Archive for August 2021

Strange happenings in refineries

Strange things are happening in this refinery. Is anyone hurt? When will we have results of those catalyst analyses? What is really in those tanks? Where is my sister? Why does that French mathematician’s name keeps popping up everywhere? Who can I trust? When was the last time you read a novel all about an…

Read MoreWhat’s the missing piece in Phillips 66 refining profit problem?

NOTE ADDED March 3/2025 See Love Letters Part 1 Big Oil Gets Tough Love From Investor Elliott Management Investors are puzzled over Phillips 66 (PSX) refining profits. Here is a comment from a PSX stock investor last week: “The 2nd quarter Pre-Tax Profitability Chart shows PSX’s refining business loss $729 million. This is perplexing as…

Read MorePoor refining profitability puzzles investors

An Aug. 16, 2021 article titled Phillips 66 Stock: Advantaged By Its Refining-Adjacent Businesses, by Laura Starks was published on seekingalpha.com. Below are excerpts of investors’ comments on seekingalpha.com Comment by Fwc3030 17 Aug. 2021, 7:31 AM Ms. Starks, Thank you for a well written over-view of Phillips. Your writing style is to be commended…

Read MoreToday’s octane economics

Because octane can seem confusing, consider a more familiar commodity, wine. Imagine you own a vineyard. You produce wine for $4/bottle, distribute it in cases for $24/bottle and sell it in your shops for $34/bottle. Your margin is $20/bottle for case sales and $30/bottle for bottle sales. A neighbor makes identical wine and sells it…

Read MoreRefining’s margin capture problem — here’s the hidden cause

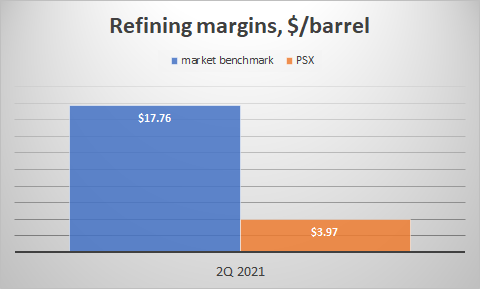

A sore point in US refiners’ 2021 earnings has been low “margin capture” rates. Margin capture refers to actual realized margin compared to a market-based benchmark margin. For example, this chart from Phillips 66 (PSX)’s 2nd quarter earnings conference call shows a market-based benchmark margin of $17.76/barrel (left tan bar), and an actual realized margin…

Read More