D3 Renewable Identification Number (RIN) Price Collapse

See previous blogs in this series:

- Part 1 – The Market That Fizzled

- Part 2 – The Biogas Solution

- Part 3 – Rewind to the Fast Crash of Kior, a Cellulosic Biofuel Company

- Part 4 – Fueling Heavy Duty Trucks With Fuel From Cows

- Part 5 – Impact of EPA’s Partial Waiver on the D3 RIN Price

- Part 6 – Quantitative Theoretical Modeling of RIN Prices

- Part 7 – D3 RIN Price – Is The Market Off By a Factor of Ten?

- Part 8 – A New Industry Emerges

- Part 9 – Aftermath of the D3 RIN Price Collapse

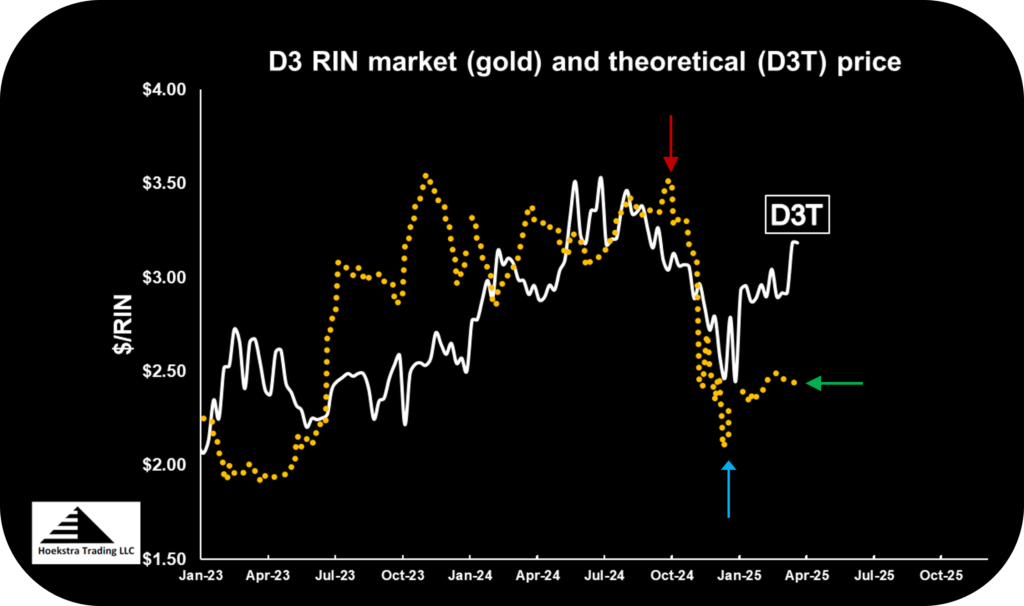

The gold data in Figure 1 shows how the D3 RIN market price collapsed by $1.32, from a high of $3.40 the week of September 27, 2024 (red arrow), to a low of $2.08 on December 5 (blue arrow). December 5 was the date of release of EPA’s proposal to partially waive the 2024 cellulosic biofuel volume mandate.

In the market’s interpretation – the $1.32 price collapse, which occured before release of the proposal, was caused by anticipation of the proposal. (See Parts 5, 6, and 7 of this series for more analysis of the D3 RIN price collapse).

In the theoretical interpretation – the white data shows the D3T theoretical RIN price collapsed along with the market price before the December 5 release. This was caused by other changing factors that affect the RIN’s theoretical value, not by anticipation of release of the proposal.

In the theoretical interpretation, the magnitude of the partial waiver impact on the RIN price is only $0.11, not $1.32, and the balance of the collapse was caused by other factors.

Dec. 5 Aftermath

Since Dec. 5, the market price of the D3 RIN has moved up by $0.32, from $2.08 (blue arrow) to $2.40 (green arrow).

In the market’s interpretation – this rebound represents the price “settling in around $2.40”, suggesting a re-equilibration from a transient over-reaction to the price shock caused by the partial waiver proposal.

in the theoretical interpretation – the white data shows the D3T theoretical RIN price has rebounded to $3.10, recovering all but $0.30 of the $1.32 collapse, representing (again) the effect of other changing factors that affect the RIN’s theoretical value, unrelated to the partial waiver proposal.

What’s next?

Five years’ experience comparing theoretical to market RIN price responses has shown the market has consistently attached much higher price sensitivity to specific EPA actions than are indicated by economic theory, and than have played out in the market. This, along with a belief in competitive market economic theory, supports the theoretical interpretation that the partial waiver is more like an $0.11 event than the $1.32 event it is being blamed for.

Which interpretation will the market follow in this case?

A great test would be if the EPA decides NOT to do the partial waiver (that is not currently the expected decision, but it is possible).

The market interpretation – implies that outcome would cause a D3 price recovery of magnitude around $1.32.

The theoretical interpretation – says the proposed partial waiver simply does not have that much explanatory power; its quantitative explanatory power calculates to an $0.11 price sensitivity.

The decision is expected in coming weeks. We will continue to watch.

Recommendation -To do this kind of analysis in real time, Get Hoekstra Research Report 10 and the ATTRACTOR spreadsheet

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.