Posts by Hoekstra Trading LLC

What was “RINsanity”? Read This Classic 2013 Article On The Big Bang of Renewable Identification Number (RIN)s

This New York Times article described the frenzy set off by the 100-FOLD increase in the D6 RIN in 2013. Now, 12 years later, most RIN participants know what really caused that price explosion. But the market remains confused and is still often blindsided by unexpected price behaviors caused by nuances of the RIN system…

Read MoreComparing Theoretical and Market Renewable Identification Number Prices Part 5 – RIN Price Forecasting

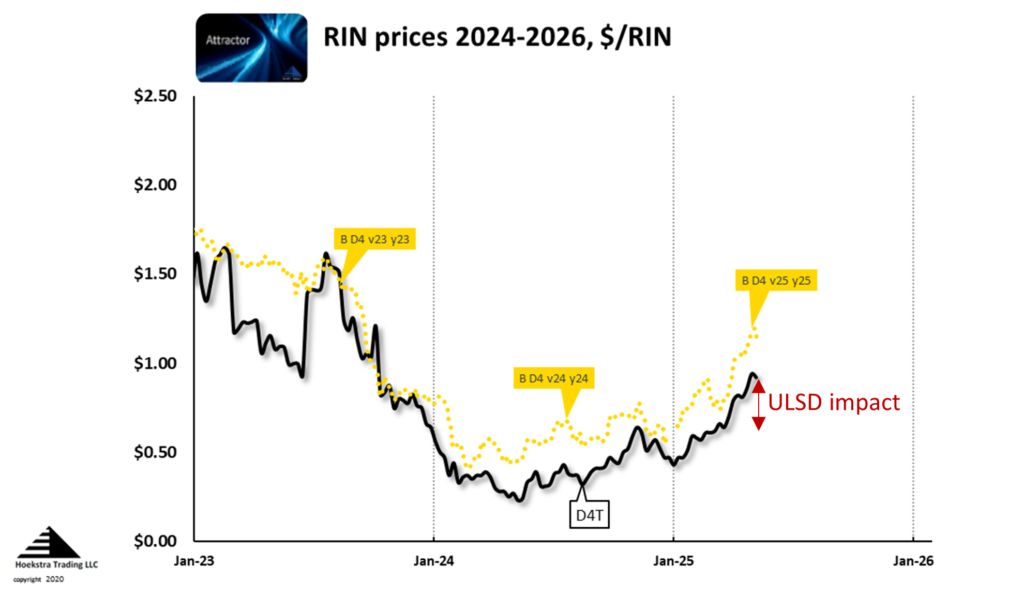

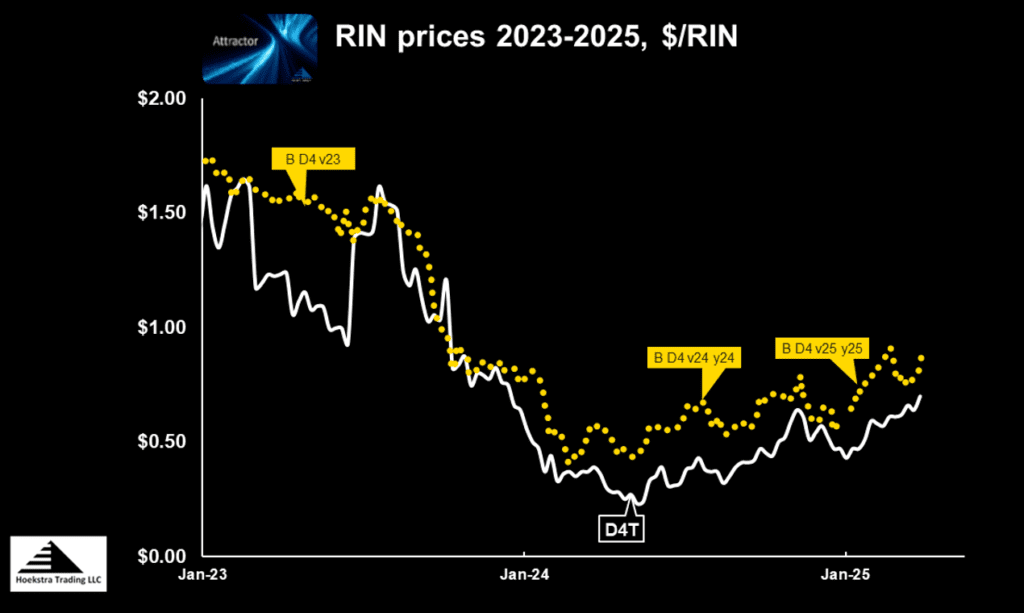

ATTRACTOR is a spreadsheet application of the RIN price equation defined in this publication by Scott H Irwin, Kristen McCormack and James H Stock. Since its Release in October, 2020, ATTRACTOR has been used by Hoekstra Trading clients to calculate theoretical Renewable Identification Number (RIN) prices based on economic fundamentals and compare them to market…

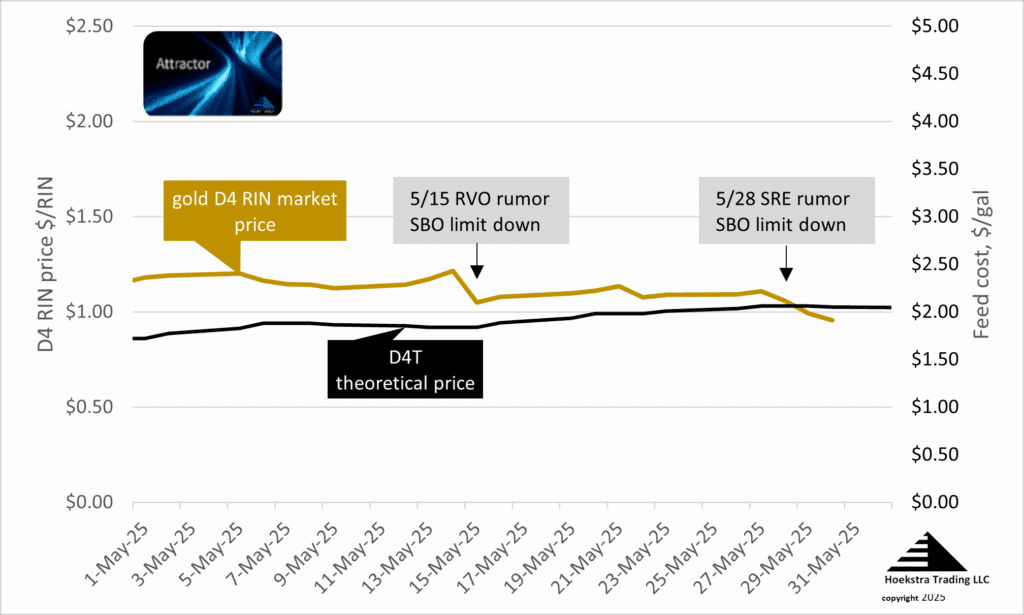

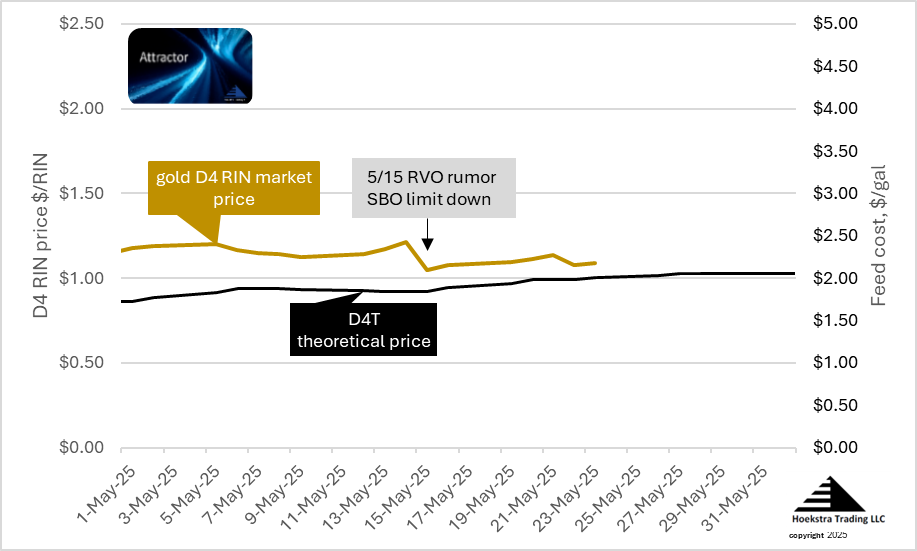

Read MoreComparing Theoretical and Market Renewable Identification Number (RIN) Prices Part 4 – Over-Reaction to Regulatory Policy Changes

A May 15, 2025 rumor said the Renewable Volume Obligation (RVO) levels for biobased diesel for years 2026 and following would be set at less than 5 billion gal/y, at a time when the market was expecting it will be a higher number. Read other blogs in this series – Comparing Theoretical and Market RIN…

Read MoreTop 3 Takeaways From Fastmarkets Biofuels and Feedstocks Americas 2025 Conference

Number 3: What is the status of U.S. biodiesel production? U.S. biodiesel production (not including plants that use hydroprocessing technology, which are commonly known as renewable diesel plants) is running at half capacity. Some biodiesel plants are not producing at all now, but are keeping a full staff who are doing other work like maintenance…

Read MoreComparing Theoretical and Market Renewable Identification Number (RIN) Prices Part 3 – Anticipating Changes in Tax Subsidies

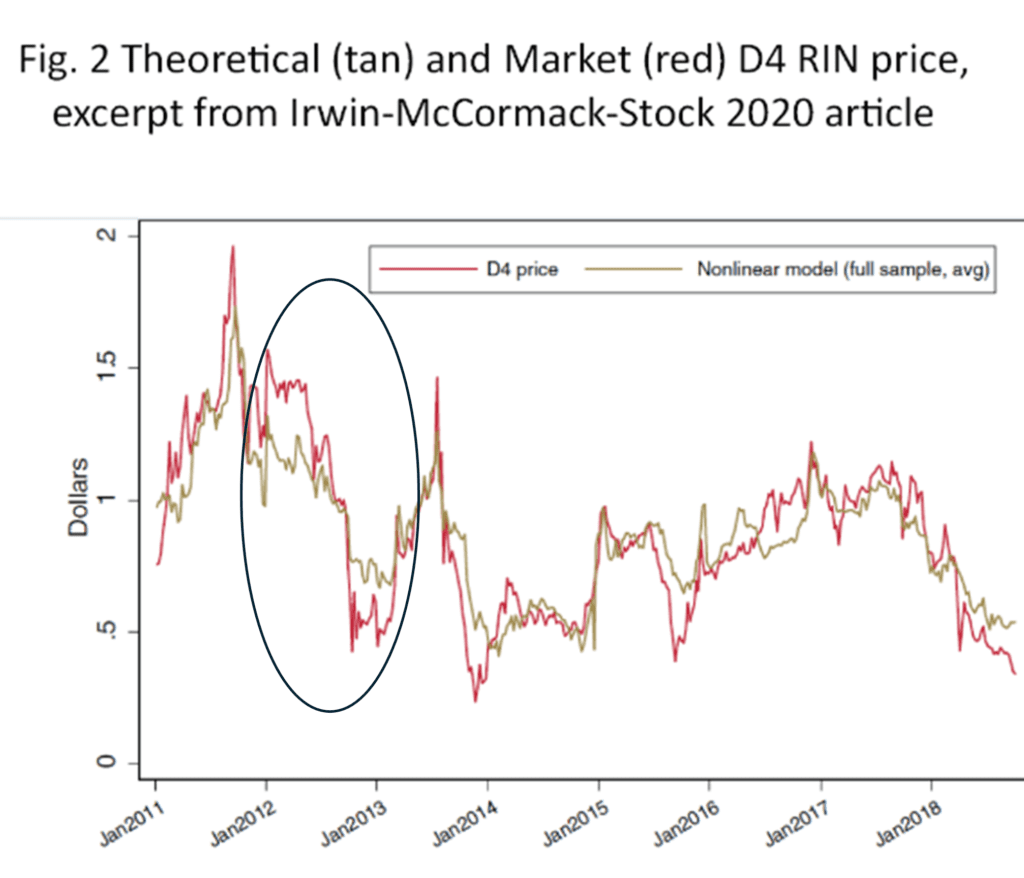

Read other blogs in this series – Comparing Theoretical and Market RIN Prices: Figure 1 (whose title says Fig. 2) shows a copy of Figure 2 extracted from the published Irwin-McCormack-Stock (IMS) article that defines D4T and the ATTRACTOR model. In Part 2 of this series, I said this chart: Shows that the D4 RIN…

Read MoreMidwest States Pose New Challenges for Gasoline Supply

With summer gasoline season upon us, refiners and gasoline distributors are now supplying the more expensive, low volatility summer gasoline grades that cause pump prices to increase in summer. This year, they include a new low volatility grade that is being supplied for the first time to motorists in several Midwest states. This is the…

Read MoreMy Top Three Takeaways From the Bloomberg Farm, Food, and Fuel Summit 2025

Number 3 — Confusion reigns At a conference in September, 2024, a panelist said, “Biofuels is a difficult place to work” At the time, that struck me as a concise understatement about the biofuels business environment. The same feeling was in the air at two other conferences in January covering California’s biofuels regulations, and again…

Read MoreComparing Theoretical and Market Renewable Identification Number (RIN) Prices Part 2 – How Well Do RIN Market Prices Track With Economic Theory?

How well do RIN Market Prices Track With Economic Theory? Read other blogs in this series – Comparing Theoretical and Market RIN Prices: This question is best answered by the 2 charts below. Figure 1 (whose title says Fig. 2) shows a copy of Figure 2 extracted from the published Irwin-McCormack-Stock (IMS) article that defines…

Read MoreComparing Theoretical and Market Renewable Identification Number (RIN) Prices Part 1 – 3 Factors

Why are Hoekstra Trading’s theoretical RIN prices (D4T and D3T) different from the D4 and D3 RIN market prices? Read other blogs in this series – Comparing Theoretical and Market RIN Prices: We ask ourselves that question every week. We propose many possible reasons why the theoretical and market prices could be different. Using a…

Read MoreD3 Renewable Identification Number (RIN) Price Collapse

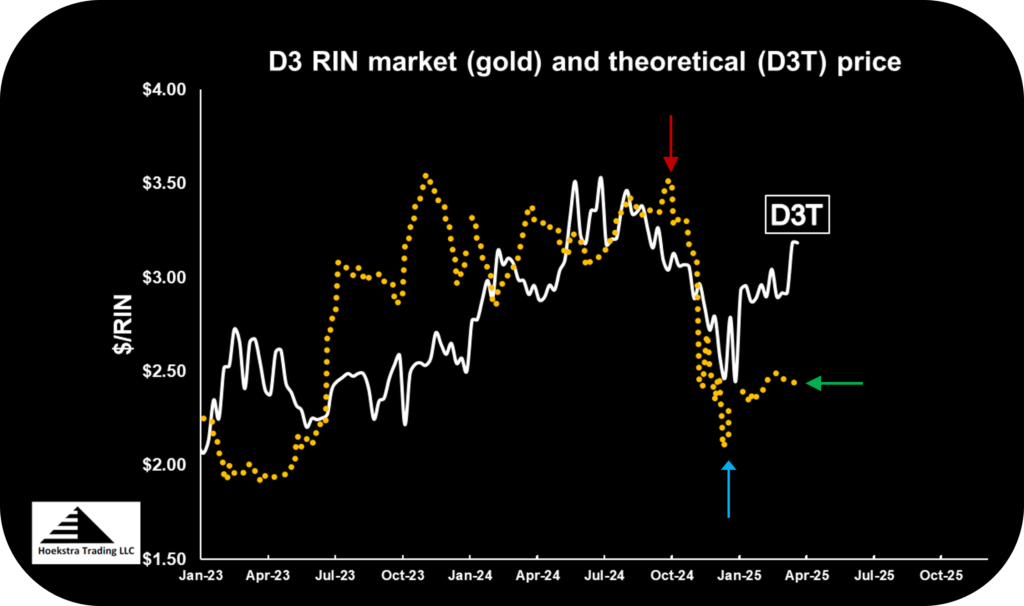

See previous blogs in this series: The gold data in Figure 1 shows how the D3 RIN market price collapsed by $1.32, from a high of $3.40 the week of September 27, 2024 (red arrow), to a low of $2.08 on December 5 (blue arrow). December 5 was the date of release of EPA’s proposal…

Read More