What’s next for cellulosic biofuels and the D3 RIN? – Part 1, The Market That Fizzled

Read other posts in this series: What’s next for cellulosic biofuels and the D3 RIN?

- Part 1 – The Market That Fizzled

- Part 2 – The Biogas Solution

- Part 3 – Rewind to the Fast Crash of Kior, a Cellulosic Biofuel Company

- Part 4 – Fueling Heavy Duty Trucks With Fuel From Cows

- Part 5 – Impact of EPA’s Partial Waiver on the D3 RIN Price

- Part 6 – Quantitative Theoretical Modeling of RIN Prices

- Part 7 – D3 RIN Price – Is The Market Off By a Factor of Ten?

- Part 8 – A New Industry Emerges

- Part 9 – Tracking the D3 RIN price

A main objective of the Renewable Fuel Standard (RFS) in 2007 was to trigger development of a market of at least 16 billion gallons/year of transportation fuel made from cellulosic biomass. Cellulosic biomass consists of non-food crops and waste biomass such as corn stalks, corncobs, straw, wood, and wood byproducts.

Though overshadowed by other biofuel categories in the past, the cellulosic biofuel market is now becoming a hot topic in the renewable fuels world.

The 16 billion gallons/year target for cellulosic biofuel was never reached. In fact, after 17 years, we are still producing less than 1 billion of the targeted 16 billion gallons/year.

The workaround

Because this market never got off the ground, from 2010-2022, EPA was required to reduce the mandated minimum volume of cellulosic biofuel to a small fraction of the statutory volume, and set up a special credit called a cellulosic waiver credit. The cellulosic waiver credit provided a workaround for refiners to comply with the cellulosic biofuel volume mandate despite there being very little volume produced.

Consideration of any renewable fuels market inevitably leads to discussion of RINs, so here we go on cellulosic biofuel RINs.

The “normal” way to comply with an RFS biofuel volume mandate is to either produce your assigned quota of that biofuel or buy a RIN credit, which in this case is a D3 RIN (RIN credits come in different categories for different biofuels, and D3 is the name of the RIN applicable to cellulosic biofuels).

As Hoekstra Trading clients and followers know well, a RIN is both a subsidy and a tax. The subsidy is realized by biofuel producers when they sell a RIN to petroleum fuel producers who buy it to fulfill an obligation. By design, the obligation functions as a tax on production of petroleum fuels that raises just enough money to fund the subsidy at the level that produces the mandated quantity of the corresponding biofuel.

This system has proven to work very will except in the case of cellulosic biofuel which, for several reasons (technical, economic, and political), fizzled. Virtually no cellulosic biofuel was produced, and the cellulosic waiver credit was used as a workaround.

How does the workaround work?

The “normal” way to comply with the cellulosic biofuel mandate is to generate or purchase a D3 RIN. But because not enough D3 RINs would be generated to meet the statutory mandates, the mandates were replaced by lower, more achievable mandates and refiners were allowed to comply by buying a (cheaper) D5 RIN plus a cellulosic waiver credit instead. By rule, the cellulosic waiver credit has a fixed price that is set each year by the EPA according to rules set by the U.S. Congress when the RFS law was enacted.

The upshot is that the D3 RIN will, in theory, be worth no less than the price of a D5 RIN (which, for other reasons, sets a floor price for the D3 RIN) – and the D3 RIN will be worth no more than the sum of the price of a D5 RIN plus the price of a cellulosic waiver credit (which sets a ceiling price for the D3 RIN).

In this way, those obligated to meet the cellulosic biofuels mandate (mainly refiners) are protected from risk of non-compliance or runaway D3 RIN prices.

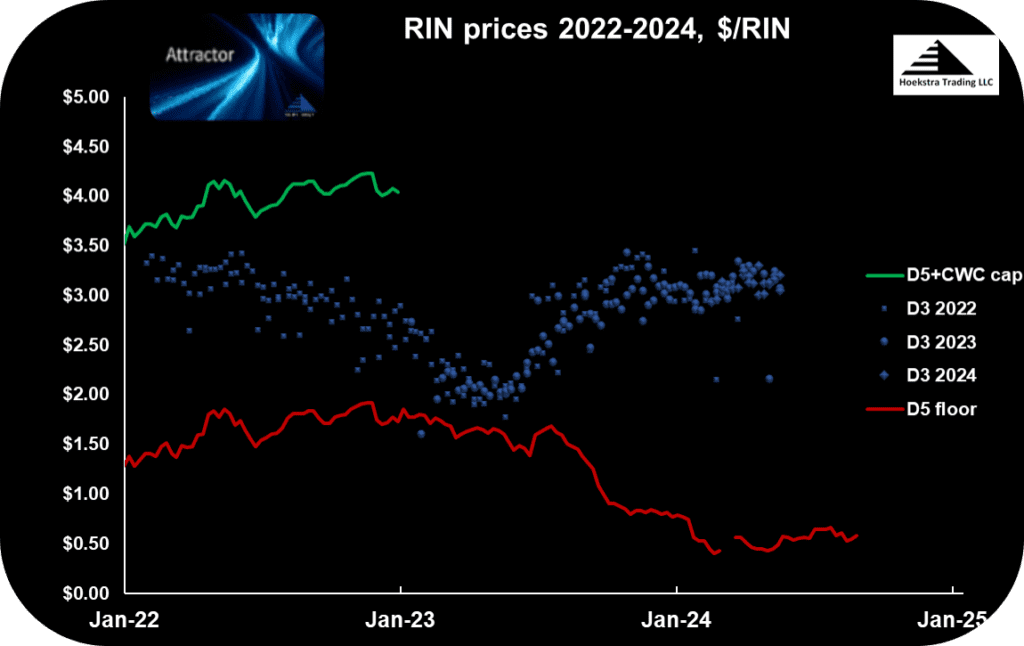

Figure 1 shows this theoretical relationship has held true in recent years. The blue data shows the price of the D3 RIN which is bracketed below by the (red) price of the D5 RIN, which is a theoretical floor, and above by the (green) price of the D5 RIN plus the price of the cellulosic waiver credit, which is a theoretical cap on the D3 RIN price.

You can see on Figure 1 that the green ceiling does not appear beyond year 2022. That’s because quirks in RFS rules caused the cellulosic waiver credit to disappear from the picture after 2022.

It’s removal changed the cellulosic biofuels game and triggered new possibilities for RIN price volatility which put cellulosic biofuels back on the front burner because, as shown on Figure 1, there is currently no upper bound on the price of the D3 RIN.

More legal costs

In 2023, the American Fuel and Petrochemical Manufacturers (AFPM) petitioned EPA to issue a partial waiver of that year’s cellulosic biofuels mandate because of concern there would be insufficient domestic supply of D3 RINs to meet the mandate which could lead to severe economic harm in parts of the U.S.

That request was denied by EPA, which means the D3 RIN subsidy remains as the only mechanism to comply with the cellulosic biofuel mandate, and it must do that by rising in price to whatever level is necessary to stimulate enough additional cellulosic biofuel production to meet the mandate. That scares those obligated to pay the price, especially because the cellulosic biofuels market has a history of not delivering the necessary volume, and because the obligated parties bear the scars from having been victims of runaway RIN prices in the past.

As shown on Figure 1, while the legal back-and forth continues on how to address the lack of a workaround, the D3 RIN price has been moving up in its now partially-bracketed range while the D5 RIN, and the other RINs, have been falling. Another round of legal work begins this week.

What is happening on the ground in the cellulosic biofuels market? How high would the D3 RIN price need to go to stimulate the currently mandated cellulosic biofuels growth? With the cellulosic waiver credit currently off the table, what other workarounds might prevent runaway D3 RIN prices?

These questions are buzzing through the renewable fuels ecosystem. Stay tuned for more.

Recommendation Get Hoekstra Research Report 10

Hoekstra Trading clients use the ATTRACTOR spreadsheet to compare theoretical and market Renewable Identification Number (RIN) prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.