Falling RIN Prices

Theoretical prices foreshadow actual price drop

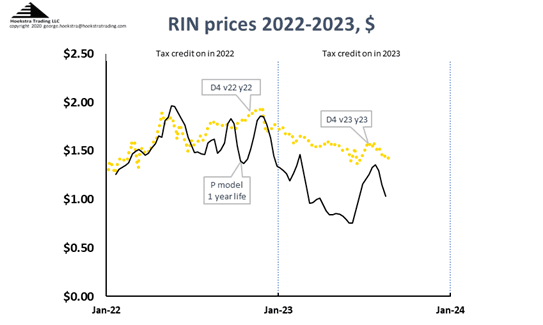

This chart compares the market price of the D4 RIN (gold dashed lines) with the theoretical price calculated by Hoekstra Trading’s spreadsheet application of the IMS (Irwin-McCormack-Stock) RIN pricing model (black line).

The actual price (gold) and model price (black) agreed closely in the first half of 2022. Then the model began a steady downtrend to half its peak level. The actual market price has followed this trend with a lag and a much lower slope, forming a growing gap between the theoretical and actual prices.

Hoekstra Trading clients discuss, interpret, and act upon gaps like this in real time. With our spreadsheet model, we can test theories on the reasons for such differences, which leads to confident, proactive RIN management and trading decisions.

Baby the RIN Must Fall

We appreciate RBN Energy for their collaboration in publishing some of our RIN and sulfur credit pricing analyses in their (outstanding!) RBN Daily Energy Blog. Hoekstra Trading’s most recent contribution is a blog series titled, “Baby the RIN Must Fall”, which analyzes the possibility of a discontinuous RIN price crash that could occur when total bio-based diesel supply exceeds the EPA mandated level. That is something different from the growing gap in Figure 1 which we attribute to other causes.

The development of the gap in Figure 1, along with fundamental analysis of RIN economics and the possibility of a discontinuous price crash event have all contributed to our strongly bearish view on RIN prices through this period.

Recommendation

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes this Hoekstra IMS RINs pricing spreadsheet that accurately calculates theoretical RIN prices, tracks them versus actual prices and predicts how RIN prices will change with the variables that affect them, and includes 6 months of unlimited consultation by phone and E-mail. Here’s the offer letter including the Table of Contents and a sample invoice with all the information needed to prepare a purchase order. Why not send a purchase order today?

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159