What’s Next for Cellulosic Biofuels and the D3 RIN Part 6 – D3 RIN Price – Is The Market Off By a Factor of Ten?

See previous posts in this series, What’s Next For Cellulosic Biofuels and the D3 RIN?:

- Part 1 – The Market That Fizzled

- Part 2 – The Biogas Solution

- Part 3 – Rewind to the Fast Crash of Kior, a Cellulosic Biofuel Company

- Part 4 – Fueling Heavy Duty Trucks With Fuel From Cows

- Part 5 – Impact of EPA’s Partial Waiver on the D3 RIN Price

- Part 6 – Quantitative Theoretical Modeling of RIN Prices

- Part 7 – D3 RIN Price – Is The Market Off By a Factor of Ten?

- Part 8 – A New Industry Emerges

- Part 9 – Tracking the D3 RIN price

Familiar corporate names like Waste Management, Cummins, Freightliner and BP have joined forces with dozens of less familiar public companies and startups to form a new American industry. Thousands of commercial trucks, powered by natural gas fueled engines, are on the roads nationwide, fueling up at dedicated natural gas refilling stations that are supplied with renewable natural gas (RNG), a cellulosic biofuel sourced from landfills and dairy farms.

A roadblock

But now on the threshold of becoming the first big cellulosic biofuels success story, the upstart industry hit a roadblock on December 5, 2024 when the EPA announced a proposal to issue a partial waiver of the 2024 Renewable Volume Obligation (RVO) for cellulosic biofuel under the Renewable Fuel Standard.

What does that mean? In a nutshell, it reduces the incentive to produce biofuel from landfill gas and cow manure.

All roads lead to the Renewable Identification Number (RIN)

This brings us back to where this blog series started, which is the story of the D3 RIN. We have given an overview of the history of the D3 RIN and explained how, after failing to catalyze the original “wood chips vision”, and after years of stagnancy in the cellulosic biofuels world, the D3 RIN was resurrected in 2023 to serve as the primary federal credit that subsidizes this young industry’s growth.

Here’s the short version of how that works: A higher RIN credit price incentivizes investment in the capabilities needed to bring renewable fuel visions to reality – and a lower price reduces returns on those investments.

The force keeping the RIN price high is a scarcity of credits in the market, which occurs when the mandated volume, also know as the Renewable Volume Obligation (RVO) is difficult to attain. EPA’s proposed partial waiver reduces the mandated target and relieves the pressure caused by that scarcity.

Big Truck Crash?

As reported below, some claim that this partial waiver is enough to crash the D3 RIN price by enough to crash returns on the investments driving the young industry’s growth. It was therefore no surprise when the partial waiver proposal triggered a controversy that, as of this writing, remains unresolved.

EPA Public Hearing

On December 20, 2024, EPA held a public hearing to get verbal comments on the partial waiver proposal that would, along with written comments, inform the final decision on the proposed waiver.

Twenty-seven people testified at the hearing, representing companies and coalitions across the spectrum of participants in the new industry including familiar names like Waste Management, American Petroleum Institute and Renewable Fuels Association, along with dairy farm and landfill renewable gas developers, RNG producers, investment companies, and companies who make the technical tools and instruments needed in a startup industry.

This testimony from a dairy gas producer presented the view from one side of the table:

“Our projects are dependent on long term certainty and predictability, in order to cover the high capital costs of building these projects. . . We’ve invested hundreds of millions of capital. And during that time, we were operating under the assumption the RVO was set in stone . . . However, at the stroke of a pen, modification to the volume requirements undermine those investments that were made, and sends a chilling effect to future projects we hope to develop.” – A WITNESS AT EPA HEARING, Dec. 20, 2024

That’s a fair point. Nobody likes it when the goalposts are moved at the last minute.

From the other side of the table, The American Fuel and Petrochemical Manufacturers (AFPM) stated the view of those who are obligated to generate or purchase the D3 RINs, saying:

“This action is necessary to address the significant production shortfalls in 2023, and 2024, that depleted the cellulosic RIN bank. Without this relief, obligated parties will be left without sufficient access to cellulosic RINS to satisfy their compliance obligations for this year. Refiners should not be held liable to purchase fuels or RINS that do not exist.” – AFPM, Dec 20, 2024

That’s a fair point too. Under the RFS, producers and importers of conventional petroleum fuels are forced to buy the RINs, which means they are paying to replace their products with more expensive renewable fuels. It is bad enough to be forced to buy the credits, even when they do exist.

Both sides of the table have fair points, which emphasizes a challenge faced by those charged with the thankless job of setting the RFS mandates.

At the hearing, one witness pointed to the price action in the D3 RIN, saying:

“the mere rumor of the EPA changing the year 2024 D3 RIN mandate for cellulosic fuel caused a price crash from $3.40 to $2.08 per D3 RIN. Almost all D3 RINs are generated by renewable natural gas production in the U.S. These decisions by EPA have caused massive financial losses among lenders and investors in renewable fuel.” – A WITNESS AT THE EPA HEARING, DEC. 5, 2025

RIN price sensitivity – off by a factor of 10?

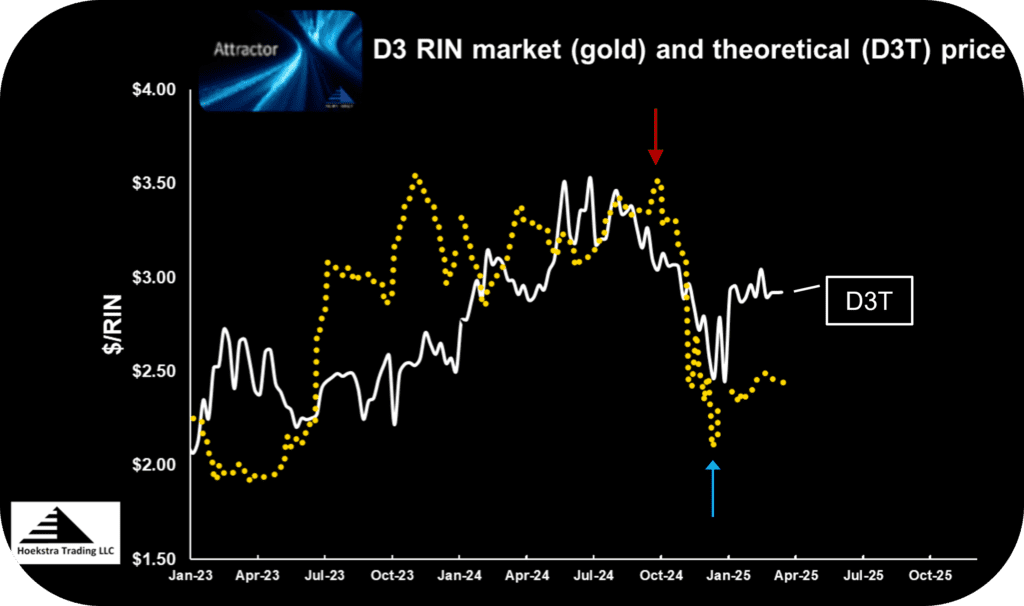

Figure 1 shows the market price of the D3 RIN in gold, charted alongside the theoretical price of the D3 RIN in white. The theoretical price, named D3T, is calculated by Hoekstra Trading in our ATTRACTOR spreadsheet using pricing models developed at University of Illinois, Harvard University, and University of Michigan and has been licensed to Bloomberg Finance L.P. for display on Bloomberg Terminals worldwide.

The red arrow on Figure 1 indicates the D3 RIN market price peaked the week of September 27, 2024, and the blue arrow marks the December 5, 2024 release of the partial waiver proposal. The D3 RIN market price was falling since late September, from a high around $3.40 to a low of $2.08 on December 5, when the waiver proposal was released. That is to say, the release of the EPA proposal occured after the RIN price had crashed.

This $1.32 fall, (from $3.40 to $2.08) was referred to at the Dec. 20 hearing, as quoted above:

“the mere rumor of the EPA changing the year 2024 D3 RIN mandate for cellulosic fuel caused a price crash from $3.40 to $2.08 per D3 RIN.” – A WITNESS AT THE EPA HEARING, DEC. 5, 2025

By this interpretation, the market anticipated the release of the EPA proposal and factored in (“discounted”) a $1.32 price impact in advance of the release. That is a plausible explanation.

But Figure 1 shows that both the D3 market price and the D3T theoretical value were falling together long before the announcement of the partial waiver proposal. The fall in the calculated D3T theoretical value prior to December 5 was caused by other fundamental factors that affect the D3 RIN price in ways that are quantified in the theoretical model, not by rumors of a change in the cellulosic mandate level.

The fall in the D3T calculated theoretical value prior to December 5 was caused by other fundamental factors that affect the D3 RIN price in ways that are quantified in the theoretical model, not by rumors of a change in the cellulosic mandate level.

Hoekstra Trading

According to the theoretical interpretation, 90% of the crash was caused by other factors and only 10% by the threat of a waiver. That explanation is also plausible.

Exactly how much should the proposed partial waiver of the mandate affect the D3 RIN price? EPA did not quantify that sensitivity, saying only

“we can reasonably project that because this action would reduce demand for cellulosic RINs, it is expected to directionally decrease cellulosic RIN prices. The exact magnitude of this price reduction depends on a wide range of market factors that prevent us from quantitatively projecting a RIN price impact.” – EPA, DEC. 5, 2024

Hoekstra Trading did quantify that price sensitivity and published it Dec. 8, 2024, in Part 5 of this blog series, saying:

“The calculated theoretical impact of the proposed reduction in the 2024 cellulosic volume requirement on D3T, other things equal, is to decrease the D3 RIN price by $0.11/RIN”. – HOEKSTRA TRADING, Dec. 8, 2024

The $0.11 theoretical sensitivity is less than 1/10 of the $1.32 sensitivity the proposed partial waiver is being blamed for. The $0.11 shows on Figure 1 as a downward spike in D3T at the end of the crash, the week of Dec. 5

It’s not the first time specific EPA actions have been given more than their fair share of the blame for RIN price volatility.

An implication is that industry stakeholders should not be surprised if, in the coming weeks or months, the final waiver decision causes much less than a $1.32 magnitude response.

industry stakeholders should not be surprised if, in the coming weeks or months, the final waiver decision causes much less than a $1.32 magnitude response.

Hoekstra Trading

Recommendation Get Hoekstra Research Report 10 and the ATTRACTOR spreadsheet

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost.