Archive for June 2024

Mid-year ATTRACTOR Update – D4 RIN market price diverges from D4T Theoretical Price, plus “Critique of the C-Suites”

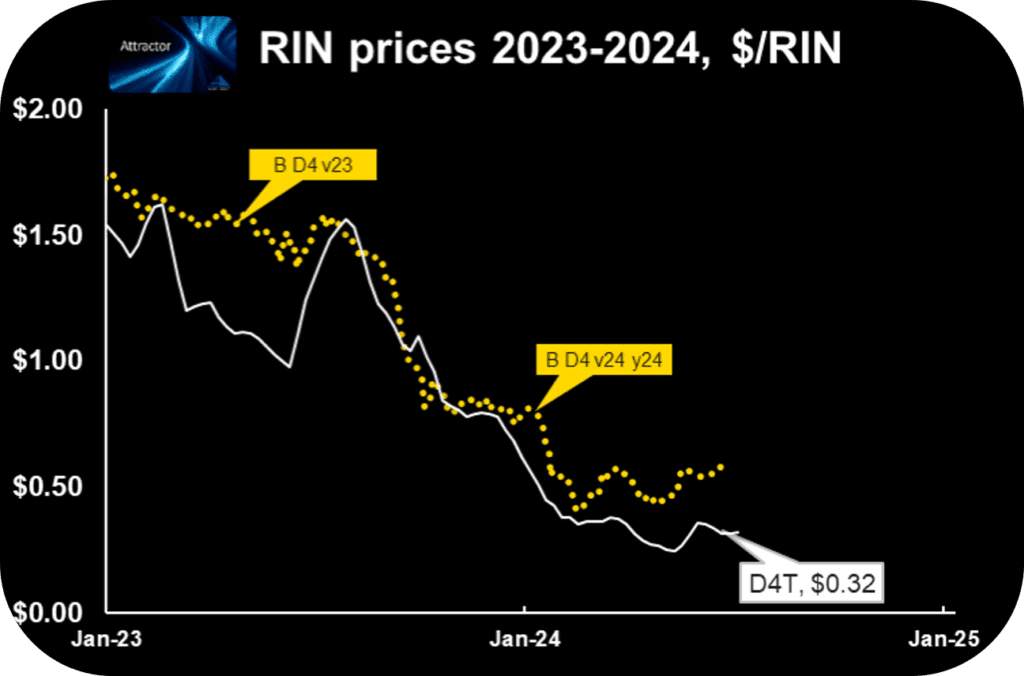

The Attractor spreadsheet (chart below) shows the 2024-vintage D4 RIN market price (gold points) and the “D4T” theoretical value (white line), updated through last Friday. After converging near the end of 2023, the D4 RIN market price has again diverged from the Hoekstra D4T theoretical price in the first half of 2024. As of June…

Read MoreRevisiting RIN Cost Pass-through Part 4 – Will the Litigation Ever End?

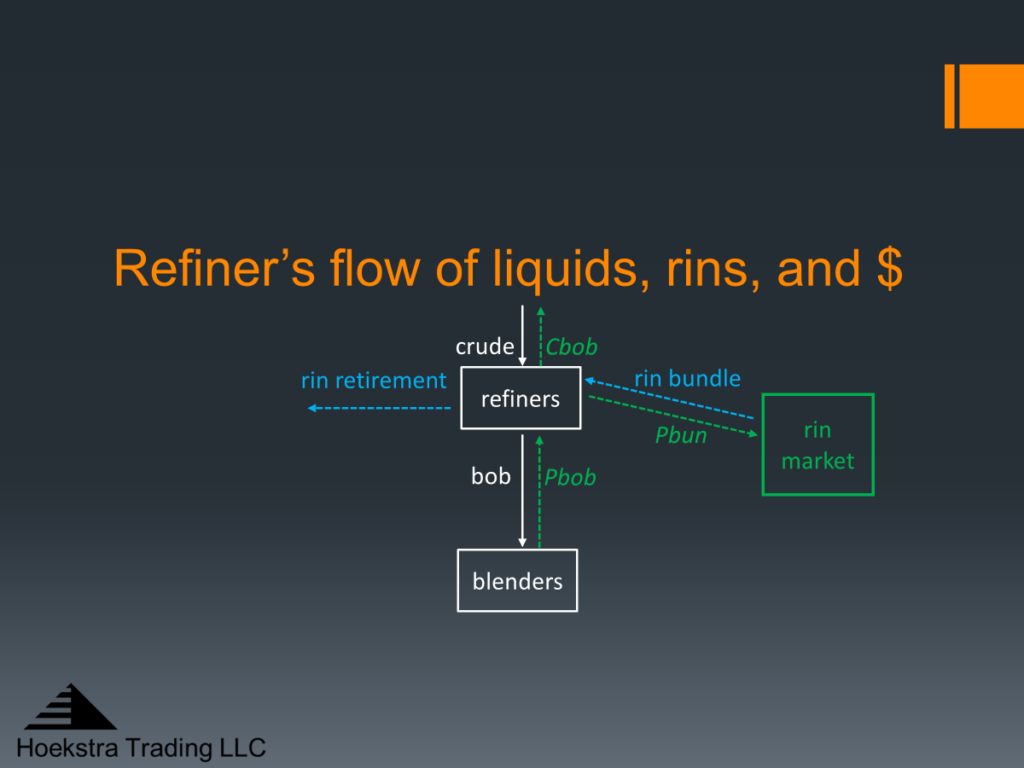

See other episodes in this series: This four part blog series focuses on the flow of streams (white), RINs (blue), and dollars (green) depicted in Figure 1 below and has addressed 2 questions about it: The answer to the first question was given in Part 3 last week. There is no fundamental difference because the…

Read MoreRevisiting RIN Cost Pass-through Part 3 – The RIN Tax Does Not Affect A Refiner’s Profits

Read other blogs in this series: Last week’s Part 2 of this series posed this question: In terms of the pass-through question, how is the RIN tax situation (Figure 1) different than when a sales tax is imposed on finished gasoline? Figure 1 Flow of streams (white), RINs (blue) and dollars (green) in the market…

Read MoreRevisiting RIN Cost Pass-through – Part 2 – How is the RIN tax different than a sales tax?

Read other blogs in this series: Part 1 – Two Camps Part 2 – How is the RIN Tax Different From a Sales Tax? Part 3 – The RIN Tax Passes Through Just Like a Sales Tax Part 4 – Will the Litigation Ever End? Figure 1 shows refiners buying crude oil and making gasoline…

Read More