Welcome to the Future – Part 1 – Sulfur credit Investments Pay Off 10-Fold For Forward-Looking Refiners

Last month, the price of the Tier 3 gasoline sulfur credit hit a new high of $3,600 per credit, up by a factor of 10 from 2 years ago. This tradable credit allows refiners to sell gasoline that exceeds the 10 ppm sulfur specification on gasoline sold in the United States. In today’s blog, we examine what’s behind the steep and steady rise of the price of this credit.

Read more blogs from this series Welcome to the Future:

- Part 1 Sulfur Credit Investments Pay Off 10-Fold For Forward-Looking Refiners

- Part 2 High Cost of Gasoline Sulfur Specification Draws Attention From Refiners, Investment Analysts

- Part 3 With Tier 3 Costs Sky-High, U.S. Refiners Consider Investments, Alternatives

Sulfur and octane

The Tier 3 gasoline sulfur standard requires that all refiners and importers who deliver gasoline to the U.S. market must meet a 10 ppm sulfur specification as an annual average, versus 30 ppm for the previous Tier 2. The Tier 3 story is really about two tightly coupled gasoline quality specifications – they are sulfur and octane. Many U.S. refineries are unable to desulfurize gasoline to 10 ppm without downgrading the octane of their gasoline pool. This has become a critical new bottleneck in gasoline production in North America that is reducing gasoline supply, increasing gasoline prices and affecting refiners’ profitability.

One year ago, our four-part Breaking the Chains series told the full Tier 3 story, first by explaining octane and gasoline blending (Part 1), then the octane/sulfur bottleneck (Part 2), the alternatives available to refiners (Part 3), and the sulfur credit system (Part 4)

Cost of compliance

This blog focuses on what has happened recently with the sulfur credit price. The current $3,600 price is a direct measure of the true cost of Tier 3 compliance. That’s because buying a sulfur credit does nothing more than relieve the refiner of the cost of their next best alternative for compliance. It follows that the next best alternative must be costing that refiner at least the price they’re willing to pay for the credit.

The current $3,600 price is a direct measure of the true cost of Tier 3 compliance

Without getting into the details of the sulfur credit system (see Breaking the Chains Part 4), we can attach a tangible meaning to the $3,600 credit price with the following example. Consider a single refinery producing 100,000 barrels per day of gasoline. At the beginning of 2022, instead of making 10 ppm sulfur for that year, that refinery had the option to make 30 ppm sulfur for the whole year 2022 and offset it by buying $11 million/year worth of credits; here is the calculation of that $11 million credit cost:

Credit cost = 100,000 barrels/day x 42 gallons/barrel x (30-10) ppm x $360/1,000,000 ppm-gallons x 365 days/year= $11 million/year.

In this calculation, we have highlighted the credit price to emphasize it was $360 at the time of this example case, and its unit of measure is dollars per million ppm-gallons.

The above calculation shows the meaning of the credit price – which is that this refinery had a choice: This refinery could comply with Tier 3 by either buying $11 million of credits or else by desulfurizing their 30-ppm sulfur gasoline down to 10 ppm and bearing the cost of the corresponding octane downgrade which in this case was $50 million. Buying the credits was the clear winner.

But today, with the credit price at $3,600 instead of $360, that credit purchase would cost $110 million instead of $11 million.

today, with the credit price at $3,600 instead of $360, that credit purchase would cost $110 million instead of $11 million.

Credit demand

What does credit demand look like? Credit purchases have usually not covered a whole year, more often a period of months. A few times a month, a trader from some gasoline supplier comes to the credit market to purchase credits to enable sale of off-spec gasoline as Tier 3 gasoline. That’s what credit demand has looked like the last few years.

Recently, when traders have come to the market to make a spot purchase like this, the high credit price has caused some to go back to headquarters to rethink their compliance strategy. In some cases, the trader’s been told by headquarters to go ahead and buy the credits regardless of the cost because they are needed. In other cases, the trader’s not come back to the market to buy the credits, suggesting headquarters chose an alternative compliance option.

The credit purchase is a perfectly legitimate compliance strategy, and a smart one for those whose incremental cost for octane is higher than the industry average. But it is a remedy, not a cure, and that fact is becoming evident now that the cost of the remedy is approaching the cost of the cure.

Credit supply

Who sells the credit and gets that $110 million? They are refiners and importers who had the capability and foresight in prior years to produce a sub-10 ppm sulfur gasoline pool to earn and bank a supply of Tier 3 sulfur credits each year over a period of years. In most cases, this was a deliberate investment strategy. With awareness of the changing industry credit supply/demand situation, and knowing their own sulfur reduction cost and likely future industry cost, they bore a known upfront cost in anticipation of the coming future octane/sulfur squeeze. That future has now arrived and, as the only suppliers of usable Tier 3 credits, they are now reaping the benefits of that proactive investment strategy.

That future has now arrived and, as the only suppliers of usable Tier 3 credits, those refiners and importers are now reaping the benefits of that proactive investment strategy.

There is no other way to generate a Tier 3 sulfur credit. The current usable credit supply is limited to those credits that were earned and banked in previous years which have not yet been retired for compliance.

There is no other way to generate a Tier 3 sulfur credit.

Shrinking balance

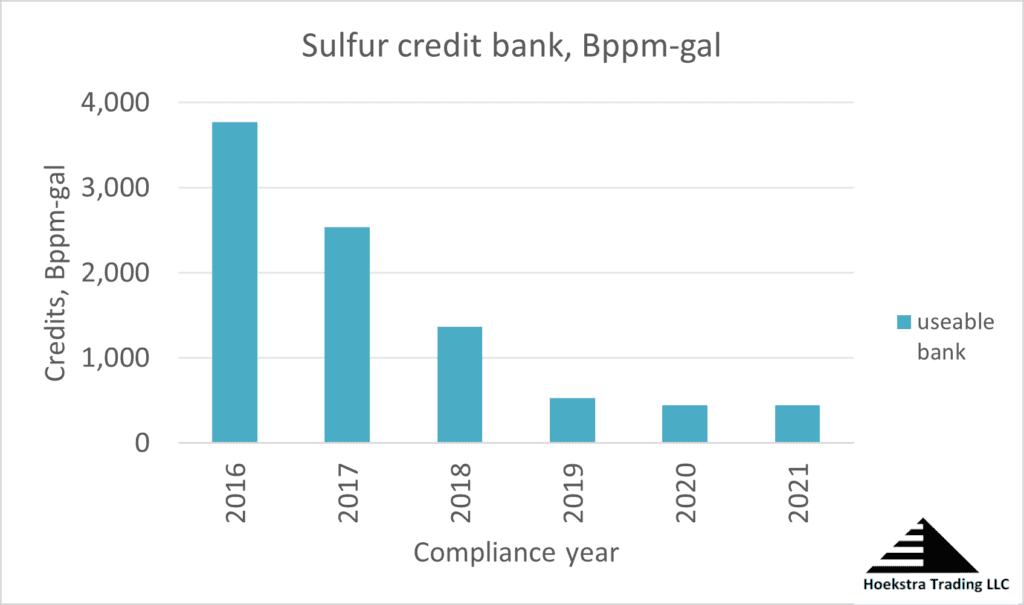

It is possible to quantify and track the industry level sulfur credit bank balance. Hoekstra Trading has been doing that since 2013. Figure 1 shows the credit bank balance for years 2016 through 2021.

Figure 1 Industry-level usable sulfur credit bank balance Source: Hoekstra Trading LLC

The supply of usable credits fell from nearly 4 trillion ppm-gallons in 2016 to 400 billion at the end of 2021. This large shrinkage is because, prior to 2019, there was a large surplus of old credits that had been generated against much more lenient specifications. Those old credits were, by rule, usable for Tier 3 compliance until the end of 2019. But since then, the only usable credits are those earned by having made an annual average sulfur below 10 ppm, which is a much more difficult feat.

Long supply timeline

For a few refiners, generating credits is still easy. But for most, it is costly, and it does not happen without adopting a deliberate strategy to become a sulfur credit supplier. The next deposits of new credits to the bank won’t be made until 2025. They will be limited to the quantity generated by refineries who successfully make a sub-ten-ppm sulfur gasoline pool (as an annual average) in 2024. To move into that group, a refiner would most likely need to make that decision now, implement it in January and stick with it through all of 2024.

To move into that group, a refiner would most likely need to make that decision now, implement it in January and stick with it through all of 2024.

No liquidity

Traders, lacking this picture of the slowly changing industry-wide trends in credit demand and supply, assume by default the price quoted today reflects a supply demand equilibrium, as it does in almost of the high volume, mature, liquid markets in which they trade. But this credit market is a very low volume, sparse, illiquid market, still in a development stage, in which supply is gradually shrinking and demand is gradually growing, and both changes are occurring over very wide ranges at glacial paces. Supply, demand, and price are unlikely to equilibrate for at least several years. Consequently, a well-informed credit strategy must take account of the transient industry-level cost, supply, and demand situation.

$10 billion/year

The cost of Tier 3 compliance was estimated by EPA in 2013 to be $1.3 billion/year. Hoekstra Trading estimates the actual cost ten years later exceeds $10 billion/year. This higher true cost only started to be felt in 2021, and since then has become increasingly evident by the amount of octane actually being destroyed in refineries and the increased demand for, and 10-fold increase in the price of the credits.

The cost of Tier 3 compliance was estimated by EPA in 2013 to be $1.3 billion/year. Hoekstra Trading estimates the actual cost ten years later exceeds $10 billion/year.

The main cause of the higher than expected cost is that the refining industry badly underestimated the future cost of Tier 3 compliance and did not make enough of the right capital investments to overcome the Tier 3 octane/sulfur bottlenecks. The prevailing assumption was that octane loss for Tier 3 would be much less than is being realized.

The outlook

The value of octane has risen steadily by 5-fold in the last 10 years (Breaking the Chains, Part 1). Given the rising value of octane and tight credit supply, the sulfur credit price is likely to move higher until it forces more refiners to either seek a cure for high octane losses (reducing credit demand) or adopt a deliberate strategy to become a credit producer (increasing credit supply). Even if those strategies get decided and implemented today, it will take years to play out to a credit supply demand equilibrium.

the sulfur credit price is likely to move higher until it forces more refiners to either seek a cure for high octane losses (reducing credit demand) or adopt a deliberate strategy to become a credit producer (increasing credit supply).

Some refiners have been taking steps to debottleneck their octane production in the Tier 3 world. These include use of new catalysts, feed optimization, unit optimization, minor revamps, and capital investment in new processes. The next blog in this series will give some specific sulfur/octane debottlenecking example cases from U.S. refineries.

Recommendation

Every refining executive should have a comprehensive understanding of the technical, regulatory, and economic aspects of Tier 3 gasoline, the sulfur credit program and how they affect your business. Those wanting a quick education on the Tier 3 issue should get the short book, Gasoline Desulfurization for Tier 3 Compliance, which will make you an industry expert in a day. Once you have become expertly informed of the problem, you can save your team years of redundant work by buying Hoekstra Research Report 8. We saw this situation coming, did the research and field tests, ran the simulations and analyzed the results so you and your team can take immediate steps to increase gasoline margin capture in the Tier 3 world. The report includes detailed pilot plant and commercial field test data, full detail of sulfur credit pricing, spreadsheet models to help improve gasoline optimization, sulfur credit strategy and refining margin capture in the Tier 3 world.

Don’t get caught panic buying after the credits spike.

George Hoekstra

George.hoekstra@hoekstratrading.com

+1 630 330-8159