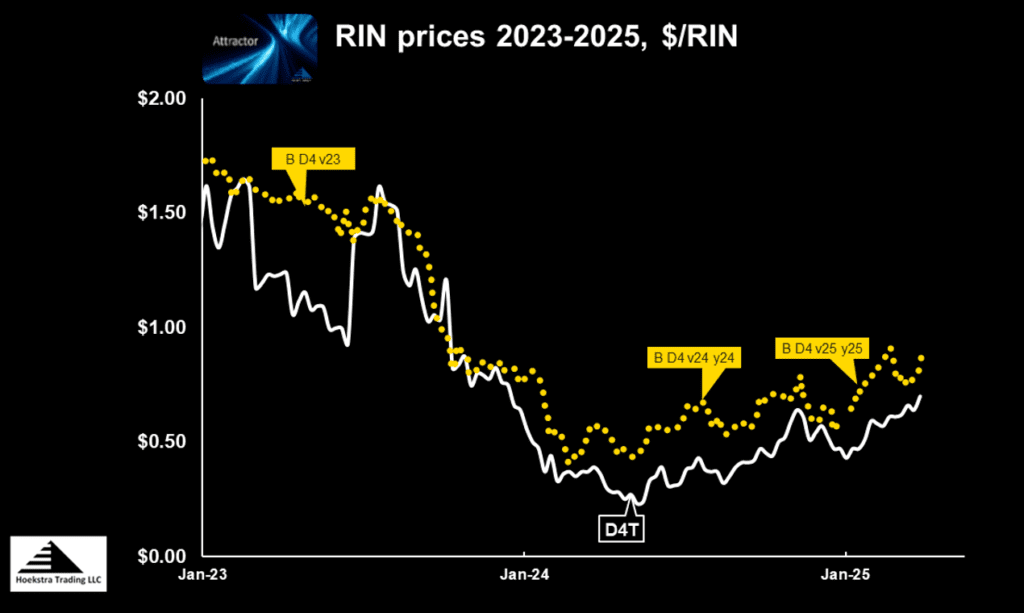

The theoretical D4T value (white line) on Figure 1 is the calculated theoretical value of a hypothetical D4 RIN with one year until expiration. That hypothetical RIN always has a settlement date exactly one year from today, which, today, is March 31, 2026.

The D4 market price (gold data) is the quoted price of the actual 2025 vintage RIN with an expected settlement date of June 30, 2027. That difference of 456 days in settlement date affects the theoretical values of the RINs plotted on the chart, and contributes to the gap between the gold and white data:

Why use a hypothetical 1-year RIN for D4T? A constant 1-year life enables D4T to serve as a reference that can be tracked over time without the bias and distortion of a constantly changing expected life.

Our ATTRACTOR spreadsheet calculates the theoretical prices of the actual RINs (with their own expected settlement dates) each week as well as D4T, and ATTRACTOR users always know how many cents of time value are attached to each actual and each theoretical RIN.

Currently, the time value factor contributes substantially to the the difference between the gold and white data in Figure 1 (that is, the theoretical price of the gold RIN is closer to the gold market data than is D4T).

Factor 2: The Non-RIN Subsidy Factor

Calculating D4T and D3T requires assessing the expected value of non-RIN subsidies that apply to that category of biofuel, that is, subsidies that contribute to producer revenues, not counting the RIN.

As all RIN fans know, those subsidy levels are uncertain and subject to change.

Hoekstra Trading’s client group continues to believe there is a non-zero probability the $1.00 per gallon Blenders Tax Credit (BTC) will be resurrected during the life of currently traded RINs. That probability is factored directly into the D4T value and we believe that non-RIN subsidy factor has been causing a downward bias on D4T compared to the market price during 2025.

The BTC has a history of being hard to kill. Its simplicity, compared to carbon-intensity dependent credits that require complex, highly debatable modeling, is a compelling feature of the BTC, especially when last-minute deal-making comes into play. We expect that, if the BTC is again resurrected, the gold data will fall down toward D4T by that non-RIN subsidy sensitivity of D4T.

In fact, we expect the market would probably fall by more than that, in an over-reaction to that eventuality, because of Factor 3 below:

Factor 3: The Regulatory Policy Factor

In five years analyzing theoretical vs. market RIN prices once each week, we have discovered a consistent bias toward the market over-reacting to announcement of regulatory policy changes, while under-reacting to other changing factors that affect RIN prices. This has happened many times, with near 100% reliability.

As a current example, we believe the market has overestimated the explanatory power of the proposed partial waiver of the 2024 cellulosic volume mandate. This view leads directly to tradable inferences about future D3 RIN price behavior.

Another question we ask frequently is how well does D4T track the market price over time? Tune in next week for the answer to that.

Where else do you find . . .

fundamental, quantitative values for the sensitivities of RIN prices to key market uncertainties and the implications for future RIN price behavior?

Do you see . . .

how D4T, D3T, and the ATTRACTOR spreadsheet can help your RIN strategy? if yes, start using them! They are available to anyone immediately at negligible cost. Just click the link below, convince your boss to send a purchase order, and get started this week.

Recommendation Get Hoekstra Research Report 10 and the ATTRACTOR spreadsheet

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.

George Hoekstra

+1 630 330-8159