Posts by Hoekstra Trading LLC

Get a grip on renewable fuel credit complexity in 3 easy steps

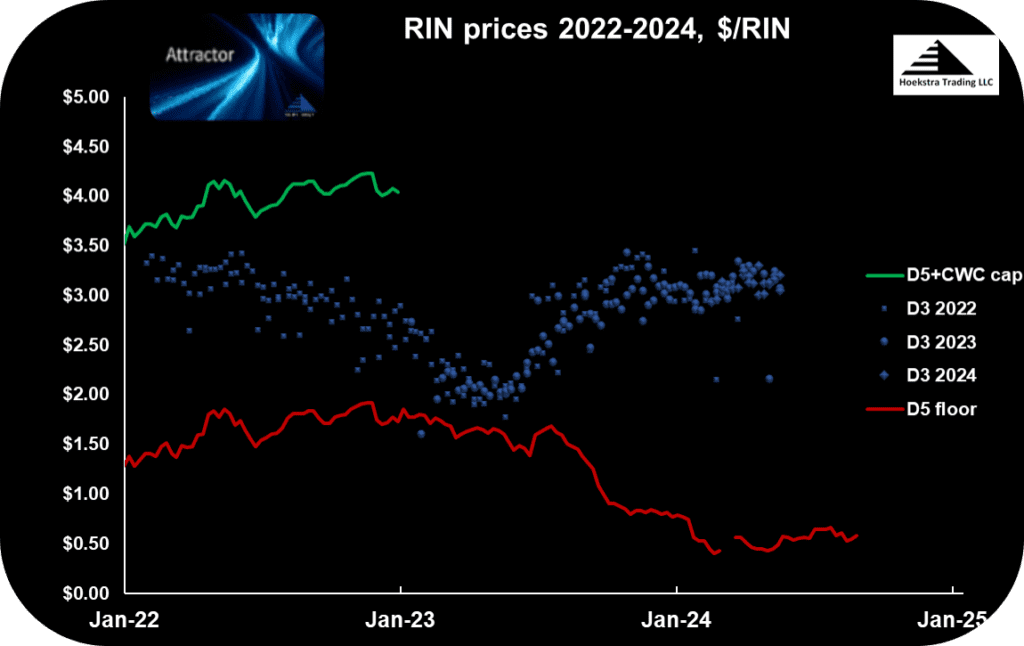

What’s next for cellulosic biofuels and the D3 RIN? – Part 1, The Market That Fizzled

Read other posts in this series: What’s next for cellulosic biofuels and the D3 RIN? A main objective of the Renewable Fuel Standard (RFS) in 2007 was to trigger development of a market of at least 16 billion gallons/year of transportation fuel made from cellulosic biomass. Cellulosic biomass consists of non-food crops and waste biomass…

Read MoreSustainable Aviation Fuel And The RIN Subsidy- Policy and Economics

Tune in to this 36-minute episode of the Climate Now podcast which dissects the “most complex environmental credit ever invented” with two experts in the field: George Hoekstra, President of Hoekstra Trading, and Brooke Coleman, the Executive Director of the Advanced Biofuels Business Council. https://climatenow.com/podcast/sustainable-aviation-fuel-episode-4/ Recommendation Get Hoekstra Research Report 10 Hoekstra Trading clients use…

Read MoreThe New Game of Renewable Fuels Part 6 – Playing By The Rules

A renewable identification number (RIN) is a tax, a subsidy, a mandate, a financial asset that can be banked, borrowed, and traded, a contingent claim, and part of a four-component nested structure, all packed into one instrument. That’s why we call it the most complex environmental credit ever invented. Read the other blogs in this…

Read MoreThe New Game of Renewable Fuels Part 5 – Changing Factors

In this blog series we are explaining how the invention of the renewable identification number (RIN) environmental credit in 2007 was a game changing development in the fuels industry. The RIN is more than just an environmental credit. It is a cleverly designed financial instrument. In fact, we claim it changed the fuels game in…

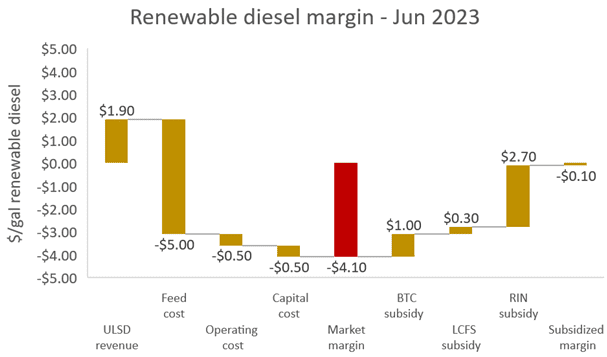

Read MoreThe New Game of Renewable Fuels Part 4 – Rewind to June 2023, On The Brink of a RIN Price Collapse

In this blog series, we are explaining how the invention of the Renewable Identification Number (RIN) environmental credit in 2007 was a game-changing development in the fuels industry. The RIN is a clever, sophisticated financial instrument – in fact, we have made the bold claim that the RIN alters fuels economics in ways so unfamiliar…

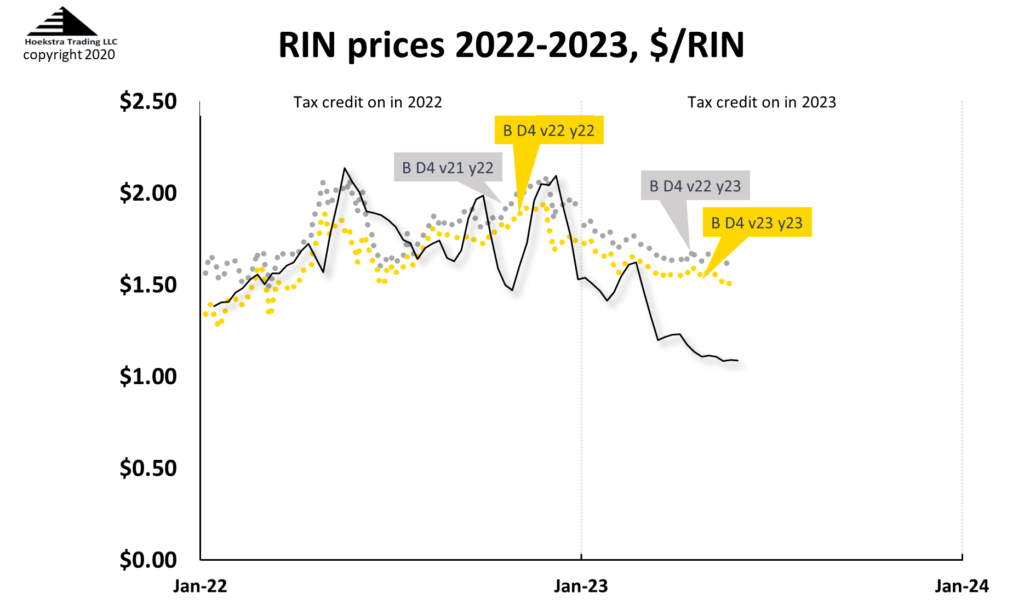

Read MoreWhy The Gap Between the D4T Theoretical Price and D4 RIN Market Price?

I have been asked how the D4T theoretical price (yellow line in Figure 1) is calculated and why it is lower than the D4 Renewable Identification Number (RIN) market price (orange line). D4T is calculated in a spreadsheet called ATTRACTOR using the model derived in this article. In the past year, the D4 RIN market…

Read MoreThe New Game of Renewable Fuels Part 3 – WHY Are The RFS Mandates Nested?

The spectacular increase in the price of the D6 Renewable Identification Number (RIN) in 2013 was one of the most extreme moves in the history of major commodity trading. Read the other blogs in this series, The New Game of Renewable Fuels: RINs are the environmental credits used to certify compliance with the U.S. federal…

Read MoreThe New Game of Renewable Fuels Part 2 – Principles 1, 2, and 3

The RIN is a game-changing environmental credit that is a tax, a subsidy, and a mandate, all at once. Read the other blogs in this series, The New Game of Renewable Fuels: 1) The RIN is a tax . . . . . . that is levied on petroleum fuels supplied by refiners and importers.…

Read MoreThe New Game of Renewable Fuels – The Rules Of The Game

The Renewable Fuels Standard (RFS) caused many businesses to be thrust involuntarily into a new game. The game came with a new kind of environmental credit called the Renewable Identification Number (RIN), which has rules different than any other environmental credit. Read the other blogs in this series, The New Game of Renewable Fuels: People…

Read More