Welcome to the Future – Part 2 – High cost of gasoline sulfur specification draws attention from refiners and financial analysts

The price of the Tier 3 gasoline sulfur credit hit $3,600 in October, up by a factor of 10 since 2022. The high price of this credit is a direct indicator of the true cost of compliance with the Tier 3 gasoline sulfur standard and has raised attention recently in refining and financial circles. In today’s blog, we give some specific examples of how refiners and investment analysts are reacting.

Read more blogs from this series: Welcome to the Future:

- Part 1 Sulfur Credit Investments Pay Off 10-Fold For Forward-Looking Refiners

- Part 2 High Cost of Gasoline Sulfur Specification Draws Attention From Refiners, Investment Analysts

- Part 3 With Tier 3 Costs Sky-High, U.S. Refiners Consider Investments, Alternatives

New bottlenecks

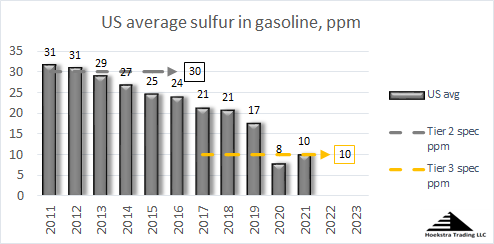

the Tier 3 story is about two tightly coupled gasoline quality specifications: sulfur and octane. Many U.S. refineries are unable to desulfurize gasoline down to 10 ppm without also downgrading the octane of their gasoline pool. This has become a critical new bottleneck in gasoline production in North America that is reducing gasoline supply, increasing prices and affecting refiners’ profitability.

One year ago, our four-part Breaking the Chains series told the full Tier 3 story, first by explaining octane and gasoline blending (Part 1), then the octane/sulfur bottleneck (Part 2), the alternatives available to refiners (Part 3), and the sulfur credit system (Part 4)

Credit strategy

As we explained in Part 1 of this series, the gasoline sulfur credit trading system enables the most efficient gasoline producers to create revenue by producing gasoline with sulfur below the current Tier 3 10 ppm maximum spec while enabling others to exceed the maximum sulfur specification and still sell that product as compliant gasoline.

For example, a refinery could make a 30-ppm sulfur gasoline pool, just as they did before the current Tier 3 10-ppm sulfur specification kicked in, and still comply with the Tier 3 requirement by buying enough sulfur credits to offset the 20 ppm (=30-10) it is over the spec. The cost of those credits, at today’s credit price, would be $3/barrel or 7 cents per gallon of gasoline – and those dollars would go to a refiner who, in previous years, built up a bank of sulfur credits by making an annual average gasoline sulfur level below 10 ppm. For refiners who produce 100,000 barrels/day of gasoline, that amounts to a $110 million per year cash transfer from the credit buyer to the credit supplier, which is enough to raise attention.

For refiners who produce 100,000 barrels/day of gasoline, that amounts to a $110 million per year cash transfer from the credit buyer to the credit supplier, which is enough to raise attention.

Sulfur credits have been traded for many years, but since the credit price increased 10-fold in the last 2 years, the financial impacts are now being noticed by financial analysts.

In CVR Energy’s 3rd quarter earnings conference call, CEO Dave Lamp was asked how CVR avoided taking a major financial hit from an unplanned shutdown caused by a fire on a gasoline desulfurizer at their Wynnewood, Oklahoma refinery in May, 2023. Here is that Q&A Exchange:

Question from Munav Gupta, Executive Director, UBS Securities, August 1, 2023:

“Very strong refining results. If one didn’t know that there was an outage at the gasoline desulfurizer, there’s no way the results would tell you that. So, help us understand, because we do know there was some kind of outage, how did you manage so well around this outage? And if it had not happened, would the results have been actually even better than what we saw?”

Answer from Dave Lamp, CEO, CVR Energy Inc.:

“Well, as you know, that where the fire occurred was in a gasoline hydrotreater, which basically takes gasoline and treats down the sulfur to meet Tier 3 specs. We’ve been running that unit for quite a long time and at both Coffeyville and Wynnewood we have generated significant credits. We monetized some of those credits during this time. And those credits are on our balance sheet at zero value. So, you didn’t see much impact on the financials. We are hurt a little bit because those are credits we could have sold, which right now are selling around $2,500 per credit, and we could have sold those in the future.”

Without the sulfur credit system, this incident would have resulted in lower gasoline production and profits. By deliberately over-performing on gasoline sulfur at times of low incremental cost in previous years, CVR had generated and banked Tier 3 sulfur credits that paid off this summer by allowing them to keep producing Tier 3-compliant gasoline at a time of maximum compliance cost and maximum seasonal gasoline demand.

By deliberately over-performing on gasoline sulfur at times of low incremental cost in previous years, CVR had generated and banked Tier 3 sulfur credits that paid off this summer

21st-Century optimization

The high cost of gasoline sulfur reduction has caused some refiners to pay closer attention to optimizing gasoline desulfurizer performance and to do small revamps and optimization projects:

At one refinery, a 1-week performance test using detailed hydrocarbon analyses revealed that a hydrogen-sulfide (H₂S)-bearing stream had been bringing H₂S into the desulfurization reactor, unknowingly reducing catalyst activity and selectivity. By rerouting that stream, $7 million per year of octane value was saved and catalyst life was extended, for a net present value of $60 million.

$7 million per year of octane value was saved and catalyst life was extended, for a net present value of $60 million.

A similar 1-week performance test in a different refinery produced the data needed to prove the benefit for a $25 million revamp that eliminated the need to purchase sulfur credits by reducing octane loss on an existing gasoline desulfurizer. That revamp project had been in the hopper a long time, but the detailed hydrocarbon analyses from a good performance test, and awareness of the high cost of sulfur reduction, nailed down the case for action, which got the $25 million project approved and funded within one month, completed within one year, and is now saving $27 million/year in octane with a present value of $205 million.

the $25 million project got approved and funded within one month, completed within one year, and is now saving $27 million/year in octane with a present value of $205 million.

Another refiner took this to another level by doing detailed hydrocarbon analyses on all their FCC product streams while running first on their easiest, and later, on their most difficult feedstocks. This provided the quantitative data needed to update their process and optimization models for the octane/sulfur cost trade-off to help reduce Tier 3 costs for any feed they expect to run in their FCC train.

New technology

Evonik has introduced a new line of gasoline desulfurization catalysts called OctaMax using a novel concept that employs a higher activity catalyst that has been partially deactivated in previous commercial service. Making a better catalyst by employing recycled materials may sound counter-intuitive, but this is a case where it works. In independent pilot plant tests alongside today’s leading catalysts, this innovative catalyst proved the capability to increase sulfur credit generation with a present value of $75 million for a typical unit at today’s credit price at no cost, requiring only the will to implement a new catalyst.

this innovative catalyst proved the capability to increase sulfur credit generation with a present value of $75 million

Several refiners are evaluating a new gasoline formulation technology called Hydrogen Rich Content (HRC) gasoline. This patented technology uses only low sulfur, hydrogen-rich refinery blendstocks like straight-run gasoline, isomerates, alkylate, butanes, and renewable naphtha in gasoline blends. Such hydrogen rich blends are normally thought to be too low in octane for blending gasoline, but the concept works by exploiting the fact that ethanol addition to the formulations provides a double octane boost upon ethanol blending, thus finished ethanol-containing blends meet octane requirements.

the concept works by exploiting the fact that ethanol addition to the formulations provides a double octane boost upon ethanol blending

The concept has been proven in one commercial application and another refinery has scheduled its first production for the first quarter of 2024. The technology can be applied with no capital investment or change to refinery operations except segregation of existing gasoline blending components and use of new formulation recipes. The owner of the technology, HRC Fuels Inc., has plans for a four-phase transition of the conventional gasoline pool that could eventually lead to sharp reductions in the level of aromatics and olefins in gasoline while meeting all 21st century gasoline specifications.

There are 83 gasoline desulfurizers in the United States which were installed for the purpose of meeting the previous (Tier 2) gasoline sulfur spec in the late 1990s. Historically, they have not been considered important units for profitability; but now, with Tier 3, many of them are over-stressed and have become serious bottlenecks for gasoline production and refining profitability. Undoubtedly, these bottlenecks will continue to be addressed in coming years with catalyst, optimization, and technology improvements like those described above.

Capital investment

The next step would be to make larger capital investments, in the $100 – $500 million range to install new refining units for improved gasoline production, something that has been highly unpopular in recent years. However, with the reduction in refining capacity, and the prospect of sustained long-term gasoline demand and higher fuel prices, these investments could be very attractive for some U.S. refineries. The capital investment options and economics of such investments will be covered in the next episode of this series.

Conclusions

- The high cost of gasoline sulfur reduction, now around $3/barrel or 7 cents per gallon of gasoline, is directly proven by the current $3,600 price for a Tier 3 sulfur credit.

- Refiners are responding with credit strategies, small revamps, gasoline desulfurizer performance tests using detailed hydrocarbon analysis, sulfur/octane optimization, new gasoline desulfurization catalysts and new gasoline formulation strategies.

- Capital investments to improve gasoline production have been unpopular in recent years but are back on the table.

Recommendation

Every refining executive should have a comprehensive understanding of the technical, regulatory, and economic aspects of Tier 3 gasoline, the sulfur credit program and how they affect your business. Those wanting a quick education on the Tier 3 issue should get the short book, Gasoline Desulfurization for Tier 3 Compliance, which will make you an industry expert in a day. Once you have become expertly informed of the problem, you can save your team years of redundant work by buying Hoekstra Research Report 8. We saw this situation coming, did the research and field tests, ran the simulations and analyzed the results so you and your team can take immediate steps to increase gasoline margin capture in the Tier 3 world. The report includes detailed pilot plant and commercial field test data, full detail of sulfur credit pricing, spreadsheet models to help improve gasoline optimization, sulfur credit strategy and refining margin capture in the Tier 3 world.

Don’t get caught panic buying after the credits spike.

George Hoekstra

George.hoekstra@hoekstratrading.com

+1 630 330-8159