All Eyes on Renewable Diesel Margins – Part 1, Get Ready for Q1 Earnings Reports

Read other posts in this series:

- Part 1, Get Ready For Q1 Earnings Reports

- Part 2, The High Cost of Renewable Diesel

- Part 3, RIN Price Crash Wipes Out Free Market Gains

- Part 4, What Caused the $1.70 Crash in RIN Value?

- Part 5, Hard Numbers on Renewable Diesel Margins

Consider a business that makes hydrogenated renewable diesel fuel from soybean oil and sells if for $1.90/gallon. To make the gallon requires purchasing $4.30 worth of soybean oil as feedstock. This business has upside-down economics. It loses $2.40/gallon before even factoring in production costs or capital charges.

This was the situation 3 years ago in the spring of 2021. Things have changed since then, but the free market demand for, and the free market supply of renewable diesel are still zero. To the extent there is a market at all, it is dependent on government mandates and subsidies.

Get ready for earnings reports

In coming days, renewable diesel producers will start reporting first quarter 2024 earnings. Undoubtedly, financial analysts will be probing for insights on the current status and the outlook for renewable diesel margins and segment profitability.

Here are some probing questions on renewable diesel profit margins that came from analysts in recent earnings conference calls:

“Any help thinking about the base business and how margins look at DGD (Diamond Green Diesel)?”

“Historically, you’ve talked about a dollar baseline margin over time. And I’m just curious with everything that’s going on in those markets, do you still feel like that’s the appropriate way to think about the business?”

“you did provide some other commentary with the third quarter earnings and you’re refraining to do that today. And I’m just trying to make sure we understand actually what’s changed.”

This series of weekly blog posts will highlight some financial aspects of this business in real time while companies are reporting the most recent business results.

ATTRACTOR UPDATE

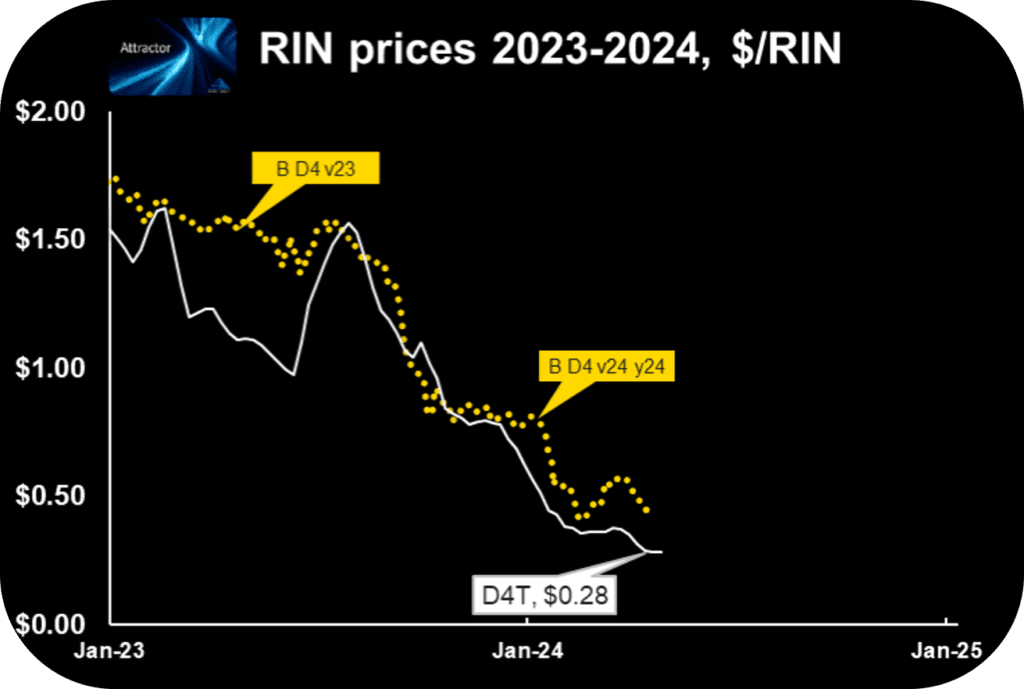

The Attractor spreadsheet shows the D4 RIN market price (gold points) and the “D4T” theoretical value (white line) updated through last Friday. The theoretical value of a hypothetical D4 RIN with 1 year remaining life (D4T) is $0.28.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone!

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159