Baby the RIN Must Fall, Part 4 — D4 RIN Price Nosedives, Triggering a Flurry of Market Reactions

In late July, 2023, the D4 Renewable Identification Number (RIN) credit price started nosediving from $1.60 on July 25 to $1.00 on September 25. The D4 RIN is part of the regulatory system that sets and ensures compliance with mandates on the supply of renewable fuel components in diesel fuel in the United States.

Read other blogs in this series Baby The RIN Must Fall:

- Part 1 What’s Behind The Chatter About The RIN Price Crashing To Zero?

- Part 2 Will a RIN Price Crash Make a Mess In The Renewable Diesel Market?

- Part 3 The Odds and Timing Of A Potential RIN Price Crash

- Part 4 D4 RIN Nosedives, Triggering a Flurry of Market Reactions

This is the fourth in a series of blogs about how rapid growth of renewable diesel supply could trigger a sudden crash in the D4 RIN price that would rock the renewable diesel market. Here we report on the market’s reaction to the current nosedive in this key credit price and explain how the D4 RIN price action compares to a theoretical pricing model based on economic fundamentals.

Recall from our Misunderstanding series that a RIN is a 38-digit number that’s generated when certain types of renewable fuels are produced. The RIN can then be detached and sold to producers or importers of non-renewable fuels to satisfy their renewable supply volume obligations under the Renewable Fuel Standard (RFS). The code D4 is the RIN category for renewable diesel fuel made from soybean oil, animal fats and used cooking oil.

Part 1 of this series focused on the technology and economics of renewable diesel and explained how rapid growth in its production could bring supply past an important boundary we call the End Wall which is set in place by the RFS minimum volume mandates for 2023, 2024, and 2025.

Part 2 analyzed the possible implications of crossing that boundary, which would trip a switch that would put the renewable diesel market into uncharted territory and could trigger a real mess in the market, comparable to the mess triggered by hitting a different RIN boundary called the Blend Wall in 2013 (see our Misunderstanding series for a full account of the Blend Wall mess).

In Part 3, we had a go at estimating the likelihood and timing of a breach of the End Wall and concluded it is certainly possible that, in the next 2 years, a breach of the End Wall could cause market turmoil and put many renewable diesel suppliers underwater on profitability.

Summer selling

The D4 RIN price nosedived in August and September, accompanied by surging volume and open interest in far-out D4 RIN futures traded on the Intercontinental Exchange (ICE), where prices plunged, suggesting sellers are rushing to lock in a positive RIN value for future renewable diesel production. Volume in ICE D4 RIN futures soared from 4 million contracts in July to 15 million in August.

During August’s earnings conference calls with refining executives, Jason Gabelman, integrated oils securities analyst for TD Cowen, pressed refining executives on whether they were concerned about the possible impact of fast-growing renewable diesel production on RIN prices. Their responses are represented by a quote from one executive who said their outlook for RIN prices is “business as usual”. The collective response to Gabelman’s questioning in the 2nd quarter round of conference calls indicated no concern about this in refining C-Suites.

Market reaction

Meanwhile, in the marketplace, what was faint chatter in July turned into a loud buzz in the hallways at an Argus RFS industry conference in August and an OPIS RFS industry conference in September. The D4 RIN price nosedive was described by S&P Global as a “collapse driving down the whole RIN sector”. The apparent rush to sell D4 RINs had conference attendees asking whether the D4 RIN price could fall below that of the D6 RIN (D6 is the code applicable to use of ethanol in gasoline). That is said to be happening even though it is like selling $5 dollar bills for $1 dollar.

In the question period after the keynote address the director of the EPA Fuels program was asked whether the possible breach of the mandate was causing any discussion or concern at EPA. We interpreted his answer as a no.

Another market reaction was the launch of a flurry of efforts to estimate the growth of renewable diesel supply and demand. Previously, in its Regulatory Impact Analysis, EPA had estimated that demand would not grow to the mandated level before 2025. Then, on May 31, the RIN crash theory was presented (for the first time) in an article by Scott Irwin and Maria Gerveni of the University of Illinois. That article included estimates of the End Wall boundary to be around 4.5 billion gallons per year and the current production rate to be dangerously near that level. Since the onset of the RIN price nosedive, we’ve seen three private estimates of renewable diesel volume growth that suggest End Wall breaches are highly likely in the next year or two, and have been told of another recent study that draws the same conclusion.

New demand in Canada

Forecasting renewable diesel demand involves many unknowns, including exports to Canada. Canada’s new national Clean Fuel Regulation (CFR) took effect July 1, 2023. It follows the model of California’s Low Carbon Fuel Standard program, where suppliers of fuel with high carbon intensity incur credit liabilities and suppliers of fuel with low carbon intensity generate credits. Credit liabilities are covered by purchasing credits at a market price. The targeted average carbon intensity gets lower (more stringent) over time, with a goal to reduce carbon emissions from consumption of gasoline and diesel by 15% by 2030, from a 2016 baseline level.

Under this new Canadian CFR program, refiners and importers will tend to be credit buyers; these include Imperial Oil, Suncor, Irving Oil, Valero, Shell Canada, and 8 smaller Canadian refiners. Producers and importers of low carbon fuels like ethanol and renewable diesel will earn credits. Credits can also be earned by fossil fuel producers who reduce the carbon intensity of their operations and by those who supply electricity or fuel for use in electric vehicles or fuel cells. Electricity is expected to earn a growing portion of credit supply as the targeted carbon intensity moves lower (gets more stringent) with time. This program will certainly cause an increase in renewable diesel demand in Canada. Other federal, state, and provincial incentive systems will also play into the demand picture.

Canada consumes 600,000 bbl/day of diesel fuel which contains under 3% renewables. That percentage is expected to increase to 6% by 2030. Renewable diesel producers in the U.S. and Canada will compete to fill that new demand. With all the moving parts, watching this play out is likely to keep supply/demand forecasters busy for a while.

The price of a biofuel vs. the price of its RIN

But the rush to forecast renewable diesel supply and demand somewhat misses the point of the End Wall theory. The theory says RIN demand will vanish when renewable diesel supply crosses the mandate boundary. That is the critical point. Faster growth of renewable diesel does not move the boundary, instead it increases the rate of approach to the boundary. Some forecasters indicate that rapid growth of renewable diesel demand implies the RIN crash scenario is “an illusion”. This interpretation seems to confuse the price of the biofuel itself with the price of its RIN—increased demand for renewable diesel will indeed tend to support the price of the renewable diesel itself, but it will only hasten the rate of approach to the possible collapse of the price of the D4 RIN –more to come on this important distinction.

Actual vs. theoretical price

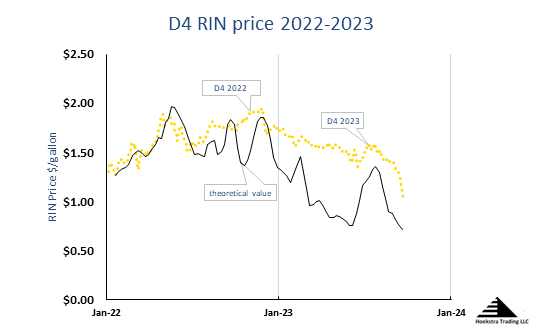

Returning now to the current D4 RIN price nosedive, this chart shows the falling market price of the D4 RIN in gold and its theoretical price in black. For most of the past year, the theoretical price was far below the market price. Only recently has the decline in the market price started to catch up to the much lower theoretical price.

The theoretical price is calculated by Hoekstra Trading’s spreadsheet application of the D4 RIN pricing model developed by Scott Irwin (University of Illinois), Kristen McCormack (Harvard University), and James H Stock (Harvard University). Why was it so much lower than the market price through all of 2023?

Theoretical vs. empirical price indicators

One reason is the theoretical price is based on the price differential between ultra low sulfur diesel and the incremental biofuel currently being used in its manufacture. Market participants rely almost exclusively on an indicator called the BOHO spread (soyBean Oil – Heating Oil) as an indicator in empirical correlations for RIN price. In the past, soybean oil used in production of FAME biodiesel was indeed the incremental biofuel for manufacture of biobased diesel and therefore the BOHO spread was the reliable economic indicator for use in correlating the D4 RIN price. But the market fundamentals have changed in ways that mean that the true economically relevant spread has been lower than the BOHO spread in the past year, and consequently, so has the theoretical value of the RIN. This is a good example how an empirical indicator can be extremely reliable for years but lose its relevance when economic fundamentals change. That may seem like a fine point, but it is a very important point that we will elaborate on in future episodes of this series.

Trading opportunity

The gap in Figure 1 between the gold and black data provided a trading opportunity for those with confidence in the fundamental economic theory and a belief that true economic value will win the day. The trade was to short the D4 RIN, which can be done a couple of ways. Well-informed RIN traders did that early in 2023 to capitalize on an indicated mispricing versus true economic value, and that strategy paid off handsomely with the nosedive shown in the gold data on the chart.

This interpretation of the 2023 price data raises the question whether the current nosedive is a manifestation of the End Wall theory or merely a correction to an unrelated mispricing of the RIN. That question will also be addressed in the next episode, along with the two distinctions raised above, which are the distinction between the price of soybean oil and that of the incremental renewable diesel feedstock, and the distinction between the supply and demand for renewable diesel and the supply and demand for its RIN.

Recommendation

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Hoekstra IMS RINs pricing spreadsheet that accurately calculates theoretical RIN prices, tracks them versus actual prices and predicts how RIN prices will change with the variables that affect them, and includes 6 months of unlimited consultation by phone and E-mail. Here’s the offer letter including the Table of Contents and a sample invoice with all the information needed to prepare a purchase order. Why not send a purchase order today?

George Hoekstra [email protected] +1 630 330-8159