The 2022 OPIS Biofuels conference – my top 3 takeaways

See the other posts in this series, Top 3 Takeaways:

The OPIS 14th Annual RFS, RINs & Biofuels Forum brought some marquee names in the renewable fuels world to the platform and drew 200+ delegates to Chicago in September 2022. This annual conference is a good way to keep aware of happenings in the biofuels industry.

Here is the countdown of my top 3 takeaways from this year’s conference:

Number 3: New Rules

Sustainable aviation fuels, bio-intermediates, multi-year standards, electric vehicle pathways, and a new clean fuel production credit are on the list of topics up for change in the coming year. Things keep changing in this business – it pays to be looking ahead.

Number 2: Advocacy

I like watching industry advocates engage in banter and verbal arm-wrestling during the proceedings. Lobbyists play a big role in the biofuels world, and OPIS facilitators do a good job exposing what’s on their minds by putting them on stage together and asking good questions. Big Oil and Big Corn are always exchanging blows. This year, Big Airlines took some jabs from Big Truckers who worry increased airline involvement might make truckers’ lives more difficult.

Number 1: Small refiner exemptions

A coalition of small refiners intends to continue their legal dispute with EPA on small refiner exemptions. This story evolved over a ten year period in what I see as a 3-season series:

Season 1 – The big bang

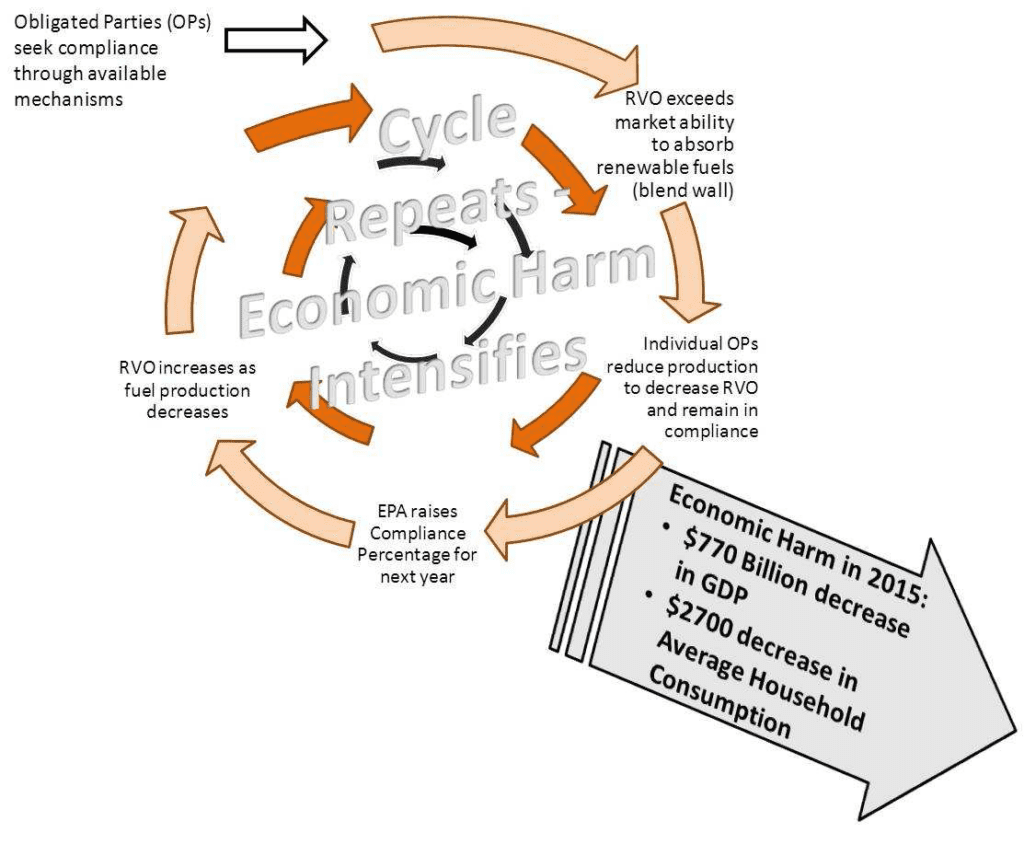

Season 1 was triggered when the price of D6 (ethanol) Renewable Identification Numbers (RINs) skyrocketed from a low of 1 cent in 2012 to 60 cents in April 2013, and then to over a dollar in August 2013, with most of that 100-fold increase coming in a 3-week time interval. This event was the big bang of RINs that thrust RINs into the headlines. Season 1 featured mostly bluster among politicians, farmers, fuel retailers and oil companies over how RIN expense affects them and the U.S. economy. A landmark of this season was the report “Economic Impacts Resulting from Implementation of RFS2 Program”, done by National Economic Research Associates (NERA) Economic Consulting for American Petroleum Institute (API), October 2012, which forecasted a death spiral for the fuels industry:

“As domestic fuel supplies decrease, large increases in transportation fuel costs would ripple through the economy imposing significant costs on society. More specifically, as the RFS2 mandate is ratcheted up every year, the fuels market will be pushed into a death spiral shown in Figure 1. The death spiral depicts the economic harm that occurs as individual obligated parties act to remain in compliance with the program.”

Excerpt from Executive Summary of “Economic Impacts Resulting from Implementation of RFS2 Program”

Season 2 — Points of obligation

Season 2 began in 2014 with various proposals to amend Renewable Fuel Standard (RFS) rules and then focused in on proposals to change the definition of “obligated parties”, i.e. those who are obligated to pay for Renewable Identification Numbers (RINs). A Season 2 landmark was EPA’s 2017 “Denial of Petitions for Rulemaking to Change the RFS Point of Obligation” which included this statement:

EPA is also not persuaded, based on our analysis of available data, including that supplied by petitioners and commenters, by arguments that merchant refiners are disadvantaged under the current regulations in comparison to integrated refiners in terms of their costs of compliance, nor that other stakeholders such as unobligated blenders are receiving windfall profits.

Excerpt from “Denial of Petitions for Rulemaking to Change the RFS Point of Obligation, November, 2017

Season 3 – Small refiner exemptions

The above excerpt foreshadowed the direction things were heading — which was toward disagreements about whether small refiners are disadvantaged in their cost of compliance compared to integrated refiners and unobligated blenders, and whether blenders receive windfall profits from RINs. If you study the history of this dispute, you will see these questions have been at the core of the 10-year disagreement ever since the big bang in 2013. A landmark from Season 3 was the April 2022 EPA “Denial of Petitions for RFS Small Refiner Exemptions”, in which this paragraph stood out for me:

Prior to the issuance of the Proposed Denial, two petitioning small refineries submitted data to EPA on fuel prices in their markets that enabled EPA to analyze current data in additional markets using a methodology similar to the analysis we conducted for Des Moines in 2015.204 Both parties claimed this data presented supported their claims of DEH (Disproportionate Economic Hardship). One petitioner used monthly gasoline and ethanol pricing data from a local terminal, along with RIN pricing data, to determine a monthly calculated E10 price from 2010 to the present using an equation nearly identical to Equation 2.205The petitioner then plotted these calculated E10 prices, which assume that 100% of the RIN value is passed through to wholesale purchasers through lower prices for blended fuel, against the posted prices for E10 at that same terminal. The petitioner found an extremely strong correlation (R2 = 0.9976) between the calculated E10 price (assuming 100% RIN passthrough) and the posted E10 price, demonstrating for this terminal that the RIN value has been fully passed through to wholesale purchasers since 2010.206

Excerpt from EPA document “April 2022 Denial of Petitions for RFS Small Refinery Exemptions”, April 2022

This excerpt exposes disagreement about the implications of a specific data set submitted by a refiner, and about whether, in competitive markets, the cost of a RIN and its value as a subsidy pass through the supply chain to be reflected in equilibrium market prices. The refiner submitted the data and a detailed quantitative analysis to prove the passthrough theory does not apply in that market. The EPA responded by saying the data proves the passthrough theory does apply in that market. And there is no good explanation enabling interested readers to reconcile that direct contradiction.

This is not a matter of opinion, like whether the stock market will go up or down tomorrow; and it is not a matter of interpretation, like why the market went up or down yesterday; and it is not a matter of law. We have 2 yes-or-no questions about economics: 1) Does economic theory say the RIN cost and subsidy should pass through in competitive markets? and 2) Does this detailed data show the RIN cost and subsidy do pass through in this local market?

My question to the presenter was whether there could be a forum where the parties get together and come to common understanding of the answers to these yes-or-no, matter of fact questions about economics. The answer was, “that will most likely occur in court”.

I fear that is the correct answer, which is good news for lawyers but nobody else.

Recommendation

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Hoekstra ATTRACTOR spreadsheet spreadsheet that accurately calculates D4T, the theoretical RIN price, tracks it versus quoted market prices, and predicts how RIN prices will change with the variables that affect them. Why not send a purchase order today?

George Hoekstra [email protected] +1 630 330-8159

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10

Regardless of what happens next on the legal front, RIN strategy will continue to be an important aspect of financial management in the refining industry for the foreseeable future. We are told litigation over the Renewable Fuel Standard is expected to continue.

George Hoekstra [email protected] +1 630 330-8159