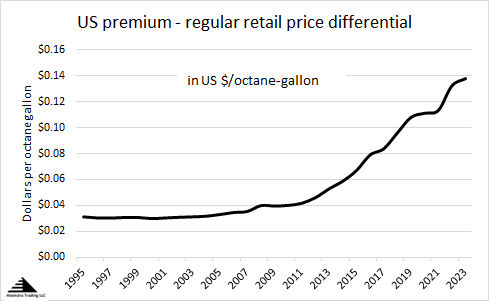

No let-up in rising U.S. octane values

The relentless rise in octane value is seen in the U.S. average retail premium-regular pump price differential, expressed here in units of $ per octane-gallon, up to date through today:

To convert this number to actual pump price differential in $/gallon, multiply by 6 octane (=93-87).

The building pressure on octane cost is also seen upstream in the octane-barrel supply chain and the sulfur credit market.

$10 billion/year of octane is being destroyed in FCC gasoline desulfurizers today to meet the Tier 3 10-ppm gasoline sulfur specification. Workarounds to adapt to this supply destruction are directly increasing the cost of gasoline to consumers, affecting all grades, not just premium. For more details, see the “Gasoline Desulfurization for Tier 3” category on this blog page.

Many refiners still seem blind to the root cause of this octane/sulfur problem. But profitable solutions are being implemented by those who recognize it and take steps to improve their sulfur/octane economics and fuel margin capture rates.

Recommendation

Every refining executive should have a comprehensive understanding of the technical, regulatory, and economic aspects of Tier 3 gasoline, the sulfur credit program and how they affect your business. Those wanting a quick education on the Tier 3 issue should get the short book, Gasoline Desulfurization for Tier 3 Compliance, which will make you an industry expert in a day. Once you have become expertly informed of the problem, you can save your team years of research by buying Hoekstra Research Report 8. We saw this problem coming, gathered the required data, ran the simulations and analyzed the results so you and your team can immediately initiate well-informed strategies. The report includes detailed pilot plant and commercial field test data, full detail of sulfur credit pricing, spreadsheet models to help improve gasoline optimization, investment decisions, sulfur credit strategy and refining margin capture in the Tier 3 world.

Don’t get caught panic buying after the credits spike.

George Hoekstra

George.hoekstra@hoekstratrading.com

+1 630 330-8159