What’s Next for Cellulosic Biofuel and the D3 RIN? – Part 5, Impact of EPA’s Partial Waiver on the D3 RIN Price

Read other blogs in this series:

- Part 1 – The Market That Fizzled

- Part 2 – The Biogas Solution

- Part 3 – Rewind to the Fast Crash of Kior, a Cellulosic Biofuel Company

- Part 4 – Fueling Heavy Duty Trucks With Fuel From Cows

- Part 5 – Impact of EPA’s Partial Waiver on the D3 RIN Price

- Part 6 – Quantitative Theoretical Modeling of RIN Prices

- Part 7 – D3 RIN Price – Is The Market Off By a Factor of Ten?

- Part 8 – A New Industry Emerges

- Part 9 – Tracking the D3 RIN price

On December 5th 2024, EPA issued a proposal to partially waive the cellulosic biofuel volume requirement for 2024 from 1.09 billion to 0.88 billion Renewable Identification Numbers (RINs). This requirement sets the minimum volume of annual supply of biofuels made from cellulosic biomass like wood chips, corn stalks, landfill biogas and cow manure in the U.S. The volume requirements for the other categories of RINs would not be changed.

RINs come in different categories with different code names. The primary implication of this partial waiver for RIN pricing would be to reduce the demand for cellulosic (D3) RINs and increase the demand for advanced (D5 and/or D6) RINs, which means, directionally, to reduce the price of the D3 RIN and increase the price of advanced RINs.

In its proposal, EPA did not quantify these price impacts. But Hoekstra Trading has done that using our ATTRACTOR 3.0 spreadsheet model which uses principles of RIN price theory published in this article by Scott Irwin, Kristin McCormack and James H. Stock and this dissertation by Ben Meiselman, and their references.

ATTRACTOR 3.0 calculates theoretical prices we call D3T and D4T, which are the theoretical values of hypothetical RINs that expire 1 year from the current date. It also calculates theoretical values of the actual D3 and D4 RINs for their actual expiration dates.

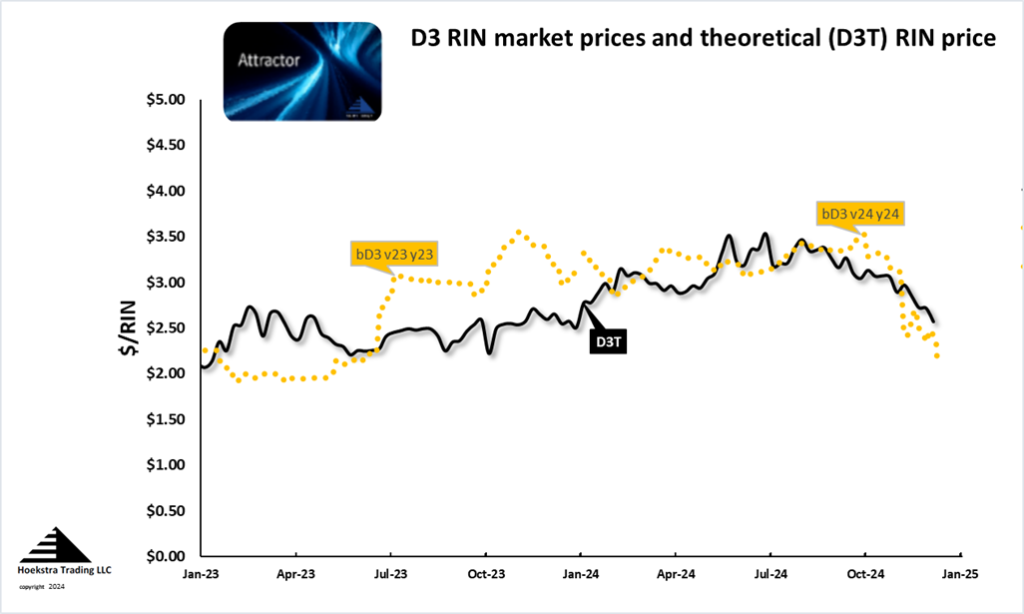

Figure 1 shows the chart of the theoretical value D3T in black along with quoted market prices of the latest-vintage D3 RINs in gold (the label “bD3 v23 y23” refers to the vintage 2023 D3 RIN trading in year 2023, and “bD3 v24 y24 refers to the vintage 2024 vintage D3 RIN trading in year 2024.)

The calculated impact of the proposed reduction in the 2024 cellulosic volume requirement on D3T, other things equal, is is to decrease the D3 RIN price by $0.11/RIN.

RIN time values

In addition to the partial waiver, EPA’s proposal would extend the compliance deadlines for obligated parties to comply with each year’s mandate. This extension also affects the price of an affected RIN by virtue of the RIN’s time value. That’s because, as a financial instrument, a RIN is an option, and, like other options, extending its life increases its value by virtue of its higher “time value”.

The time value component of a RIN is included in the price calculated in ATTRACTOR, and this secondary effect of the proposed change in settlement dates is reflected in the calculated theoretical prices of the actual RINs affected by the partial waiver.

But this secondary effect does not show up in the price of D3T or D4T, which are hypothetical RINs that expire exactly 1 year from the current date. The use of a constant 1-year life for the theoretical RIN allows consistency in comparing its value over time without the bias that would otherwise be introduced by its changing remaining life and corresponding time value. Because the life of D3T has not changed with the waiver, neither has this component of its price.

Watch for next week’s episode of this blog series for more on how these theoretical values are calculated.

ATTRACTOR, D3T, and D4T

The ATTRACTOR spreadsheet is used by Hoekstra Trading clients to compare theoretical and market prices, analyze departures from theoretical values, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

D3T and D4T have been licensed to Bloomberg Finance LP who are authorized to use, display, and deliver their values to Bloomberg users. They are posted on the Bloomberg Terminal with weekly updates and are the world’s first licensed theoretical values of an environmental credit.

Recommendation Get Hoekstra Research Report 10

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.