What’s the missing piece in Phillips 66 refining profit problem?

NOTE ADDED March 3/2025 See Love Letters Part 1 Big Oil Gets Tough Love From Investor Elliott Management

Investors are puzzled over Phillips 66 (PSX) refining profits.

Here is a comment from a PSX stock investor last week:

“The 2nd quarter Pre-Tax Profitability Chart shows PSX’s refining business loss $729 million. This is perplexing as

(i) Figure 5 indicates crack spreads were generally higher than crude costs for the second quarter (though that fell in July),

(ii) gasoline usage is about 90% -95% back to 2019 normal levels, and

(iii) I am (and consumers in general are) paying retail gasoline prices 50% greater than a year ago.

By gosh, if PSX refining can’t make a profit with these kinds of tailwinds, well, I doubt it ever can.”

A Phillips 66 investor

Being an owner in the company, and paying $100 every time he fills his tank, he is puzzled over why his refining company lost $700 million in the second quarter.

Other investors are too.

What’s the problem?

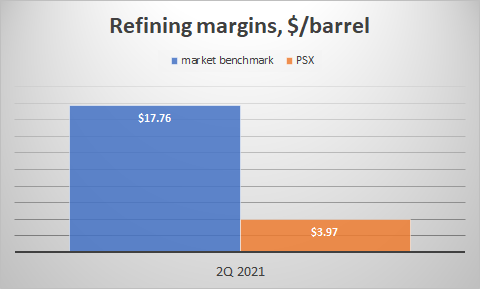

The market benchmark refining profit margin in their area was $17.76. Phillips 66’s refining margin was $3.97:

This margin measures effectiveness in making high-value fuels from low-cost crudes. It goes up when wholesale fuel prices go up and/or when crude costs go down.

Capturing only 22% ($3.97 / $17.76) of the market benchmark margin indicates highly ineffective refining business performance and should raise investors’ concerns.

My theory

I have a theory that Phillips 66 refineries are not able to make enough of the ultra-low sulfur, high octane blend stocks needed to meet current gasoline demand because the new Tier 3 gasoline sulfur specification (10 ppm sulfur max versus 30 ppm before) is handcuffing gasoline production in their refineries.

This theory is explained in many blog posts and links to my industry publications, presentations, and videos on this web site.

Phillips 66 disagrees.

At least, what they’ve said publicly is: “We are in good shape to meet the Tier 3 standards.” That was two years ago, when asked by financial analysts in 2nd quarter 2019 earnings conference calls.

And this year, I’ve been asking Phillips 66 privately, through every conceivable channel, whether my Tier 3 theory has any merit. They don’t respond, or else employees say “no comment”.

They have never said “no”.

More hard data

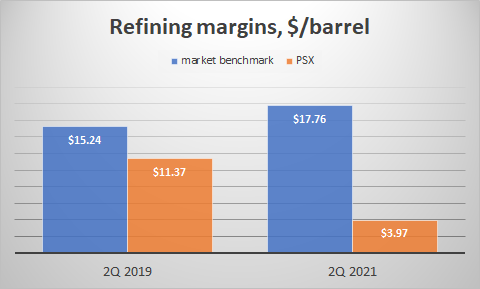

In 2nd quarter 2019, (2 years ago, before COVID) PSX’s refining margin was $11.37 versus $3.97 today.

So $3.97 is not only bad, it ‘s much worse than the last good reference point.

OBJECTION! –We can’t compare 2019 margins to 2021 without considering changes in market factors like changing crude and product prices.

This can be done by including the 2nd quarter 2019 (pre-COVID) data on the chart and comparing the company’s actual and benchmark refining margins for both years:

In 2Q 2019 (left pair of bars), the market benchmark margin (blue) was $15.24, and PSX’s margin (orange) was $11.37, for 75% margin capture.

Comparing the two blue bars shows market conditions are better today than 2019.

Comparing the two orange bars shows PSX’s refining effectiveness is not only bad — it’s much worse than before, by almost a factor of 3.

So this only heightens investors’ concern.

OBJECTION! –We must consider RIN expenses, winter storms, product imports/exports, and timing effects on margin.

I disagree, for reasons given in previous posts and published articles. But even if we grant this and make those adjustments, it doesn’t change the conclusion.

OBJECTION! — PSX and other large refiners were required to make Tier 3 gasoline starting in 2017. So the Tier 3 theory can’t explain the difference between their 2019 and 2021 margins.

Overruled. A loophole in the sulfur credit rules allowed any refiner to make 30 ppm sulfur gasoline during 2017-2019 and cover the difference with worthless early-vintage credits that existed in inexhaustible supply and expired at the end of 2019. Most refiners did this, which temporarily avoided the Tier 3 octane/sulfur squeeze and pushed off the true day of reckoning to today.

Investors are right to be puzzled by P66’s current 22% margin capture, and it is a fair question whether Tier 3 is a factor.

Is Tier 3 the missing piece?

I don’t think it is mathematically possible for margin capture to be this low unless PSX’s realized gasoline margin is much lower than in 2019, and than the market today.

The path of least resistance, when handcuffed by a Tier 3 gasoline sulfur/octane constraint, is to BUY (instead of MAKE) the ultra-low sulfur, high octane blend stocks needed to make Tier 3 gasoline. This effectively turns a refiner into a gasoline blender.

In a previous post, I showed how buying Tier 3 blend stocks can reduce gasoline margin by a factor of 5, which gives the mathematical leverage we need to square the numbers.

But this convenient remedy also hands the investors’ refining margin to others (like India).

And there are much better ways to immediately mitigate Tier 3 issues without just handing your profit to India.

Is this theory correct for PSX? I don’t know. It’s a contrarian theory, to be sure. But it’s supported by lots of hard data. And why won’t they at least respond to my fair question?

Time for a second opinion

I commend PSX for being more transparent with the margin capture issue than competitors who have the same problem lurking below the surface of their income statements. If I am right, the PSX C-Suite was blindsided by the Tier 3 profit impact. Why not hear out a very well-informed second opinion? The cost is negligible. In PSX’s case, it would cost less than 1 minute’s worth of their annual revenue.

Those who confront and manage Tier 3 proactively can turn it into a money-maker. Those who hide or deny it will be losers.

Conclusions

- PSX’s refining business has been ineffective in capturing 2021’s market opportunity.

- This puzzles investors.

- The Tier 3 theory makes things fit together.

- PSX won’t comment whether it has any merit in their case.

Recommendation

There are steps any refiner can take to immediately improve Tier 3 gasoline profitability. And there are many more things they could do in the near-term to restore gasoline profitability. Refiners affected by Tier 3 should buy the Hoekstra Research Report 8 and take a fresh look at their Tier 3 strategy. The cost is negligible. For example, in PSX’s case, it costs only 1 minute’s worth of their annual revenue.

Hoekstra Research Report 8

In a 3-year, $1 million research project, our client group developed new methods and tools to help refiners avoid hidden pitfalls and improve profitability of Tier 3 gasoline. All our data and tools are available to anyone for immediate application at negligible cost. Just see this offer letter and join our client group by sending a purchase order today: Hoekstra-Trading-Offer-letter-Research-Report-8-refiners-under 1 million barrels/day