Top 3 Takeaways From Fastmarkets Biofuels and Feedstocks Americas 2025 Conference

Number 3: What is the status of U.S. biodiesel production?

U.S. biodiesel production (not including plants that use hydroprocessing technology, which are commonly known as renewable diesel plants) is running at half capacity. Some biodiesel plants are not producing at all now, but are keeping a full staff who are doing other work like maintenance while waiting for margins to improve. It is a day-to-day decision whether to resume production, based on that day’s incremental margin numbers.

Number 2: Will there be a resurrection or partial resurrection of the $1.00 per gallon biobased diesel tax credit?

The first panel answered with an adamant, unequivocal no — under no circumstances will that occur.

The second panel gave it a 30% chance.

The third panel said it is absolutely essential for the survival of the biodiesel industry, a fact that is well understood by the powers in Washington.

So I came away thinking the probability is somewhere between zero and one.

Number 3: Why has the D4 RIN price doubled in 2025?

In an informal opinion poll, I asked 20 people this question. They all said it was a combination of two factors:

- the switch from the bio based diesel tax credit to the 45-Z producer tax credit

- anticipation of a higher renewable volume obligation for 2026 and beyond.

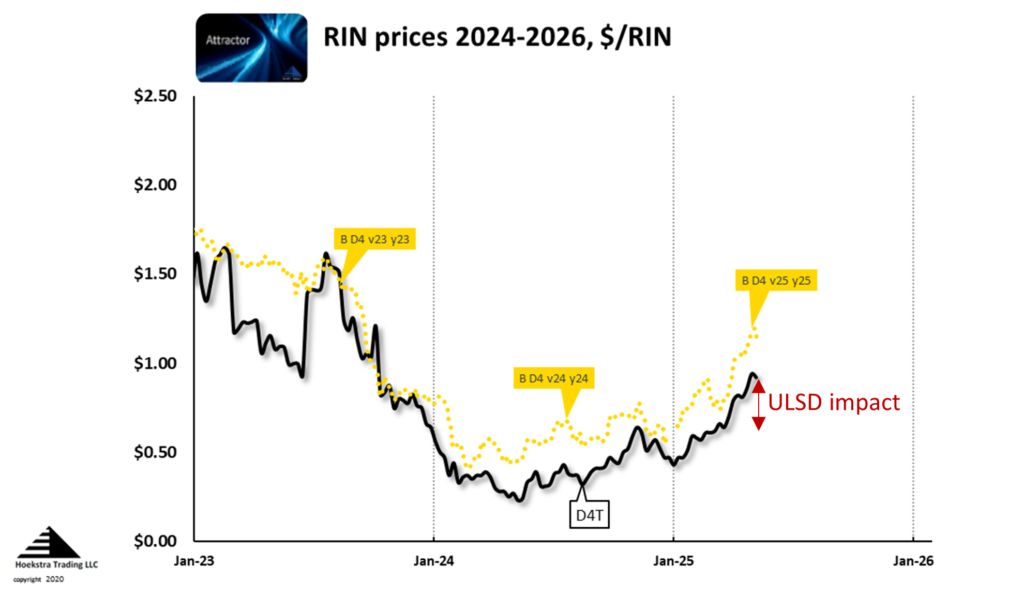

In fact, from a fundamental standpoint, the single biggest factor driving the RIN price rise in 2025 has been the crash in ultra low sulfur diesel (ULSD) fuel price from $2.60 to $2.00/gal. Figure 1 shows the market price of the latest vintage D4 RIN (in gold) and Hoekstra Trading’s theoretical price (D4T in black). The red arrow shows how much the crash in ULSD price contributed to the increase in the D4T theoretical price since Jan 1, 2025.

This is another example where, when it comes to RIN price sensitivity, market sentiment seems to attach too much weight to uncertain regulatory factors and too little weight to known economic fundamentals.

What will cause the next step move in the D4 RIN price during 2025?

I say it will be either the announcement of a settlement of the outstanding small refiner exemptions, or an announcement that a large renewable diesel plant is being shut down on poor profitability. All market players should have quantitative estimates of the theoretical impact of such possibilities, which are available immediately to anyone from Hoekstra Trading at negligible cost.

Recommendation Get Hoekstra Research Report 10 and the ATTRACTOR spreadsheet

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.

George Hoekstra

+1 630 330-8159