Hoekstra Trading releases Hoekstra Research Report 12 – Renewable Identification Number (RIN) Market Pricing Model

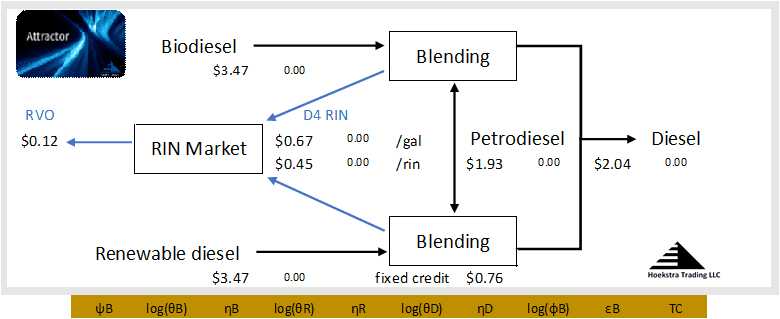

Hoekstra Trading today released its 12th annual research report titled Hoekstra Research Report 12 – Renewable Identification Number (RIN) Market Pricing Model. The report is available to anyone and includes a new user spreadsheet, ATTRACTOR 3.0, that calculates flow rates and prices of all fuels and all RINs in markets affected by the RIN credit using a fundamental economic model based on Chapter 2 of this dissertation by Ben Meiselman.

This new spreadsheet calculates theoretical prices of all four categories of RINs

Our original ATTRACTOR 1.0 spreadsheet, released October 31 2020, applies this fundamental economic model published by Scott Irwin, Kristin McCormick and James H. Stock to calculate D4T, the theoretical price of a D4 RIN, using option pricing theory.

These two academic gems, now integrated in a user friendly spreadsheet for commercial use, offer a wealth of untapped opportunities to RIN traders. Those opportunities exist because of unusual price inter-relationships caused by the RIN’s complexity that are not recognized in today’s trading markets and cannot be grasped or anticipated without help from a proper tool like ATTRACTOR.

ATTRACTOR 1.0 has a proven 4-year track record helping users find and capture those opportunities in the D4 RIN market. ATTRACTOR 3.0 expands that capability to all segments of the RIN market.

Recommendation

Get Hoekstra Research Report 10

It includes the ATTRACTOR spreadsheet which calculates D4T, the theoretical value of a D4 RIN, using economic fundamentals. Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market Renewable Identification Number (RIN) prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.