Renewable Diesel In The News – Part 4, Critique Of The C-Suites

This is Part 4 of a four-part series reviewing my notes from a December 15, 2023 presentation made by Scott Irwin, Professor of Economics at The University of Illinois, titled “The RFS, Renewable Diesel, SAF & the Future of Biofuels”.

Read more blogs from this series Renewable Diesel in the News –

- Part 1 Two Ways to Skin a Fat

- Part 2 What The Investment Bankers Missed

- Part 3 A Renewable Wreckoning?

- Part 4 Critique Of The C-Suites

Part 1 provides some basic facts about the enormous boom that is occurring in renewable diesel production. Part 2 explains what’s driving that boom and points to a key insight missed by investment bankers who funded it. Part 3 predicts that oversupply in this market will have consequences unlike those that occur in normal free markets. This part 4 explains my belief that renewable diesel producers are not well-prepared for those consequences.

Scott Irwin described the imminent condition of “oversupply” as a boundary where a minimum volume equals a maximum volume and “something must give”. After his presentation, I asked Scott, from the floor of the conference:

Do you see any evidence that anyone in the Phillips 66 C-Suite, or any of the others, are even aware of what you said that “something must give”?

George Hoekstra question to Scott Irwin, Dec. 15, 2023

Scott replied:

I’ve thought about that a lot because you ordinarily think of the C-Suite, that at that level, they’re super sophisticated, really smart people, and I can’t help but think that they understand this and their response is we’re just going to power through it; or is this one of those situations where they got, basically, caught with their pants down?

Scott Irwin, Dec. 15, 2023

This exchange prompted a broader discussion that extended to related topics involving other conference participants that can be heard starting at minute 36 of the audio presentation of Scott’s talk which was broadcast on WILL AM-580 radio’s program “Closing Market Report,” and is available via the link at the bottom of this post which was kindly provided by Todd Gleason, the moderator of the conference and host of that radio program.

Misunderstanding

The balance of this blog post focuses narrowly on my own views on the above question/answer sequence about whether renewable diesel producers understand and are prepared for the consequences of crossing the boundary that defines both the minimum and the maximum biomass-based diesel market size.

My response was:

I don’t think they understand what you explained here.

George Hoekstra to Scott Irwin, Dec. 15, 2023

Pants down?

By way of explanation to the readers of this blog, I believe:

- Bio-based diesel producers do understand that the renewable volume mandates determine the size of the renewable fuel markets they supply,

- but very few of them understand the consequences of surpassing that level.

In other words, my answer is yes, with regard to this imminent “something must give” situation, I believe C-Suites are at high risk of getting caught again with their pants down.

An abundance of evidence supports this belief, including

- C-Suites’ responses to financial analysts’ questioning on this topic in earnings conference calls.

- My personal in-depth discussions with scores of employees of these companies.

- My own experience in struggling to understand, and then explain, and then anticipate the odd behaviors of markets under the control of the RIN credit system.

As explained in my previous writings and in Hoekstra Trading Research Reports, the RIN system has constructed artificial boundaries, like blend walls and end walls, which, when crossed, cause discontinuous market shocks instead of the smooth, continuous changes with which we are familiar, and these shocks keep causing CEO’s to get caught with their pants down.

Objection!

“Objection! The C-suites do understand this Hoekstra, they are just keeping their cards close to their vests and playing dumb when discussing it in public for strategic, competitive reasons.”

Objection overruled. That is a widely-held theory that is plausible but, in this case, it simply does not hold up under scrutiny.

Furthermore, the misunderstanding of the RINs system and its tendency to cause unexpected market shocks extends far beyond the C-suites to producers in general, and in fact to most participants in the bio-based-diesel markets, including the investment bankers mentioned by Scott Irwin (see Part 2) who, we presume, are also smart, sophisticated people.

Bewildering complexity

Please don’t think I am trying to make others look dumb, or myself smart. The problem is the bewildering complexity of the RIN system itself. Speaking for myself, to understand RIN economics at a fundamental level required dedicating 3 months, full time, to the study of scores of documents that print to hundreds of pages each, like Regulatory Impact Analyses, PhD dissertations, Supreme Court decisions, and other long documents to which they refer, which I did during the 3rd quarter of 2020.

The problem is the bewildering complexity of the RIN system itself.

George hoekstra

Considering this, it is not at all surprising that the behavior of RIN prices have escaped the full grasp of even the smart, sophisticated, capable people who rise to C-Suite levels, their employees, and other participants in the RIN market.

Wouldn’t it be nice?

My critique of the C-suites then reduces to this question: Considering the importance of RINs to their financial results and stock prices, why hasn’t someone in a C-suite, or a leader among their subordinates, demanded that someone in their organization be relieved of his normal duties for a few months and dedicate himself to the full-time study of RIN pricing and economics until he understands it at a deep, fundamental level, and could then explain it in an understandable way to those in the C-suites and others who badly need access to that deep fundamental understanding?

In addition to bringing deep fundamental understanding of RIN pricing and economics to the organization, this would greatly reduce the risk of CEO’s continuing to get caught with their pants down.

And it would provide the capability to anticipate and prepare for otherwise unexpected RIN price behavior in real time before the wheels come off like they do whenever the market approaches or crosses another RIN system boundary.

Wouldn’t it be nice if someone assigned a person to do that and it got done?

And wouldn’t it be nice if that dedicated person’s study uncovered valuable tools that have been developed and published by others who themselves spent years studying and analyzing the RIN system at a fundamental level? The others I am referring to include university professors and graduate students, some of whom spent years, full time, doing that and then published their dissertations and modeling tools?

And wouldn’t it be nice if that dedicated person then took those published tools and put them into a user-friendly spreadsheet that allows accurate, fundamental, quantitative modeling and analysis of RIN price behavior for commercial use?

And then this package of knowledge + spreadsheet could be made available to assist those in the organization who are responsible for guiding and managing RIN strategy.

Wouldn’t it be nice if someone did that?

Well someone has.

What gives?

Here is an understandable description of what it looks like when a RIN system boundary “gives”, from someone who has spent 3 years trying to understand it at a deep fundamental level.

It is not like a light dimming, it is like the power grid crashing. It is not like a control valve opening, it is like the relief valves popping. It is not like water rushing over a dam, it is like the dam bursting.

It is like the D6 RIN popping 100-fold (that’s 100-fold, not 100%) when the market crossed the blend wall boundary, triggering a $20 billion/year pants-down situation.

Price control system

Like a power grid, or a pressure control loop, or a dam, the RIN is a sophisticated system, specifically, the RIN is a price control system.

The RIN is a price control system

George hoekstra

Most C-Suite executives in the refining and fuels businesses already understand, or are certainly capable of understanding control systems that contain things like relief valves and circuit breakers that cause discontinuous changes when their set point limits are breached. Understood in that way, the RIN price control system, and the otherwise surprising price behavior it causes become explainable and predictable rather than shocking, and you can anticipate and prepare for, rather than continuing to be blindsided by them.

Recommendation

To people in C-Suites and leaders among the employees of companies affected by RINs pricing and economics: you should get Hoekstra Research Report 10 which includes 6 months of unlimited consultation and the Hoekstra Attractor RINs pricing spreadsheet that accurately calculates theoretical RIN prices, tracks actual prices, and predicts how RIN prices will change with the variables that affect them and is available to anyone immediately at a small fraction of the cost of doing it yourself from scratch. Why not send a purchase order today?

Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10

Attractor update

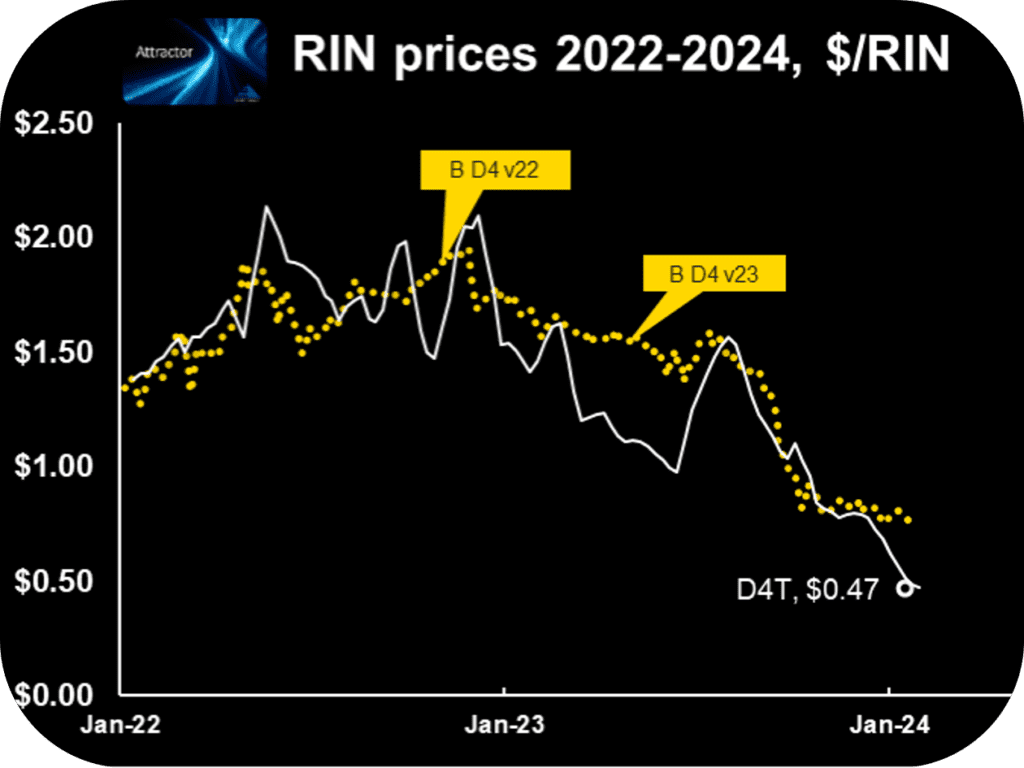

The Attractor spreadsheet shows the D4 RIN market price (gold points) and the “D4T” theoretical value (white line and open white data point) updated through last Friday. The theoretical value of a hypothetical D4 RIN with 1 year remaining life (“D4T”) is $0.47 which is down 3 cents from last week and 29 cents below the most recent quoted market price of $0.76

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone!

Link to Scott Irwin’s presentation audio “The RFS, Renewable Diesel, SAF & the Future of Biofuels”:

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159