Under the Hood of the ATTRACTOR RIN Price Spreadsheet Part 4 – The Famous Burkholder Memo

See the other posts in this series: Under the Hood of the ATTRACTOR RIN Price Model:

- Part 1 How to foresee otherwise surprising price behavior

- Part 2 Why renewable diesel margins collapsed

- Part 3 A thought experiment on profit margins

- Part 4 The Famous Burkholder Memo

A landmark document in renewable fuels history is “A Preliminary Assessment of RIN Market Dynamics, RIN Prices, and Their Effects”, by Dallas Burkholder, Office of Transportation and Air Quality, US EPA, May 14, 2015. Soon after its release, it earned the nickname: The “Burkholder memo”:

If you are interested in RINs, you should certainly read at least the Executive Summary of this document.

The Burkholder memo starts with a focus on the 2013 D6 RIN price explosion (that is the 100-fold explosion we call The Big Bang). It then more broadly lays out, step-by-step, how, in theory, the RIN system affects individual transactions in the gasoline and diesel fuel supply chains. In doing that, it compares the theory with real-life market price data. It concludes the theory and the real-life price data, more-or-less, agree.

In most cases, the effect of the RIN on the said transaction is counter-intuitive.

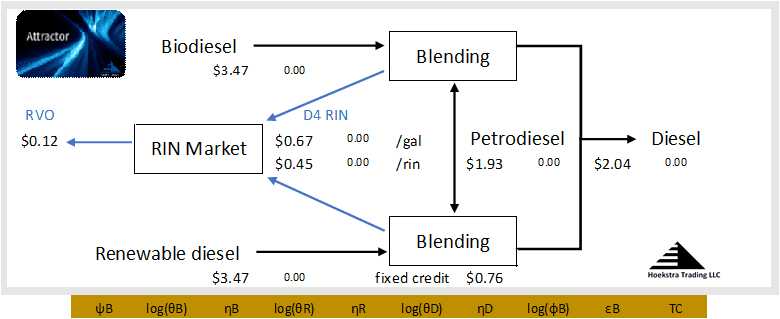

Hoekstra Trading’s ATTRACTOR RIN price model does the same thing in a different way. It applies fundamental economic theory to calculate and display the theoretical prices for a given set of input values and allows the user to compare them with market prices in a simple, user-friendly way. The user can then change the input values and immediately see the results for that new situation.

ATTRACTOR gives the same results as the Burkholder memo in a tool that that brings easy understanding, enables unlimited case studies to be run, and helps day-to-day decisions for improved business results, whether those be financial or legal results.

Legal battles

Many people disagree with the findings of the Burkholder memo. A billion dollar, ten year legal war over the applicability of the theory continues today. That war story is not told in the Burkholder memo, but the key disagreements and Misunderstandings among the participants can be traced in court documents, for example, in this excerpt from one of the courtroom episodes:

“At the root of petitioners’ claim is a single premise: that the current point of obligation misaligns incentives by requiring those who refine fossil fuel, but not those who blend it, to meet the RFS program’s annual standards. In petitioners’ view, this misalignment forces refiners to purchase RINs to satisfy their RFS obligations, jacking up their costs, while giving windfall profits to blenders, who produce (but don’t consume) RINs.”

US Court of Appeals for The District of Columbia Circuit, Aug 30, 2019

The same court decision states the contrary premise, with reference to the Burkholder memo and other documents as follows:

“The problem with this argument, however, is that EPA reasonably explained why, in its view, there is no misalignment in the RFS program. According to EPA, refiners recover the cost of the RINs they purchase by passing that cost along in the form of higher prices for the petroleum based fuels they produce . . . It grounded that conclusion in studies and data in the record.”

U.S. Court of Appeals for the District of Columbia Circuit, Aug 30, 2019

Regardless of one’s stance on this contradiction, any company in the RINs game should have at least one person who understands the theory underlying what’s in the Burkholder memo. This is most readily done with ATTRACTOR.

And the ATTRACTOR alternative has the big advantage that it can be used directly as a user-friendly tool to increase the profitability of your RIN business activities.

Memo demo

For those considering venturing beyond the Executive Summary and digging deeper into the Burkholder memo, be forewarned, you shouldn’t expect to speed read through. It is not known as light, easy reading.

That’s mainly because the RIN price control system is itself inherently complex and confusing, especially to those accustomed to the behavior of free market prices.

Here are a few highlights from the memo’s contents.

First, this non-intuitive finding about how RINs affect retail fuel prices:

While RIN prices were significantly higher in 2013 than in previous years, we did not see, nor would we expect to see, a corresponding net increase in the overall retail price of transportation fuels across the entire fuel pool. This is because the RIN price, rather than acting as an additional cost, generally acts as a transfer payment between parties that blend renewable fuels and obligated parties who produce or import petroleum-based fuels and are required to obtain RINs for compliance purposes.

The Burkholder memo

This important finding also describes what you’ll see in ATTRACTOR’s output, because it falls out as a logical outcome of the fundamental equations that, in theory, drive RIN price dynamics.

I am among a small group of non-lawyers who have dissected the tables in the Burkholder memo in the depth required to grasp their detailed content. I did that in 2020 when the U.S. economy was locked down (for the first time in my long life).

I was trained as an engineer. Consequently, I instinctively started drawing diagrams like the one below (which closely resemble some that appear in the Burkholder memo), and verified by hand calculation the numbers showing the counter-intuitive inter-relationships among fuel and RIN market prices under the control of the RIN system, all in a effort to get my head around the price behavior.

Those diagrams, and others like them, appear in “Hoekstra Research Report 10, RIN Pricing and Economics”, and the ATTRACTOR spreadsheet which comes with it. With them, our clients see the same non-intuitive theoretical price dynamics and come to understand it quickly. Without them, such understanding is rare.

Not everyone affected by RINs needs that understanding. But any company in the RINs market should certainly have at least one person who does – whether you agree with Dallas Burkholder or not. Otherwise, you will continue working in a Land of Confusion when it comes to the often strange and surprising behavior of RIN prices.

Not everyone affected by RINs needs that understanding. But any company in the RINs market should certainly have at least one person who does.

Here’s one more non-intuitive result from inside the Burkholder memo:

If fuel prices are fully flexible, markets are perfectly competitive, and we assume no changes to the price of renewable or petroleum based fuels, these two price impacts, the discounting of renewable fuels enabled by the sale of the RINs and the higher petroleum prices that result from the cost of purchasing RINs, are expected to offset each other, resulting in the RIN price having no net impact across the entire fuel pool.

The Burkholder memo

By understanding the basis for this claim, the ATTRACTOR spreadsheet user can foresee and predict other non-intuitive events like the 4-fold 2023 RIN price crash that was not foreseen or predicted by any of the seven high-priced RIN forecasting services we researched, except, we are told, Turner-Mason & Company.

Recommendation Get Hoekstra Research Report 10

It includes the ATTRACTOR spreadsheet which calculates D4T, the theoretical value of a D4 RIN, using economic fundamentals. Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market Renewable Identification Number (RIN) prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.