RINs pricing and economics

Baby the RIN Must Fall, Part 4 — D4 RIN Price Nosedives, Triggering a Flurry of Market Reactions

By Hoekstra Trading LLC |

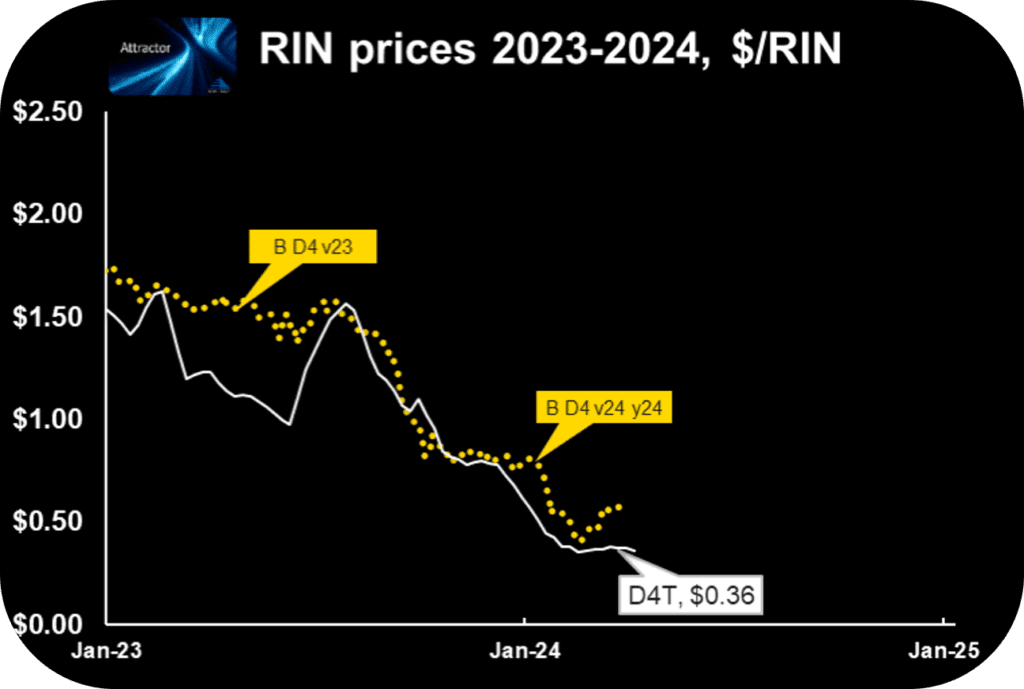

In late July, 2023, the D4 Renewable Identification Number (RIN) credit price started nosediving from $1.60 on July 25 to ...

Read More Falling RIN Prices

By Hoekstra Trading LLC |

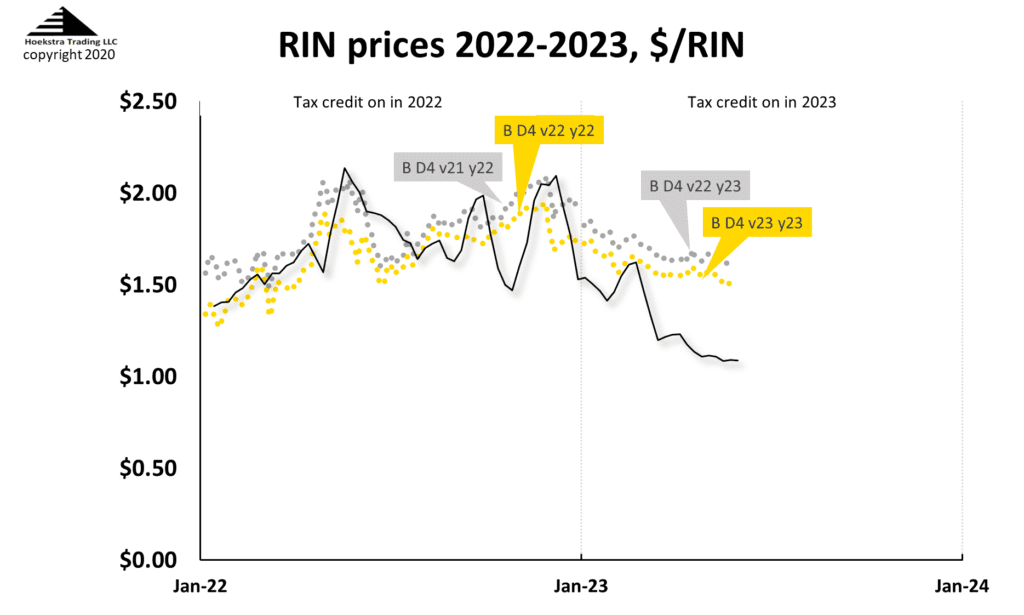

Theoretical prices foreshadow actual price drop This chart compares the market price of the D4 RIN (gold dashed lines) with ...

Read More Baby the RIN Must Fall Part 2 – Will A RIN Price Crash Make a Mess In The Renewable Diesel Market?

By Hoekstra Trading LLC |

U.S. production of hydrogenated renewable diesel (RD), made from soybean oil and animal fats like used cooking oil, is growing ...

Read More Baby, The RIN Must Fall Part 1 – What’s Behind The Chatter About RIN Prices Crashing To Zero?

By Hoekstra Trading LLC |

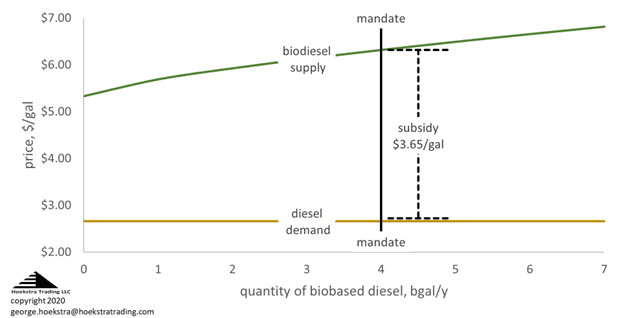

The Renewable Identification Number (RIN) is an environmental credit that functions as a subsidy to force renewable fuels like ethanol ...

Read More Modeling RINs As An Option – Part 2

By Hoekstra Trading LLC |

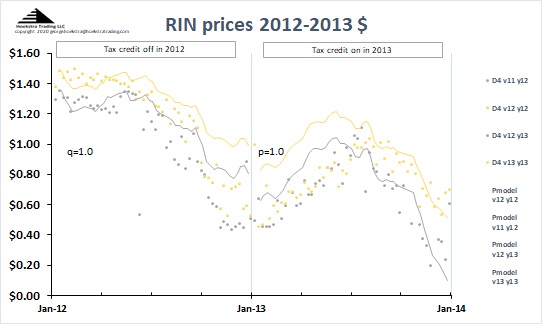

Also see Part 1 of this series In Figure 1, the silver points represent the price of D4 RINs that ...

Read More Modeling RINs as an option – Part 1

By Hoekstra Trading LLC |

Also see Part 2 of this series This chart shows the price of D4 Renewable Identification Numbers (RINs) traded in ...

Read More Release of Hoekstra Research Report 11: The Tax-and Subsidize Interpretation of RINs

By Hoekstra Trading LLC |

To order this report including 6 months of unlimited consultation by phone and E-mail please issue a purchase order using ...

Read More The Big Bang Theory Part 2 – Could there be more RIN price explosions?

By Hoekstra Trading LLC |

See Part 1 of this series In 2013, the price of the D6 Renewable Identification Number (RIN) spiked from a ...

Read More The Big Bang Theory Part 1 – The surprising RIN price spike of 2013

By Hoekstra Trading LLC |

See Part 2 of this series Renewable Identification Numbers (RINs) are credits used to certify compliance with the Renewable Fuel ...

Read More The 2022 OPIS Biofuels conference – my top 3 takeaways

By Hoekstra Trading LLC |

See the other posts in this series, Top 3 Takeaways: 2021, 2022, 2023, 2024 The OPIS 14th Annual RFS, RINs ...

Read More