Renewable Diesel In The News – Part 1, Two Ways To Skin A Fat

Last week, Scott Irwin, Professor and Laurence J Norton Chair of Agricultural Marketing at University of Illinois, presented “The RFS, Renewable Diesel, SAF & the Future of Biofuels” at the 2023 Farm Assets Conference in Champaign, Illinois. His assignment from The Management was to explain this topic in 30 minutes or less.

Read other blogs in this series: Renewable Diesel In The News –

- Part 1 Two Ways To Skin A Fat

- Part 2 What The Investment Bankers Missed

- Part 3 A Renewable Wreckoning?

- Part 4 Critique Of The C-Suites

Inspired by his impressive response to that challenge, I am posting below this first of four weekly segments (Part 2 here, Part 3 here, Part 4 here), with my notes on his key points embellished with some additional detail from a refiner’s perspective. Those who have purchased Hoekstra Research Report 10 and or 11 and read this blog series will notice a family resemblance.

This four segment blog series will lead up to two provocative questions I was waiting to ask Scott, and did from the floor of this conference.

Two ways to skin a fat

Two types of biomass-based diesel are commonly called FAME biodiesel and hydrogenated renewable diesel. Both types are derived from oxygen-containing organic compounds called triglycerides that make up vegetable oils and waste animal fats.

The process for making FAME biodiesel reacts the triglycerides with methanol to make oxygen-containing fuel molecules called fatty acid methyl ester (FAME) biodiesel.

By contrast, the process for making hydrogenated renewable diesel reacts the triglycerides with hydrogen (instead of methanol) to make oxygen-free fuel molecules identical to those in conventional diesel fuel.

The feedstocks for the two processes are the same. The difference in the two products is that FAME biodiesel still has oxygen atoms embedded in its molecules which limits its use as a diesel fuel substitute and requires it be blended with conventional petroleum diesel before being sold as fuel, whereas hydrogenated renewable diesel is a straight “drop-in” substitute for petroleum diesel.

FAME biodiesel still has oxygen atoms embedded in its molecules which limits its use as a diesel fuel substitute and requires it be blended with conventional petroleum diesel before being sold as fuel, whereas hydrogenated renewable diesel is a straight “drop-in” substitute for petroleum diesel.

Oil boom

The hydrogenation of renewable feedstocks to produce renewable diesel is done in oil refineries using the same refining process used to remove sulfur from petroleum diesel and gasoline. The difference is, with renewable feedstocks, we are removing oxygen atoms instead of sulfur atoms.

Hydrogenation is the most widely used process in petroleum refining – for example, in 2000, after BP had purchased Amoco, Sohio, Arco, and Veba Oil, the combined BP had 16 refineries with 90 hydrogenation units producing low sulfur petroleum fuels from high-sulfur petroleum feedstocks. Today, some of those same units are instead producing hydrogenated renewable diesel from vegetable oils and animal fats.

Since 2019, U.S. nameplate production capacity of hydrogenated renewable diesel has been ramping up at a rapid pace, from 0.6 to a scheduled 7.4 billion gallons/year including an expected growth of 1.4 billion gallons in 2024 that includes a 680 million gallon capacity Phillips 66 refinery in Rodeo California.

This boom has consumed most of the refining industry’s “growth” capital investment budgets in recent years, in some cases, exceeding $1 billion capital investment per plant.

Since 2019, U.S. nameplate production capacity of hydrogenated renewable diesel has grown from 0.6 billion gallons/year to a scheduled 7.4 billion gallons/year by 2025

Crush rush

For decades, soybean oil contributed about 1/3 to the value of a bushel of soybeans, and soybean meal 2/3. The current renewable diesel boom caused an explosion of soybean oil prices to the point where, in 2021 and 2022, soybean oil represented half the value of a bushel of soybeans.

This was accompanied by a sharp increase in the price of soybeans and in soybean crushing capacity which is scheduled to expand by 1/3 in the next 4 years.

Moving further back in the supply chain, this suggests a need for 18 to 30 million additional acres of soybeans to supply soybeans to feed the crush plants.

The knock-on effects of this renewable diesel boom are being felt across the whole renewable fuels ecosystem.

The knock-on effects of this renewable diesel boom are being felt across the whole renewable fuels ecosystem.

Policy stack

What’s behind the boom? The short answer is the “policy stack” – that’s investment banker lingo, to be explained in next week’s Segment 2, along with a blindingly important insight the investment bankers missed.

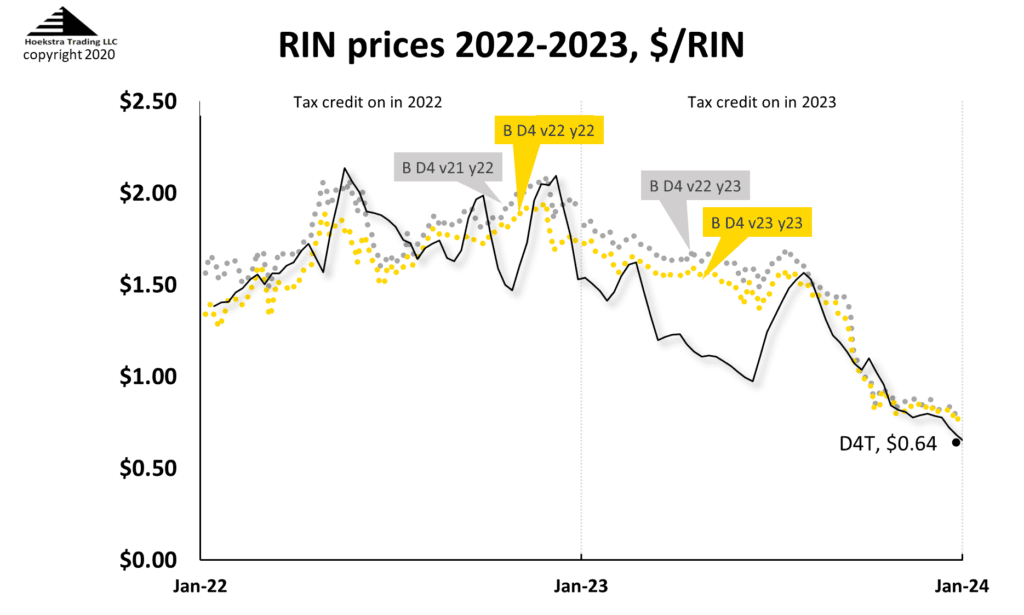

Attractor update

The Attractor spreadsheet shows the D4 RIN market price (gold and silver points) and the “D4T” theoretical value (black line) updated through last Friday. The theoretical value of a hypothetical D4 RIN with 1 year remaining life (“D4T”) is $0.64 which is down 2 cents from last week and 13 cents below the most recent quoted market price of $0.77

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

Get the Attractor spreadsheet, it is included with Hoekstra Research Report 10 and is available to anyone!

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159