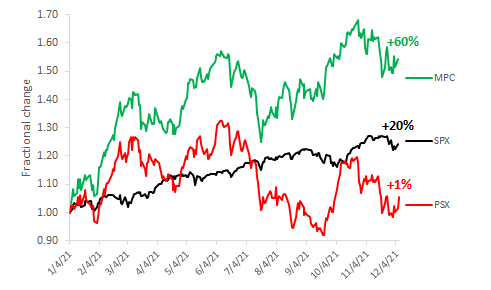

Refining stock performance 2021

There was a large dispersion in the stock price performance of US refining companies in 2021. Calumet Specialty Products stock quadrupled. That is a special case, congratulations to them and their investors.

Marathon Petroleum (MPC), shown in green below, is up 60% this year. Phillips 66 (PSX), in red, is up 1%. The S&P 500 is shown in black for reference:

The Marathon-Phillips spread is striking. The space between the green and red grew steadily through the year. It is hard to find a time interval during 2021 where you wouldn’t have made money buying MPC and selling PSX.

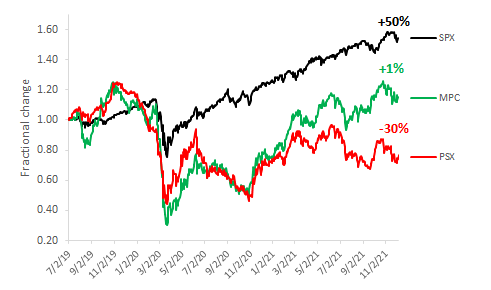

If we zoom out on the chart and reset time zero back to mid-year 2019, we can see MPC and PSX moved closely together before and through the 2020 lockdown crash, both emerging far behind the S&P 500. Then in 2021 they diverged:

The chart shows something’s been dragging down PSX stock in 2021. They have reported poor refining margins while gasoline margins in the market are high. Their C-suite’s explanations for this are weak, confusing, and unconvincing. My theory is their refineries are bottlenecked by difficulties making the ultra-low sulfur, high octane blend stocks needed to meet the Tier 3 clean gasoline specification that just kicked in this year. In that situation, refiners can go in the market and buy those barrels instead of making them in their refineries, which is a convenient solution, but it cuts their gasoline margin by a factor of five.

In 2019, Hoekstra Trading classified all US refineries into 3 categories, green, yellow, and red, based on their ability to make low sulfur, high octane Tier 3 blend stocks consistently, reliably, and profitably. Marathon ranks green and Phillips ranks red. The Tier 3 theory fits. For more on the green-yellow-red refinery classification, see this presentation from a 2019 industry conference.

Conclusions

- Phillips 66 is among a group of refiners whose stock performance is being hurt by difficulty meeting the new Tier 3 clean gasoline specification.

- Marathon, by contrast, is in a group whose refineries are well-equipped to make Tier 3 clean gasoline.

- Since Tier 3 is here to stay, we should expect divergence to continue until more red refineries either take corrective action or go bust.

Recommendation

There are steps any refiner can take to immediately improve Tier 3 gasoline profitability. There are many more things they could do in the near-term to turn Tier 3 from a problem into a profit opportunity. Refiners affected by Tier 3 should buy the Hoekstra Research Report 8 and use it to help take a fresh look at their Tier 3 strategy. The cost is negligible. For most refiners, it costs only 1 minute’s worth of your annual revenue to confront and get your arms around this important, overlooked Tier 3 issue.

Hoekstra Research Report 8

Our three-year multi-client research project measured the effects of making Tier 3 gasoline in pilot plant and commercial performance tests. We developed new methods and tools that are helping our clients optimize performance of gasoline desulfurizers to avoid hidden hits to margin capture and adopt profitable sulfur credit strategies. All our data and tools are available to anyone for immediate application at negligible cost. Please see this offer letter and join our client group today: Hoekstra-Trading-Offer-letter-Research-Report-8-refiners-under-1-MBD