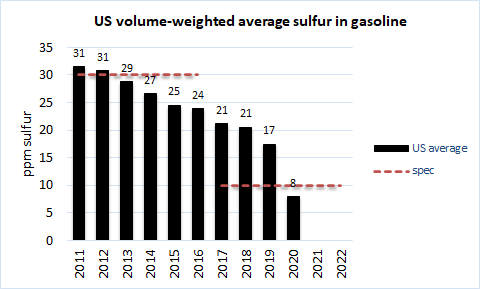

US gasoline pool was 8 ppm sulfur in 2020

We now know the complete story of the six year approach to 10 ppm sulfur gasoline in the United States. The headline 2020 number of 8 ppm is good news for regulators because it proves the feasibility of a safe landing at or below 10 ppm:

It looks a bit more like a helicopter landing than a cruise-controlled jet landing, but we do now know we reached the intended destination.

What else do we know?

- It was easy to make Tier 3 gasoline while refineries were running half-speed in 2020.

- In the six-year runup to full implementation, few refiners captured the opportunity to bank Tier 3 sulfur credits.

- The abrupt descent, showing maximal delay, speaks to the high cost of compliance.

The question has always been not whether, but at what cost will the Tier 3 sulfur specification be met?.

We also now know the starting bank of Tier 3 sulfur credits is meager, which also speaks to the high cost of compliance and is good news for the most astute and capable refiners.

I refer to the “starting” bank because we have now started the next stage of the journey which is like driving a truck through a long tunnel with a low ceiling. The 10 ppm ceiling means limited supply of credits in the future, and no one can make gasoline with negative ppms of sulfur; whereas potential credit demand is unlimited.

In 2021, many refiners experienced, for the first time, the difficulty of consistently meeting this demanding Tier 3 sulfur spec. They have been making costly adaptations like buying, instead of making, low-sulfur feeds and high-octane gasoline blending stocks, downgrading internal streams that used to be good for making US-spec gasoline, exporting high-sulfur gasoline no longer marketable in the States, restricting high sulfur crudes, and taking unplanned shutdowns in their cracking process trains which should be generating lucrative margins today, and aren’t. Accordingly, those refiners have started, this year, reporting lower than expected refining margins.

Is there any other news in this data? It’s good news for refiners who did build a credit bank, and for investors who can recognize, and differentiate among refiners — who is most astute and capable and likely to become suppliers, instead of demanders, of Tier 3 sulfur credits in the future? That will become an important new profit stream for their refining business units.

Hoekstra Trading has been researching this topic since 2015. We have the most accurate data including quantitative analysis of sulfur credit supply, demand, and price, available immediately to anyone interested in innovative profit strategies for the energy industry.

Hoekstra Research Report 8

Our three-year multi-client research project measured the effects of Tier 3 gasoline in pilot plant and commercial performance tests. We developed new methods and tools that helped our clients optimize performance of gasoline desulfurizers to avoid hidden hits to margin capture, and adopt profitable sulfur credit strategies. All our data and tools are available to anyone for immediate application at negligible cost. Please see this offer letter and join our client group today: Hoekstra-Trading–Offer-letter-Research-Report-8-refiners-under-1-MBD