SREs = Sustainable Revenues for Expensive lawyers

Will it ever end? What’s the effect on RIN prices? What’s the cost?

The acronym SRE is something you will see a lot if you follow the world of renewable fuels and Renewable Identification Numbers (RINs). SRE means Sustainable Revenues for Expensive lawyers. It involves a dispute about Small Refinery Exemptions granted during the Trump administration to several small refineries. Those exemptions took them off the hook from paying certain Renewable Identification Number (RIN) purchase obligations.

After the 2020 Presidential election, those exemptions were repealed by EPA which meant the small refineries were back on the hook to buy those RINs. But the small refiners sued, and on Wednesday they won. So they are off the hook again, at least for now.

This was the latest episode in a larger RIN War that started in 2013. At the root of the 10-year war is a disagreement (or is it a Misunderstanding?) about an economic issue called the pass-through theory which says refiners’ RIN expense, which is like a tax, is recaptured by the refiners in a higher market price for the fuel they sell.

The RIN War began in 2013 when refiners’ RIN cost suddenly skyrocketed 60-fold (not sixty percent!), from near zero to $14 billion per year. In the fallout from that event, which we named The Big Bang, it emerged that EPA considered that $14 billion cost to be not a true cost because of the pass through-recapture theory. That theory was initially rejected by refiners (though many refiners later came to accept it).

Point of Obligation

In the next episode, the refiners lost the “point of obligation” battle, in which they petitioned EPA to re-assign the RIN tax obligation to blenders or other entities in the fuel supply chain instead of refiners. In that decision, the court stated the refiners’ view as follows:

“At the root of petitioners’ claim is a single premise: that the current point of obligation misaligns incentives by requiring those who refine fossil fuel, but not those who blend it, to meet the RFS program’s annual standards. In petitioners’ view, this misalignment forces refiners to purchase RINs to satisfy their RFS obligations, jacking up their costs, while giving windfall profits to blenders, who produce (but don’t consume) RINs.”

U.S. District of Columbia Court of Appeals, August 30, 2019

that court decision stated EPA’s contradictory view as follows:

“The problem with this argument, however, is that EPA reasonably explained why, in its view, there is no misalignment in the RFS program. According to EPA, refiners recover the cost of the RINs they purchase by passing that cost along in the form of higher prices for the petroleum based fuels they produce.”

U.S. District of Columbia Court of Appeals, August 30, 2019

The Point of Obligation decision hinged on the pass-through theory and, in the D.C. court’s opinion, the EPA won that round.

Disproportionate Economic Harm

EPA also won the next round by denying the refiners’ petition for an exemption to the RINs requirement. In that denial, EPA said that, because of the pass-through theory, refiners did not face disproportionate economic harm from the RIN tax. EPA concluded that, whether the refiner is large or small:

“we find that all obligated parties recover the cost of acquiring RINs by selling the gasoline … they produce at the market price, which reflects these RIN costs (RIN cost pass-through).”

“April 2022 Denial of Petitions for RFS Small Refinery Exemptions”, EPA-420-R-22-005, April, 2022

The Disproportionate Economic Harm decision again came back to the pass-through theory. One upshot of that episode, as I read it, was that the burden of proof would now be placed on small refiners to prove they bear disproportionate harm, otherwise, no exemptions.

Calumet Data

Skipping forward now to this latest episode, the refiners won on Wednesday when a different district court, referring to the Disproportionate Economic Harm episode, pointed out that EPA had glossed over data provided by Calumet Shreveport Refining, saying:

“EPA glosses over petitioners’ refinery-specific data proving they operate in inefficient local markets that do not allow for RIN cost passthrough. In response to Calumet’s data, for example, all EPA said was that the Pasadena market demonstrated “the RIN price is fully passed through.” That’s not responsive—both petitioners and EPA agree Pasadena is efficient. The problem is that Calumet does not operate in Pasadena. EPA leaves unrebutted petitioners’ actual contention—that lower sale prices in the micro-market relative to the efficient Pasadena market prove that Calumet, like other petitioners, cannot pass through the costs of the RINs it purchases.“

U.S. Court of Appeals for the 5th Circuit, November 22, 2023

Like the previous cases, the Calumet Data decision on Wednesday hinged on the pass-through theory, now wrapped in a different set of legal theories, precedents, and opinions.

On page 28, this decision says the Calumet data proves they don’t recapture their RIN cost in that market. That Calumet data had been submitted to EPA prior to the April 2022 Disproportionate Economic Harm decision, and had indeed been glossed over by EPA.

Even Hoekstra Trading noticed, in real time, that EPA had glossed over that Calumet data!

Even Hoekstra Trading noticed that EPA glossed over the Calumet data!

Hoekstra Trading’s take

The following excerpt, from Hoekstra Research Report 11, pointed out EPA’s dismissal of the Calumet data and gave our take on it:

Excerpt from Hoekstra Research Report 11, Oct 31, 2022:

“The following excerpt from the EPA’s 2022 Denial of Petitions for RFS Small Refinery Exemptions states EPA’s conclusion about data submitted by a petitioner (a refiner) contending that RIN cost pass-through does not occur in a particular local market. EPA’s response is that the data proves the opposite contention, that the RIN cost does pass through:

Excerpt from EPA Denial of Small Refiner Petitions:

“One petitioner used monthly gasoline and ethanol pricing data from a local terminal, along with RIN pricing data, to determine a monthly-calculated E10 price from 2010 to the present using an equation nearly identical to Equation 2. The petitioner then plotted these calculated E10 prices, which assume that 100% of the RIN value is passed through to wholesale purchasers through lower prices for blended fuel, against the posted prices for E10 at that same terminal. The petitioner found an extremely strong correlation (R2 = 0.9976) between the calculated E10 price (assuming 100% RIN passthrough) and the posted E10 price, demonstrating for this terminal that the RIN value has been fully passed through to wholesale purchasers since 2010.”

From EPA 2022 Denial of Petitions for RFS Small Refinery ExemptionsHere, EPA states the equation used by the refiner “assumes that 100% of the RIN value is passed through to wholesale purchasers through lower prices for blended fuel”. EPA does not say where the refiner makes that assumption, or why it believes the refiner makes that assumption, or what if anything else is wrong with the refiner’s analysis, it simply states the equation used by the refiner assumes RIN pass-through does occur and therefore the analysis shows RIN pass-through does occur.

The refiner’s analysis includes 12 years of hard data showing an extremely strong correlation (R2 = 0.9976) which the refiner contends shows pass-through does not occur. It should be addressed with more than just an unexplained (and I believe incorrect) assertion that the refiner assumed the opposite. When I’ve asked how this direct contradiction might be resolved, I’ve been told it will be resolved in court.”

Hoekstra Research Report 11, October 31, 2022

In my opinion, court is not the right place to resolve this contradiction — but it is a great place to provide Sustained Revenues for Expensive lawyers.

Even if you follow it closely, the whole RIN War appears to be a Land of Confusion, like a pinball machine where each bumper is a different courtroom and the ball keeps bouncing around aimlessly for years while all the coins go to expensive lawyers.

Conclusions

- Will this ever end? — No, because no court will ever solve the Big Contradiction at its core.

- What will Wednesday’s decision do to RIN prices? — Reduce them, because it increases the probability of a slug of RIN supply coming back into the market.

- How much does it cost to run a 10-year litigation program involving whole teams of lawyers, including the Supreme Court of the United States, trying to solve a confounding economic riddle? The average rate for lawyers is $269 per hour. That’s an average lawyer. These are expensive lawyers. Be conservative. Round up to $300 and do the math yourself. It’s a lot!

- Anyone seriously interested in the solution to the riddle should accept the following recommendation:

Recommendation

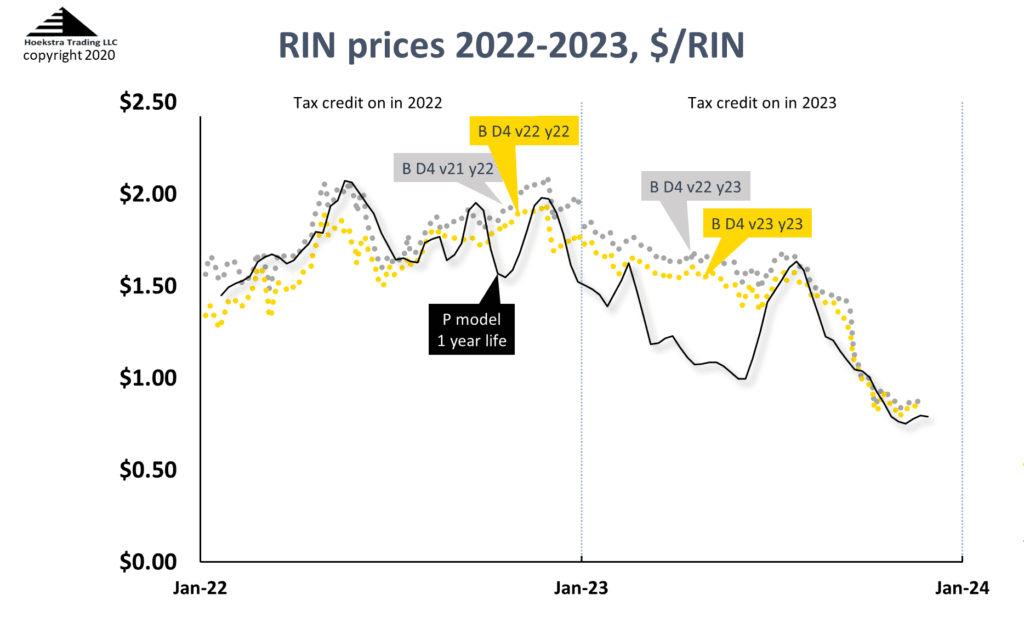

Those with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Attractor spreadsheet that calculates theoretical D4 RIN values using the Irwin-McCormack-Stock (IMS) RIN price model (black line on chart below) based on economic fundamentals, tracks them versus actual prices (silver and gold data points), predicts how the D4 RIN price will change with the variables that affect it, includes 6 months of unlimited consultation by phone and E-mail, and is available to anyone immediately at negligible cost.

It is not a monthly newsletter, it is a research report based on millions of dollars worth of academic work on RIN fundamentals that will give you a new perspective on RIN pricing and economics, unique insights and practical tools your company can use to better track, interpret and anticipate RIN price movements. Here’s the offer letter including the Table of Contents and a sample invoice with all the information needed to prepare a purchase order. Why not send a purchase order today?

Attractor update

The Hoekstra IMS RINs pricing spreadsheet shows the D4 RIN market price (gold and silver points) and the theoretical D4 RIN value updated through Friday November 24, 2023. The theoretical value of a hypothetical D4 RIN with 1 year remaining life is $0.79.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

George Hoekstra [email protected] +1 630 330-8159