RINatomy Part 1 – The RIN As A Subsidy

A Renewable Identification Number (RIN) is a part of the price control system that manipulates the prices of fuel components to force otherwise non-economical biofuels into the US fuel supply.

Anatomy noun, anat·o·my ə-ˈna-tə-mē a study of the structure or inner workings of something

Read other posts in this series RINatomy –

- Part 1 The RIN As A Subsidy

- Part 2 The RIN As A Tax

- Part 3 The RIN As A Mandate

- Part 4 The RIN As An Asset

- Part 5 The RIN As A Contingent Claim

In this control system, the RIN works as:

- A subsidy

- A tax

- A mandate

- An asset

- A contingent claim

- An element of a nested structure

A subsidy

A familiar form of subsidy is a store coupon which gives you the right to buy something, like a box of cereal, at a discount of, say, $1/box. Its purpose is to stimulate increased sales of the product by reducing its effective price.

The store coupon analogy is a good way to look at the subsidy feature of a RIN. When a gasoline blender buys ethanol for blending into gasoline, by rule, the ethanol comes with a coupon called a RIN that allows the blender to buy that gallon of ethanol at a discount to the market price.

The purpose of the discount is to stimulate increased sales of the biofuel, which would ordinarily be zero, by reducing its effective price when used in fuel.

How big?

The RIN discount is not a fixed amount, like $1/box of cereal, instead, its value adjusts automatically through the inner workings of the control system, to draw in the prescribed amount of the corresponding biofuel.

The inner workings are driven by the laws of economics.

Who pays?

In the case of a store coupon, the store turns in the coupon to the cereal manufacturer who then reimburses the store for the discount which means the manufacturer pays for the discount.

Who pays for the RIN discount on biofuels? That question is not so simple and will be tabled for now, to be picked up later, after we’ve addressed other structural features of the RIN system.

RINatomy

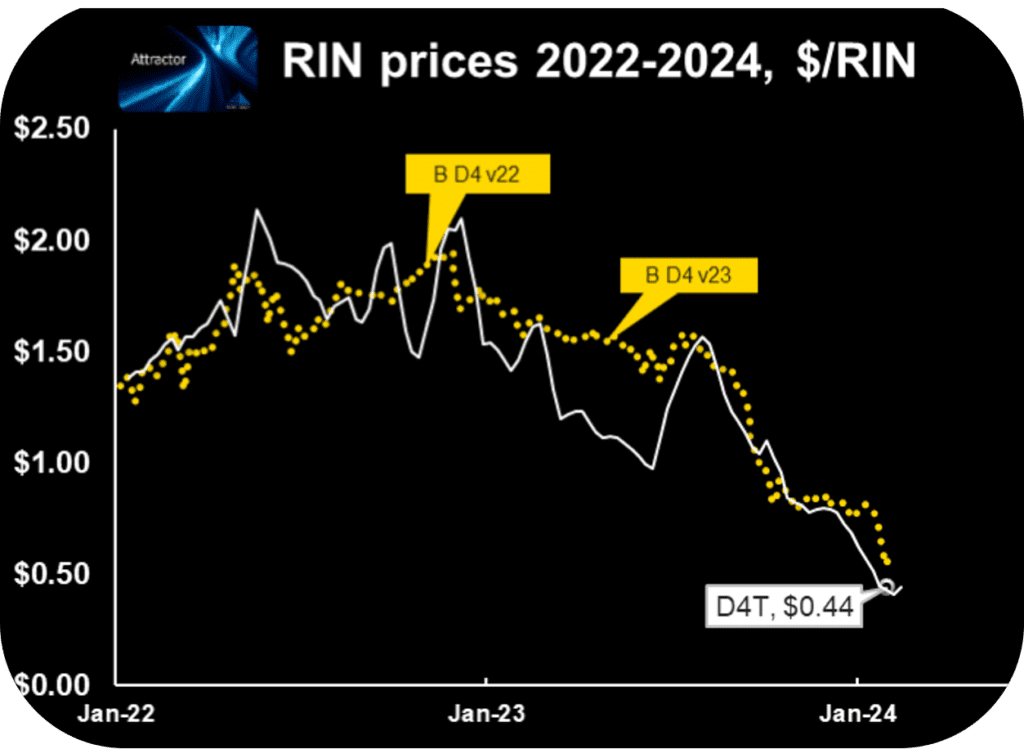

This blog series, titled RINatomy, covers the basic structure and inner workings of the RIN price control system, something I learned about 3 years ago that helped me and Hoekstra Trading’s clients get a grip on what drives the otherwise bewildering behavior of RIN prices, and then be able to effectively track, interpret, and anticipate RIN price behavior using the Attractor spreadsheet which compares D4 RIN market prices to a theoretical value called D4T.

Part 2 of RINatomy will deal with the tax feature of RINs.

Attractor update

The Attractor spreadsheet shows the D4 RIN market price (gold points) and the “D4T” theoretical value (white line and open white data point) updated through last Friday. The theoretical value of a hypothetical D4 RIN with 1 year remaining life (“D4T”) is $0.44 which is up 7 cents from last week.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone at negligible cost!

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159