RINs and Stock Prices – Financial Analysts Grill C-Suite Executives

The recent nosedive in the price of Renewable Identification Number (RIN) credits, from $1.60 to 80 cents, has financial analysts asking refining executives how falling RIN prices might affect their future profits. For example, from last week:

How do you see the RIN dynamics impacting your renewable product sales margin considering the renewable volume obligation has been set up to 2025 and US supply is increasing? It doesn’t seem that RIN pricing is going to get tighter in light of that supply and dynamic.

Question from Kate Sullivan, Citi, to Neste Management in Neste Oyj 3rd quarter 2023 earnings conference call, Oct. 26, 2023

and also from last week:

Can you just more broadly talk about what you’re seeing in terms of supply demand in the marketplace, impact of RIN pricing and RVO (Renewable Volume Obligation) limitations, et cetera?

Question from Ryan Todd, Piper Sandler to Valero Management in Valero Energy Corp. 3rd quarter 2023 earnings conference call, Oct. 26, 2023

and from this week:

I was just hoping to get your outlook for RD (renewable diesel) margins here, just given the industry capacity coming online next year. We’ve seen RINs fall, we’ve also seen some of the feedstock costs decline, as well as an offset. So just hoping to get your thoughts on the credit side as well as the feedstock side here please.

Question from Joe Laetsch, Morgan Stanley to HF Sinclair Management in HF Sinclair 3rd quarter 2023 earnings conference call, Nov 2, 2023

Hard data

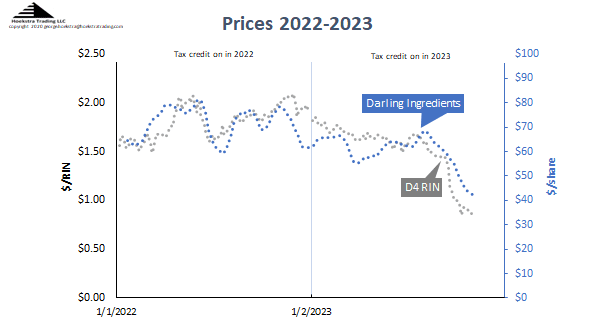

Look at this chart. Do you see a correlation between the price of Darling Ingredients Inc. stock (DAR) and the price of the D4 RIN during the last 2 years?

The recent nosedive in the D4 RIN price from $1.60 to 80 cents, and its apparent correspondence with falling stock prices of Darling and other biofuels companies have rightly drawn investors’ attention.

Rewind

Predictions of a RIN price nosedive and credible, fundamental economic arguments for its cause have been flashing across traders’ screens and public media since May. The question was asked in 2nd quarter earnings conference calls in July and August. For example, on August 9, Darling executives were asked by Ryan Todd:

Question from Ryan Todd, Piper Sandler

The final RVO (Renewable Volume Obligation), which sets the minimum biofuels volume mandates) came out during the quarter. Any thoughts on takeaways from that final guidance? What it means for your business? And maybe the biofuel sector in general as you look forward over the next few years?

From Darling Ingredients, Inc. 2nd quarter 2023 earnings conference call, Aug 9, 2023

Answer from John Bullock, Darling Ingredients Chief Strategy Officer

This is John. Yes, I mean, at the end of the day, it was interesting because when we saw that RVO rule come out internally, we were like, well, that’s great. Kind of in line with what we were hoping for. And then all of a sudden the marketplace had all sorts of headlines about disappointing, terrible, awful rotten. And of course, the RINs market has gone up since that RVO, it dipped for a couple of days and went right back up.

The reality is this: while the 650 page document that the EPA puts out every year is massively painful to read through, when you do so, what you see is this. They’ve been fairly effective at managing to a 20% RINs bank on a forward look basis. And that will keep the marketplace in a $1.25 to $1.75 RINs prices, depending on what the psychology of the moment is.

The only time that didn’t work is when the EPA came right out of left field with the small refinery exemptions and hit the marketplace with a big destruction of demand for RINs that the EPA was unable to predict in their previous rule makings.

So at the end of the day, this thing’s been condition stable, right where the EPA has managed it to or wants it to be, it seems like, which is a very nice market for us.

From Darling Ingredients, Inc. 2nd quarter 2023 earnings conference call, Aug 9, 2023

This pull quote indicates reliance on EPA to manage RIN price risks:

They’ve been fairly effective at managing to a 20% RINs bank on a forward look basis. And that will keep the marketplace in a $1.25 to $1.75 RINs prices, depending on what the psychology of the moment is.

John Bullock, darling ingredients chief strategy officer

This, and similar confident statements of RIN price stability came in July/August conference calls when the RIN was still at $1.50 and just starting its nosedive to 80 cents. Now, after 2 weeks of October/November conference calls, investors still have no confidence refiners have a good grip on the outlook for RIN price stability.

Fast forward

More earnings conference calls are scheduled for next week, including Darling’s Wednesday Nov 8.

The RIN subsidy underpins billions of dollars of renewable diesel investment. Investors and analysts are right to ask, is the RIN underpinning a stable foundation or thin ice?

Should investors accept the consensus answer it will be “business as usual” for RINs? What do refining executives think of the credible, fundamental economic theory of a RIN price nosedive that has been buzzing loudly through the RINs ecosystem since May? Are the executives aware of it? Are their subordinates? Were the executives blindsided by the RIN price nosedive from $1.60 to 80 cents? Were their subordinates? Have the executives seriously considered the merit of the credible, fundamental economic theory saying the RIN is on thin ice? Have their subordinates? After six months now, these questions keep flashing brightly on investors’, analysts, and traders’ screens.

Conclusions

From responses to questions in earnings conference calls since July:

- There is no evidence refining executives anticipated the 3rd quarter D4 RIN price nosedive

- Their efforts to explain the D4 RIN price nosedive are weak

- There is no basis for investor confidence in refiners’ ability to anticipate future RIN price stability

Recommendation

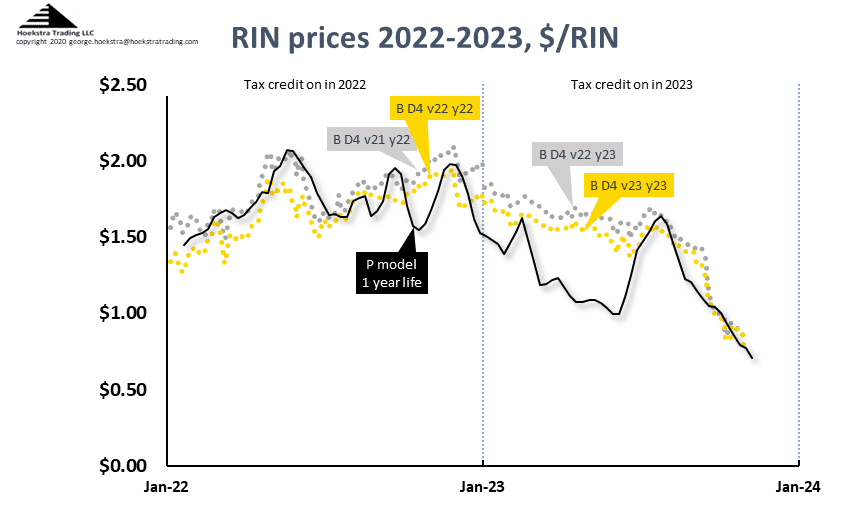

Time for a second opinion. Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Hoekstra IMS RIN pricing spreadsheet that calculates theoretical D4 RIN values using the Irwin-McCormack-Stock (IMS) RIN price model (black line on chart below) based on economic fundamentals, tracks them versus actual prices (silver and gold data points), predicts how the D4 RIN price will change with the variables that affect it, includes 6 months of unlimited consultation by phone and E-mail, and is available to anyone immediately at negligible cost.

It is not another monthly newsletter, it is a research report that will give you a new, fundamental economic view of RIN pricing and economics, unique insights and practical tools your company can use. Why not send a purchase order today? Here’s the offer letter including the Table of Contents and a sample invoice with all the information needed to prepare a purchase order.

Reliable Attractor

The Hoekstra IMS RINs pricing spreadsheet shows the D4 RIN market price (gold and silver points) and the theoretical D4 RIN value updated through Friday November 3, 2023. The theoretical value of a hypothetical D4 RIN with 1 year remaining life is $0.71.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159