A RIN is a tax and a subsidy that forces renewables into fuels Part 4 – A new perspective on RINs – the tax-subsidy interpretation

Summary

This is a four-part blog series describing the renewable identification number (RIN) as a tax (part 1) and a subsidy (part 2) that forces renewables into fuels (part 3). This is part 4 showing how this tax-and-subsidize interpretation resolves the apparent contradiction at the core of the legal dispute over RINs which is now in its 10th year. The RIN tax increases the blend cost of refined blendstocks and the RIN subsidy reduces the blend cost of renewable blendstocks. These changes cause the demand for refined blendstocks to decrease and the demand for renewable blendstocks to increase. In the case of the 10% ethanol/gasoline blend sold to consumers, which we are using as an example case, the price of the blended fuel is almost exactly unchanged. The payment of the RIN tax by refiners and the receipt of the RIN subsidy by blenders are tangible transactions whose financial effects are easy to measure and easy to understand. But two other financial effects are intangible, not easy to measure, and not easy to understand – they are the effects on the market prices of the refined blendstock (called BOB) and the blended fuel (called E10). A key for understanding RINs is to recognize that, in competitive markets, these two market prices emerge “automatically” as a consequence of competitive forces in the market rather than by the deliberate action of any individual or single company. Another key is to recognize how competition in the E10 market forces the blender to apply the revenue from its RIN sale as a credit on the effective blend cost of ethanol, and how that causes the RIN tax to cross-subsidize ethanol used as fuel. At the individual refiner and blender level, the RIN has no impact on profitability. At the aggregate market level, there are impacts on the refining and blending industries that require a different, related analysis. This tax-and-subsidize interpretation provides a sound fundamental framework for making sense of the apparent contradiction at the core of the 9-year dispute over RINs, and for understanding other important subjects like RIN pricing theory.

Part 4 – A new perspective on RINs – the tax-and-subsidize interpretation

What has been the most controversial topic in the U.S. refining industry over the last 10 years? Judging from time spent in earnings conference calls, law offices, courtrooms, congressional committees, the White House, and other forums of business and political debate, we nominate the RIN (renewable identification number), for that prize.

The RIN is the tradable environmental credit that serves to subsidize the use of renewable fuel components like ethanol in fuels.

The RIN system is not simple and is easily misunderstood. Even at its simplest, the RIN must be understood as both a tax on refined fuel paid by refiners and a subsidy granted to blenders of renewable fuel whose purpose is to force renewables into fuels.

The RIN is a tax and a subsidy that forces renewables into fuel

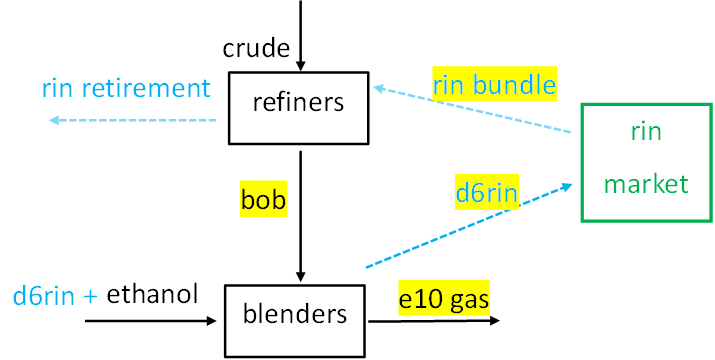

Let’s call this the “tax-and-subsidize interpretation”. In this flowsheet, a refiner buys a “RIN bundle” and retires it to fulfill an obligation imposed by government, which is like a tax on every gallon of his refined gasoline blendstock (called BOB = blendstock for oxygenate blending).

The bottom half of the flowsheet shows a blender buying ethanol which, by rule, contains an attached RIN (renewable identification number) which is like a subsidy that can only be captured by blending that ethanol to fuel, at which point the blender can sell it into the RIN trading market for cash.

Part 1 of this 4-part series shows how the tax part works. Part 2 shows how the subsidy part works. Part 3 explains how this tax-and-subsidize system accomplishes its purpose to effectively force ethanol into gasoline, and how that affects the price of the E10 gasoline most of us use to fuel our cars, SUVs, and pickups. Throughout the series, we have emphasized the financial impacts depend on two tangible transactions (the refiner’s payment for the RIN bundle and the blender’s receipt of cash for the captured RIN) and two intangible financial impacts (how the RIN changes the market prices of BOB and E10). In this final episode of the series, we focus on the yellow-highlighted parts and consider how the tax-and-subsidize interpretation sheds light on specific disagreements (or are they misunderstandings?) about the financial impacts of the RIN which have dominated the debates and legal cases.

Points of contention

For this blog series we refer to the two sides in the debate as Camp A and Camp B. There are three main disagreements about the financial impacts:

- Camp A says the RIN tax hurts a refiner’s profits and Camp B says it doesn’t.

- Camp A says the RIN subsidy is a windfall profit for the blender and Camp B says it isn’t.

- Camp A says RINs increase the price of E10 to consumers and Camp B says they don’t.

If you look deeper and analyze the specific points of contention behind these contradictory statements, you will find there is no disagreement on the tangible transactions which are the payment of cash by refiners to buy RINs and the receipt of cash from the sale of RINs by blenders. Those are hard cash transactions, made deliberately, with obvious financial impacts. All the controversy and disagreement involves the intangible parts which are how RINs affect the market prices of the highlighted product streams which are the BOB and E10. These price impacts are less tangible because they emerge “automatically” as a consequence of competitive forces in the market rather than by deliberate action of any individual or single company, and because they cannot be measured directly.

Points of Contention

Let’s consider six prominent points of contention in the legal cases and see how the tax-subsidize interpretation sheds light on them.

- Paying for RINs is an extra cost that hurts a refiner’s profits – the tax-and-subsidize interpretation says paying cash for RINs is not the only financial impact for the refiner. Figure 1 indicates the cost to a refiner also depends on how the RIN changes the market price of the BOB refiners sell to blenders. If the RIN tax is fully passed through to the market price of BOB and picked up by the blender, then the net effect on the refiner’s profit is zero. Whether the tax is fully passed through into the market price of BOB is impossible to measure directly because the change in BOB price occurs automatically by competitive forces driven by the collective actions of all participants, and because we cannot measure the BOB price that would have occurred in the absence of RINs. The effect of the RIN is hidden in the noise of other factors affecting the market price. Camp B claims pass-through of the RIN tax is complete in most cases and provides empirical evidence for that, but the empirical evidence is indirect, difficult to explain, and less concrete when compared to hard cash going out or coming in the door. The economic theory of tax incidence indicates that increases in systemic costs, which affect all suppliers in a market, like taxes, raw material, energy, transportation, and RIN costs, are passed through by suppliers into the market price of products until the price increase causes aggregate market demand to decline (see part 2). Historical data and common experience show aggregate demand for road transportation fuel is highly inelastic (insensitive to fuel price changes), which would imply RIN cost will pass through nearly 100% (Hoekstra Trading has done an original economic analysis that implies RIN cost pass-through will be 100% in competitive fuel markets even if total market demand changes).

- Some refiners don’t have pricing power to be able to pass through their RIN costs – According to economic theory, pass-through in competitive markets does not occur by deliberate exercise of an individual supplier’s pricing power. Instead, it occurs automatically by a change in the market equilibrium price of the product, which emerges from the collective actions of all participants in that market. So the tax-subsidize interpretation would say this point about pricing power stems from a misinterpretation of how pass-through occurs in competitive fuels markets.

- Cashing out the RIN subsidy is a windfall profit for the blender – the tax-and-subsidize interpretation says that, if the E10 wholesale market is competitive, and if the RIN tax passes through to the blender, then the cash the blender receives for selling the RIN (the RIN subsidy) must be applied by the blender as a credit (the RIN discount) to reduce the effective cost of ethanol blended to fuel (see part 3). Otherwise that blender’s E10 will be over-priced and will not sell. When the RIN subsidy is applied as a credit to the blend cost of ethanol, it does not increase the blender’s profit, instead, it leaves the blender’s profit unchanged and increases the demand for ethanol which is what the system is designed to do. This critical, non-intuitive outcome cannot be seen without the tax-and-subsidize perspective.

- High and volatile RIN prices indicate the RFS is dysfunctional – The observed RIN price volatility is caused by changes in the level of subsidy needed to force a mandated quantity of ethanol into gasoline. A higher RIN price signals a need for more ethanol. From the tax-and-subsidize interpretation, we can see how a higher RIN price also implies blenders receive more RIN revenue, and competition in the E10 market requires they apply this revenue to reduce their effective ethanol blend cost which draws more ethanol into fuel than would occur if the RIN price hadn’t increased. The tax-and-subsidize interpretation shows how the RIN price acts like a flow control valve, moving up or down as things change to regulate the flow of ethanol into fuel toward the mandated level. This occurs by the design of the system and through the forces acting in the competitive fuels markets. Looked at with this tax-and-subsidize perspective, the observed RIN price volatility does not indicate dysfunction, instead it indicates the system is working as designed.

- Consumers pay more for E10 because of the RIN tax – the tax-and-subsidize interpretation implies that, for E10, the passed-through cost of the RIN tax is offset by a corresponding credit (RIN discount) on the blender’s cost of ethanol, such that the effective blend cost of E10 is almost exactly unchanged. Said another way, the RIN tax cross-subsidizes the cost of ethanol blended into fuel with almost exactly zero impact on the price of E10. Part 3 of this series contains a numerical example showing how this cross subsidy can be seen explicitly in the blender’s blend cost calculation.

- An integrated refiner gets RINs free while a non-integrated refiner must buy them on the market which gives an unfair advantage to integrated refiners – here, integrated refiner refers to a combined refiner-blender unit operating as a single entity. It is true the integrated refiner does not pay cash in a separate transaction to purchase a RIN on the market like a pure refiner does. Instead, the integrated refiner gets a RIN when its blending branch buys a gallon of ethanol, captures the RIN by blending the ethanol to E10, keeps it and retires it to fulfill its refining branch’s RFS obligation on 9 gallons of its own-produced BOB with which it blended the ethanol. Because the integrated refiner does not sell those gallons of BOB into the BOB market, it foregoes the opportunity to realize the RIN premium baked into the market price of BOB, a premium that is realized by the pure refiner when they sell their BOB into the BOB market. This difference explains away the apparent unfair advantage. According to the tax-and-subsidize interpretation, the integrated refiner and pure refiner both have net RIN cost of zero; the integrated refiner gets them free with the purchase of ethanol; the pure refiner pays cash for them and gets that back in the premium received when selling BOB at the market price that includes the baked-in premium.

When you look at the RIN system from the tax-and-subsidize standpoint, Camp B’s theory makes everything fit together; whereas Camp A’s view leads to many unresolved questions. Here are 3 examples:

- Camp B’s view explains the mechanism by which the RIN acts as a subsidy to draw renewables into fuels, which is its fundamental purpose and something we know happens. Camp A’s view conflicts with this explanation, and to our knowledge, Camp A has offered no theory on how that happens.

- Camp B’s view explains the mechanism by which changing RIN prices regulate the quantity of different renewable components drawn into fuels to meet the specified target volumes, something we know happens. To our knowledge, Camp A has offered no theory on how that happens.

- To our knowledge, Camp A has provided no compelling evidence to back its claim that RINs produce systemic windfall profits for blenders, or an explanation for how that could be possible in the highly competitive E10 fuel market.

Beyond E10

We have not yet touched on other topics familiar to some readers, like the ethanol blend wall, higher ethanol blends like E15 and E85, the nesting of RIN categories, RIN pricing, and what happens when there are hard limits on supply or demand for a blended fuel or its components. These cannot be understood or correctly interpreted without the fundamental tax-and-subsidize perspective explained in this blog series.

RIN pricing theory and practice

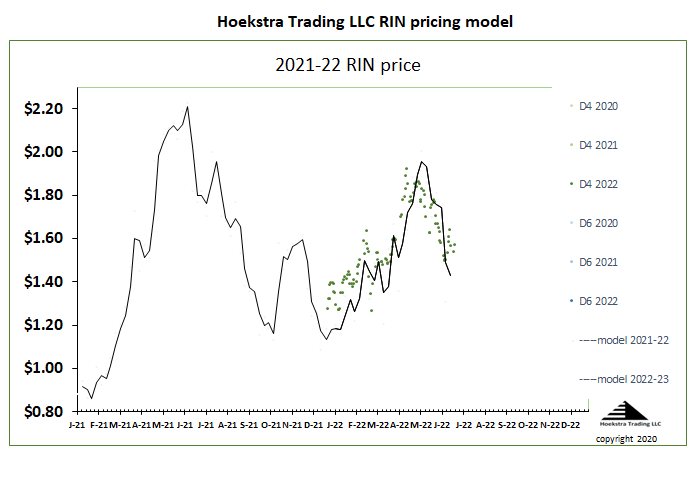

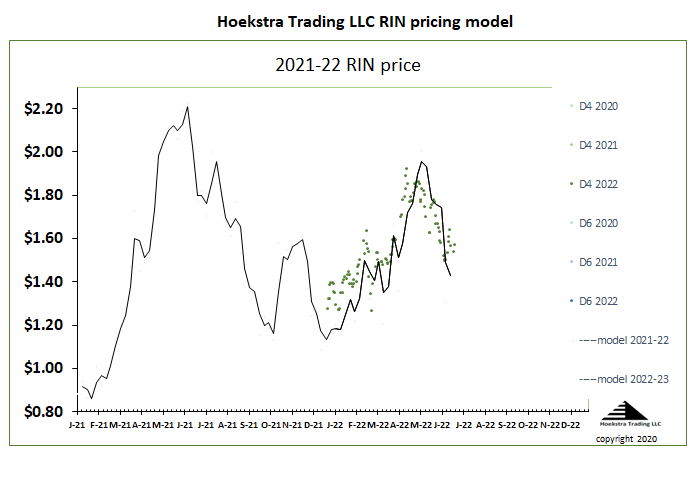

People whose job involves RINs should take the time to learn about basic RIN pricing theory, which is derived from the tax-and-subsidize framework. It explains why different categories of RINs (like D6 renewable fuel RINs and D4 biomass-based diesel RINs) trade at different prices, and why the price of the D6 RIN shot up by 60-fold, (not 60%!) in one of the most explosive moves in the history of commodity trading in 2013. Hoekstra Trading uses a fundamental, quantitative RIN pricing model that accurately describes the effects of economic variables and RIN vintage (vintage refers to the year a RIN was created) on D4 RIN prices. We refer to that model as the IMS model after its authors, Irwin, McCormack, and Stock, and we have implemented it in a spreadsheet. Figure 2 is a sample chart from that spreadsheet which shows theoretical D4 RIN prices alongside actual prices of 2022-vintage D4 RINs, so users can study and interpret price changes with reference to the fundamental economic variables and parameters that determine them.

This spreadsheet and related price modeling capability is used by Hoekstra Trading clients to study and interpret RIN price dynamics, capitalize on RIN price arbitrage opportunities, forecast and make informed estimates of how changes will affect RIN prices.

Recommendation

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Hoekstra ATTRACTOR spreadsheet spreadsheet that accurately calculates D4T, the theoretical RIN price, tracks it versus quoted market prices, and predicts how RIN prices will change with the variables that affect them. Why not send a purchase order today?

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10