Refining’s margin capture problem — here’s the hidden cause

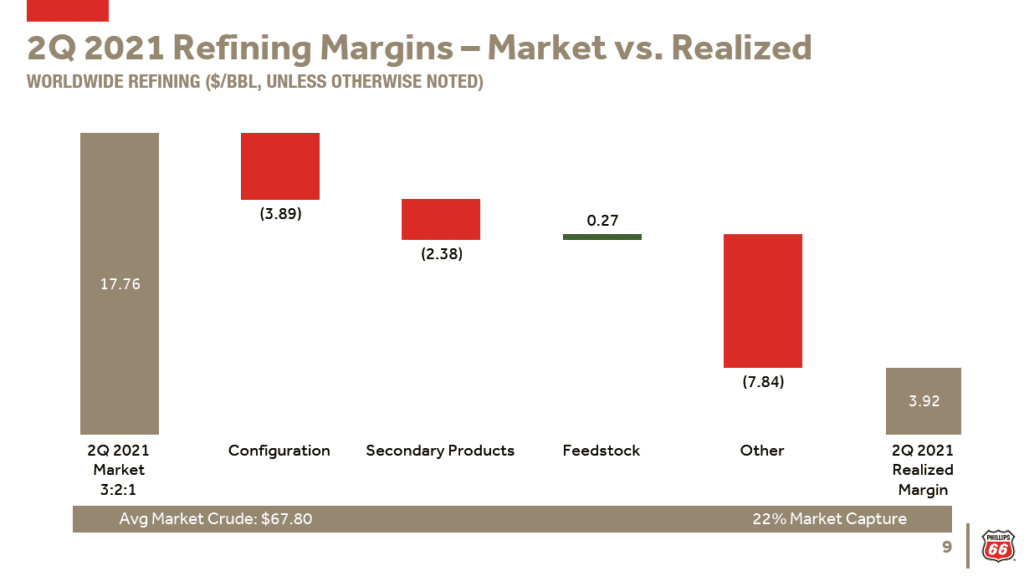

A sore point in US refiners’ 2021 earnings has been low “margin capture” rates. Margin capture refers to actual realized margin compared to a market-based benchmark margin.

For example, this chart from Phillips 66 (PSX)’s 2nd quarter earnings conference call shows a market-based benchmark margin of $17.76/barrel (left tan bar), and an actual realized margin of $3.92/barrel (right tan bar). This gives a market capture rate of $3.92 / $17.76 = 22% which is historically low for PSX’s Refining segment.

The $17.76 benchmark assumes you buy a barrel of crude at the average market price, convert it to 2/3 barrel of conventional gasoline and 1/3 barrel of ultra low sulfur diesel, and sell those fuels at their average market price.

So, while market prices are indicating a margin of $17.76, PSX is only seeing $3.92 of that on their bottom line.

This draws attention from investment analysts. The biggest sore point is the large, rightmost red bar, a negative $7.84 in the “other” category. What is this? Several refiners (not only PSX!) have been reporting, and trying to explain, this other factor behind low margin capture.

My theory

With some simplification, and some reading between the lines, I understand the -$7.84 to be made up of two factors:

- RIN costs

- Clean product differentials

Focusing now on clean product differentials, I believe that factor is driven by low realized margin on high-octane premium gasoline.

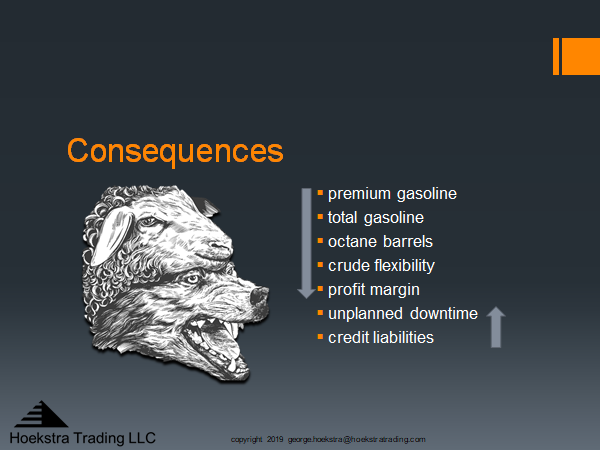

The key for capturing today’s high refining margin is to make enough octane-barrels to meet demand for high octane premium, as well as regular gasoline, using low cost, internally-produced blend stocks. If a refinery is constrained in its ability to produce enough octane-barrels internally, it will make costly adaptations to balance the refinery’s octane supply and demand, with the following consequences:

Costly adaptations, like foregoing premium sales, or buying octane blend stocks, reduce premium gasoline, total gasoline, octane barrel production, crude flexibility, premium margin and/or on-stream percentage.

All these are happening now in octane-constrained US refineries.

Tier 3 has not, to my knowledge, been mentioned by refining executives as a factor explaining low margin capture.

The hidden root cause of this margin problem is the stringent new ultra-low sulfur gasoline specification known as Tier 3. That 10 ppm sulfur specification is constraining refiners’ ability to produce enough octane barrels at a time when they are all, for the first time, making Tier 3 gasoline at high rates to meet high octane demand.

An abundance of evidence supports this theory. Yet, Tier 3 has not, to my knowledge, been mentioned by any refining executive as a factor explaining today’s low margin capture.

In fact, refining executives have mostly denied Tier 3 has any impact at all on profitability.

The effect of Tier 3 on octane supply will be addressed over time using better solutions than those being used in the heat of battle today. Some good solutions can be implemented quickly and easily, while others require capital investment.

Meanwhile, the high leverage clean fuels differential factor will remain a big drag on some refiners’ margins.

A previous post and this YouTube video explain how Tier 3 is reducing octane supply, what costly adaptations are being made, and how the Tier 3 octane/sulfur supply squeeze can be permanently relieved.

Conclusions

- US refiners’ margin capture is being held down today by new octane supply constraints resulting from the Tier 3 gasoline sulfur specification.

- This is causing a big hit to refining margins that has not been anticipated by refining executives or investment analysts.

Recommendation

There are many ways to reduce negative Tier 3 impacts. Capital investment is the best option, but that takes capital and time to implement. Refiners should be taking other steps now to optimize their gasoline desulfurizers and Tier 3 strategies, something that has not been a priority before.

Hoekstra Research Report 8

Our three-year multi-client research project measured the effects of Tier 3 gasoline in pilot plant and commercial performance tests. We developed new methods and tools that helped our clients optimize performance of gasoline desulfurizers to avoid hidden hits to margin capture, and adopt profitable sulfur credit strategies. All our data and tools are available to anyone for immediate application at negligible cost. Please see this offer letter and join our client group today: Hoekstra-Trading-Offer-letter-Research-Report-8-refiners-under-1-MBD