RIN Price Nosedive Part 3 – It WAS Foreseen, It’s Cause Was COMPETITION, And It WILL Continue

From January 2023, Hoekstra Trading clients were analyzing and acting on the growing gap between the D4 RIN theoretical value and its quoted market price. Starting in February, a series of 12 articles on renewable diesel supply was published by University of Illinois economists with quantitative supply/demand analyses and explanations of the theory behind a possible D4 RIN price crash.

Read other blogs in this series – RIN Price Nosedive

- Part 1 C-Suites Questioned On RIN Price Nosedive

- Part 2 Was It Foreseen, What Was The Cause, Will It Continue?

- Part 3 It Was Foreseen, It’s Cause Was Competition, And it Will Continue

- Part 4 A Nosedive Is One Thing, A Cliff Is Another

- Part 5 Dissecting the 2023 RIN Price Nosedive

Was it foreseen?

Yes. During the summer a buzz grew through the trading community and media that included my series of articles titled “Baby the RIN Must Fall – A Decade After the ‘Big Bang’, are RIN Prices Headed for a Crash?“, published in 3 parts in the RBN Energy Daily Blog starting in June, and several more highly publicized quantitative estimates of future RIN supply/demand balances suggesting a D4 RIN oversupply.

As the buzz grew louder, executives were grilled on it in 2nd quarter earnings conference calls, when the RIN had already started into its nosedive, louder still through July and August when it was well into its nosedive, even louder in September RIN conferences, and to a low roar by 3rd quarter earnings conference calls.

This is to say, the RIN nosedive was foreseen, and was readily foreseeable to those paying attention.

What was the cause?

Competition. The growth of renewable diesel production, and the substitution of higher-cost biodiesel gallons with renewable diesel gallons, is causing a reduction in the incremental cost of bio-based diesel. This competition and substitution means the RIN price required to subsidize the production of bio-based diesel, other things equal, must fall.

Said in econo-speak, the supply curve is shifting down and dragging the D4 RIN with it – more to come on this next week.

Will it continue?

Yes, for as long as lower-cost renewable diesel continues to compete with and substitute for higher cost fatty acid methyl ester (FAME) biodiesel. There is abundant evidence this predictable downward bias is not reflected in quoted RIN market prices but is instead appearing well after the market changes happen. Therefore we should expect the competition and substitution to continue appearing as a trailing downward bias in the market price, compared to theoretical price, over time. Of course, other factors affect RIN price – that is why we call it a downward bias.

Another way to say this is the market price will be attracted toward the theoretical price over time.

Recommendation

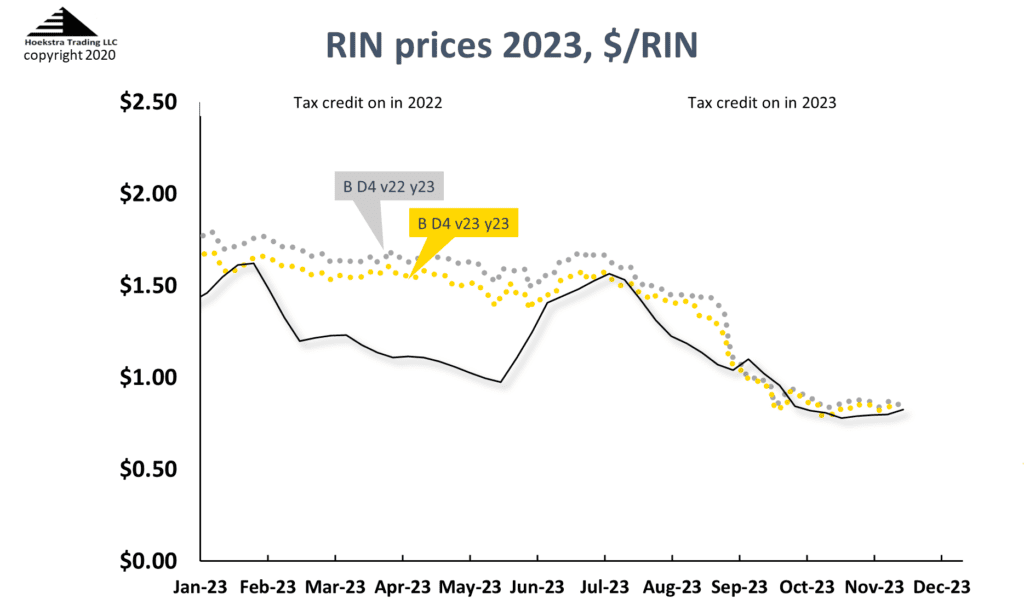

Those with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Attractor spreadsheet that calculates theoretical D4 RIN values using the Irwin-McCormack-Stock (IMS) RIN price model (black line on chart below) based on economic fundamentals, tracks them versus actual prices (silver and gold data points), predicts how the D4 RIN price will change with the variables that affect it, includes 6 months of unlimited consultation by phone and E-mail, and is available to anyone immediately at negligible cost.

That is to say, why not send a purchase order today?

It is not a newsletter, it is a research report based on millions of dollars worth of academic work on RIN fundamentals that will give you a new perspective on RIN pricing and economics, unique insights and practical tools your company can use to better track, interpret and anticipate RIN price movements. Here’s the offer letter including the Table of Contents and a sample invoice with all the information needed to prepare a purchase order.

Attractor update

The Hoekstra IMS RINs pricing spreadsheet shows the D4 RIN market price (gold and silver points) and the theoretical D4 RIN value updated through last Friday. The theoretical value of a hypothetical D4 RIN with 1 year remaining life is $0.83.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159