Revisiting RIN Cost Pass-through – Part 1, Two Camps

See other episodes in this series:

- Part 1 – Two Camps

- Part 2 – How is the RIN Tax Different From a Sales Tax?

- Part 3 – The RIN Tax Passes Through Just Like a Sales Tax

- Part 4 – Will the Litigation Ever End?

A Renewable Identification Number (RIN) is a tax and a subsidy that forces renewables into fuels.

There is a long-running controversy over how the RIN tax affects the profits of refiners.

One camp, which we call Camp A, says the RIN tax is an extra cost that hurts the refiner’s profit.

The other camp, which we call Camp B, says the RIN tax passes through from the refiner to the blender and that offsets the tax paid by the refiner, resulting in almost no net impact on the refiner’s profit. Camp B’s theory is called the pass-through theory.

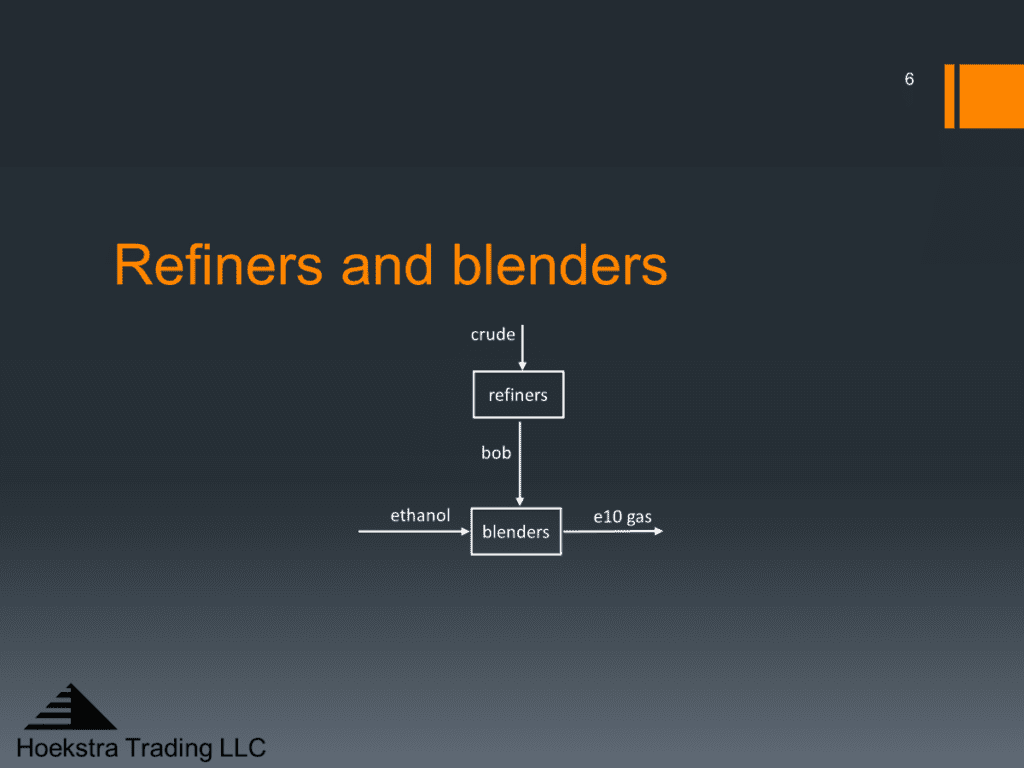

Figure 1 shows the basic process flow for making what is called “E10” gasoline which is the 10% ethanol blend we use in our cars. The refiner buys crude oil and refines it to produce refined gasoline called blendstock for oxygenate blending (bob) which, when blended with 10% ethanol, meets all required gasoline specifications.

Figure 1: Flow of streams for e10 gasoline manufacture

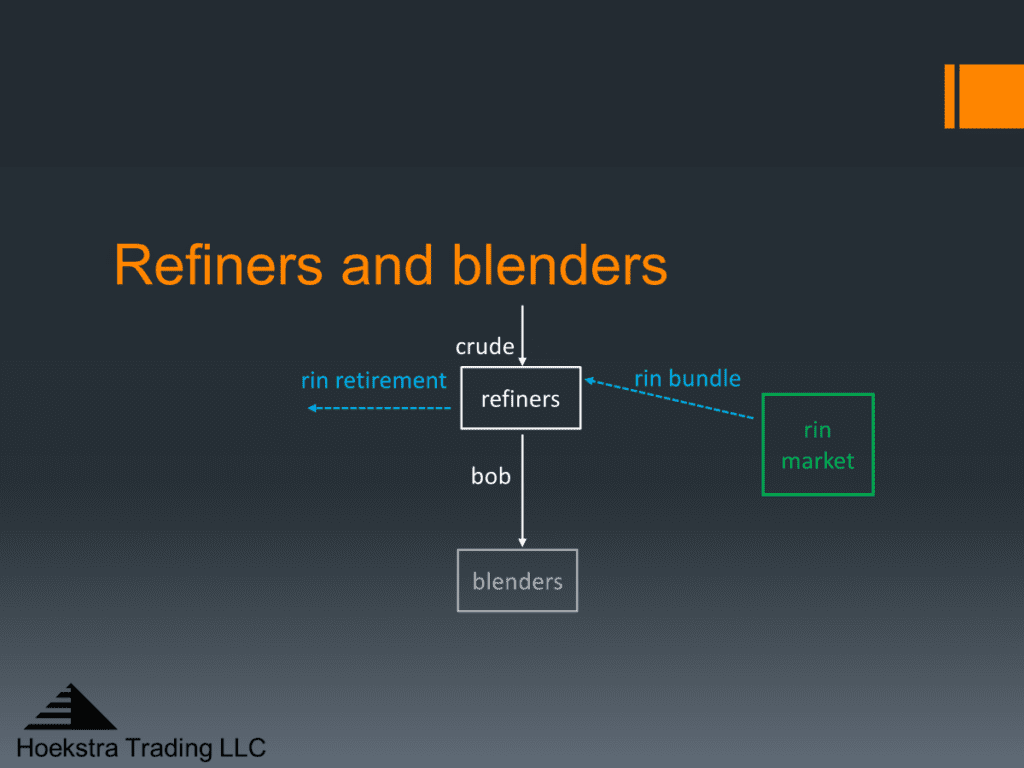

By selling the bob, the refiner incurs a tax obligation which is satisfied by proving he has acquired sufficient RINs to cover the tax. The blue arrows in Figure 2 show the tax aspect of RINs as seen from the perspective of the refiner. The refiner buys a “RIN bundle” which is like a receipt showing he purchased his quota of RINs. The quota is set annually by EPA and is called the Renewable Volume Obligation (RVO). In RIN retirement, the refiner turns in the receipts to prove the obligation was met.

Figure 2 Flow of streams (white) and RINs (blue) from a refiner’s perspective

Think of these two steps, the purchase and the retirement of a RIN bundle, as the fulfillment of a tax obligation.

How does the RIN tax affect a refiner’s profit?

Camp A, mostly refiners with some economists, consultants, and politicians, says the RIN tax is an extra cost that reduces a refiner’s profit. The refiner sends real cash out the door to buy RINs whose prices fluctuate wildly with no apparent offsetting revenue. It is a source of large, uncontrollable, highly variable cash expense. How can it not affect his profit?

Camp B, mostly renewable producers with other economists, consultants, and politicians, says the RIN tax is passed through and recaptured in a higher price for the BOB that offsets the cash expense. This is called the pass-through theory.

This raises two questions:

- What is the basis for Camp B’s claim?

- Where does the tax go, if not to the government?

These questions, which will be addressed in future episodes of this series, are at the root of an 11-year, multi-billion dollar legal dispute that is still in progress with no end in sight.

Recommendation

Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market RIN prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.