All Eyes on Renewable Diesel Margins – Part 2, The High Cost of Renewable Diesel

Read other posts in this series:

- Part 1, Get Ready For Q1 Earnings Reports

- Part 2, The High Cost of Renewable Diesel

- Part 3, RIN Price Crash Wipes Out Free Market Gains

- Part 4, What Caused the $1.70 Crash in RIN Value?

- Part 5, Hard Numbers on Renewable Diesel Margins

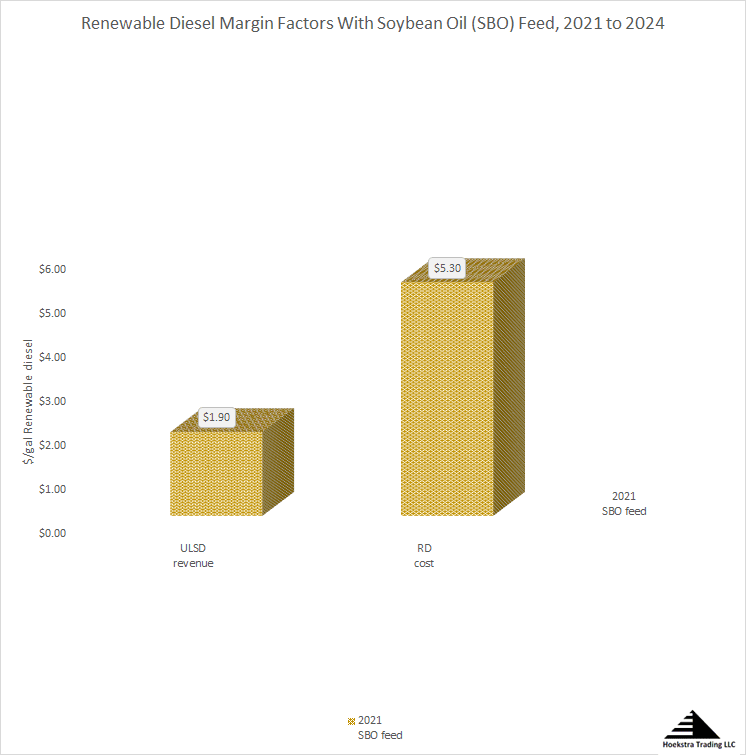

As the renewable diesel (RD) business has grown, its profit margins have come under scrutiny. In analyzing RD margins, our starting point is the cost of RD production. For a representative renewable diesel plant feeding soybean oil and selling its RD in California in April 2021, the cost of RD production was $5.30/gal. As shown in Figure 1, this stands in stark contrast to the $1.90 wholesale market price of conventional petroleum diesel at that time.

RD is a direct substitute for petroleum diesel, which is also known as ultra-low sulfur diesel (ULSD). RD must compete with ULSD on price, which means it will be sold at the wholesale market price of ULSD, which was $1.90 in April 2021. So, the renewable diesel producer’s free-market margin was $1.90 minus $5.30 equals negative $3.40/gal.

It is an often overlooked fact that the cost of a gallon of renewable diesel is roughly triple that of petroleum diesel.

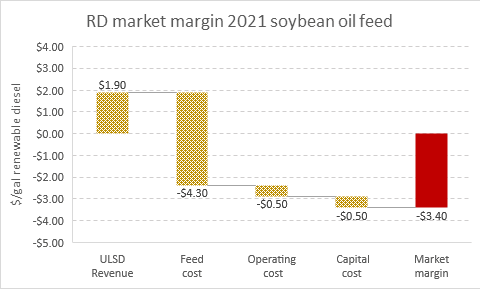

Why is the cost of RD so high? Figure 2 breaks down the $5.30 of RD cost into 3 components: feedstock, operating, and capital cost:

Feedstock cost is the culprit. Making $1.90 worth of renewable diesel requires $4.30 worth of soybean oil. After adding in $0.50 of operating cost and a capital charge of $0.50, and then selling the RD gallon for $1.90, this representative producer loses $3.40 on every gallon. Obviously, in a free competitive market where suppliers seek to maximize profit, RD would not exist.

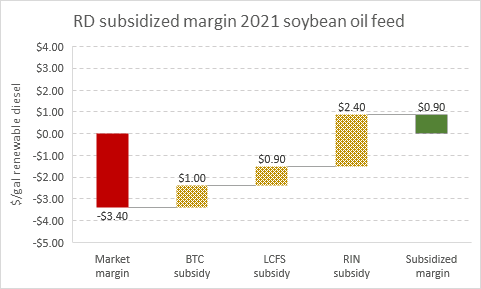

But it does exist because of large subsidies. In this case, they come in the form of a federal blender’s tax credit (BTC) worth $1.00, a California low carbon fuel standard credit (LCFS) worth $0.90, and a federal renewable identification number credit (RIN) worth $2.40 per gallon. Figure 3 starts with the negative $3.40 free market margin derived in Figure 1 and adds in the value of these 3 subsidies, which total to $4.30, which builds the negative free market margin back up to a positive subsidized margin of $0.90 per gallon.

So in this case the renewable diesel producer ends up making a $0.90 per gallon profit.

Noteworthy points from working the numbers on this representative 2021 case are:

- The $5.30 cost to produce RD is nearly triple the $1.90 wholesale price of ULSD

- The $4.30 subsidy value is more than double the $1.90 wholesale price of ULSD

- The $0.90 subsidized margin is roughly double the typical margin on petro-diesel

There are many variables in this margin analysis. This April 2021 case sets a base case from which we will quantitatively examine renewable diesel profit margins.

Conclusions:

- This is a very heavily subsidized market!

- It must be heavily subsidized to justify the high production cost of RD.

- In this case, the margin on RD was high enough to be attractive to refiners.

I appreciate those who are reading my writings on this topic! This is a reminder that what is written here is mostly years-old news to Hoekstra Trading clients. Our best, most valuable, and current work is available by becoming our client through purchase of our annual reports like Hoekstra Research Report 10, which are available to anyone a negligible cost and which, if you are seriously interested in this topic, you really should have!

ATTRACTOR UPDATE

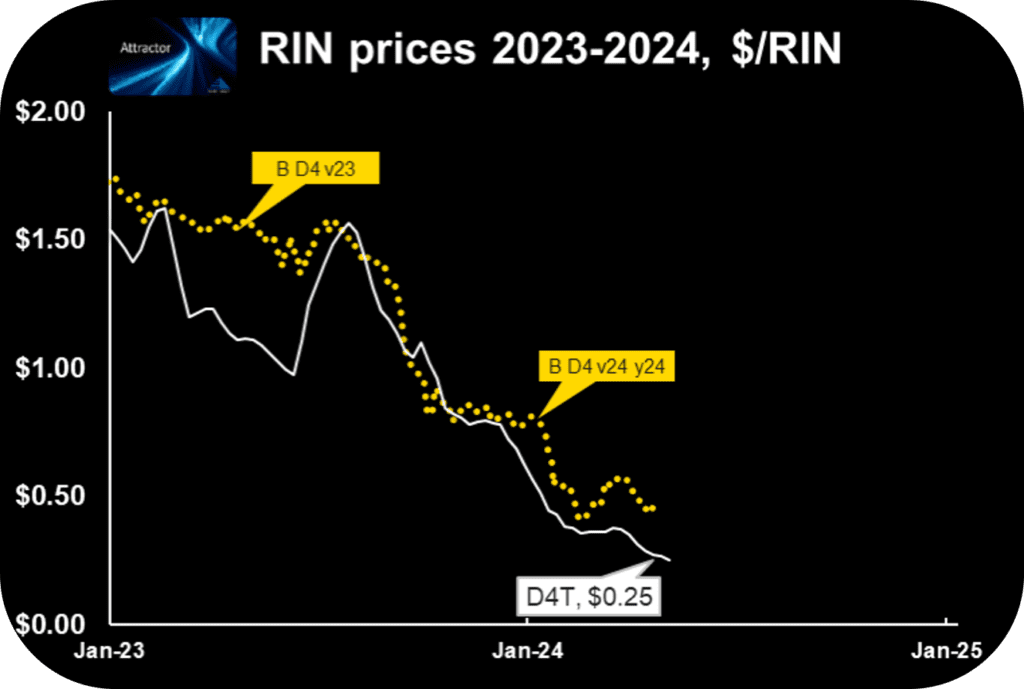

The Attractor spreadsheet shows the D4 RIN market price (gold points) and the “D4T” theoretical value (white line) updated through last Friday. The theoretical value of a hypothetical D4 RIN with 1 year remaining life (D4T) is $0.25.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone!

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159