Posts by Hoekstra Trading LLC

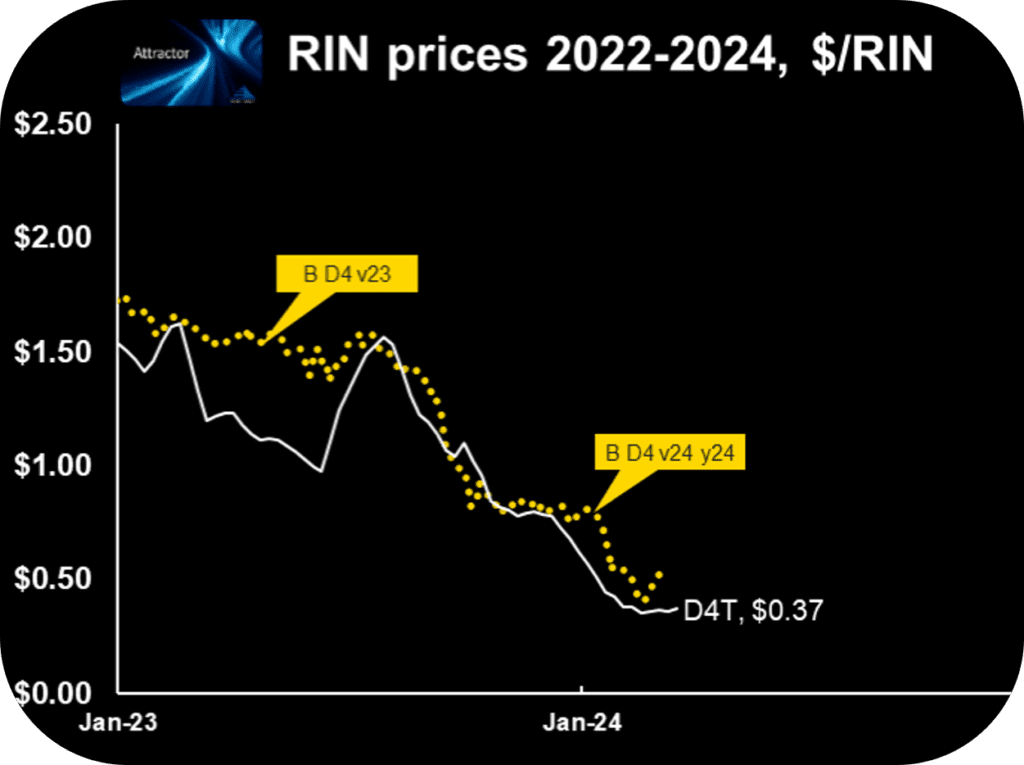

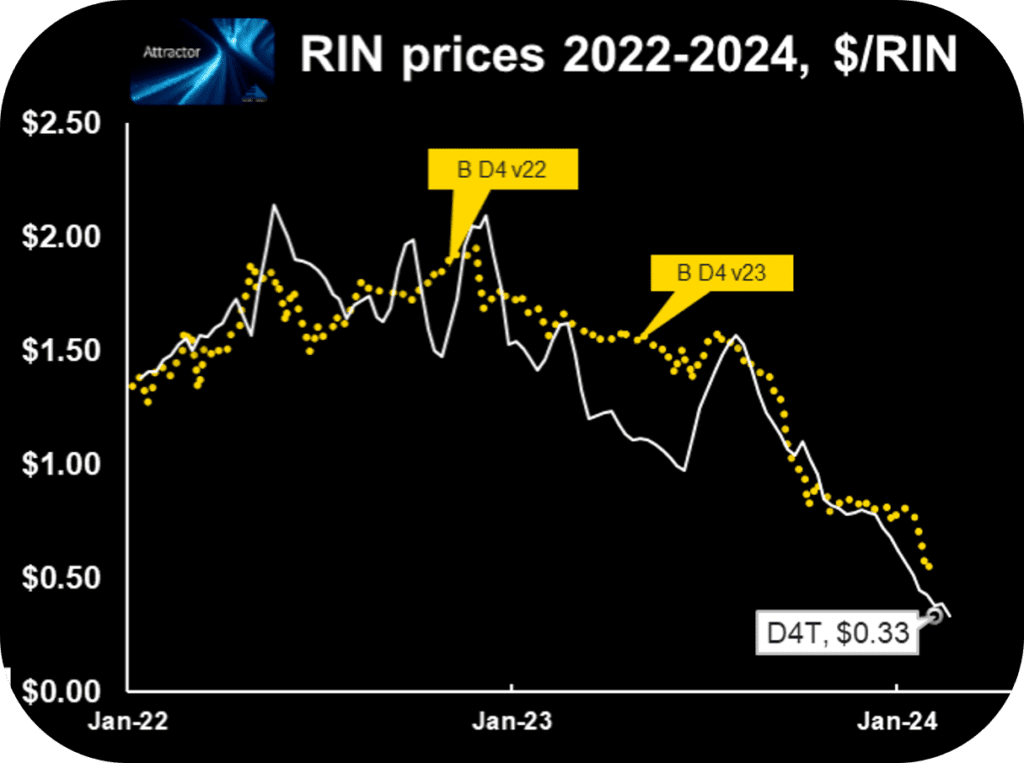

D4T – The world’s first licensed theoretical value of an environmental credit

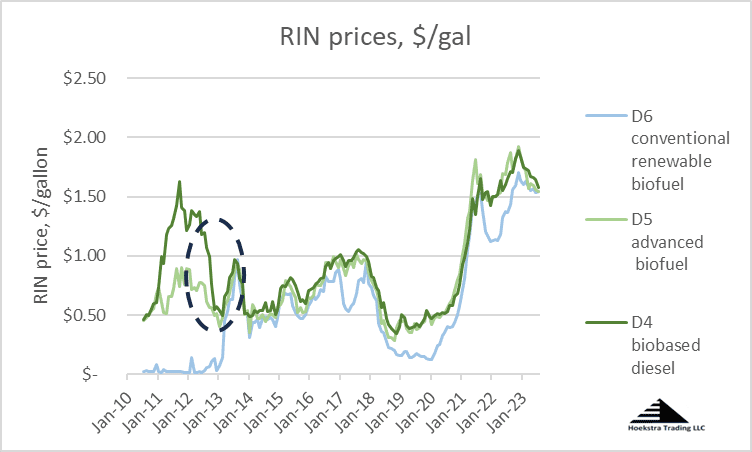

Hoekstra Trading has studied Renewable Identification Number (RIN) pricing and economics since 2020 and reported on this topic in our Annual Research Reports and other publications. The RIN is a complex financial instrument. It is: It is a financial derivative whose value derives from and depends on the prices of other commodities. Like many other…

Read MoreThe Bloomberg Farm, Food, and Fuel Summit – My Top 3 Takeaways

This Summit was held in Kansas City Tuesday and Wednesday this week. I learned a lot about food, farms, and fuels, but my top 3 takeaways were about Bloomberg – here is the countdown: 3) Bloomberg does a wealth of applied research that is valuable to their client companies. 2) Bloomberg client companies should encourage…

Read MoreThe MPC-PSX Stock Price Spread – Update Number Six

Since 2021, I have tracked and reported on the relative performance of Marathon Petroleum (MPC, green) and Phillips 66 (PSX, red) stock on this blog. This is the sixth post in the series. The others are Aug 23 2021, Dec 9 2021, Jan 19 2022, Mar 17 2022, Feb 1 2023. This latest update shows…

Read MoreRINatomy Part 6 – The RIN As A Nested Structure

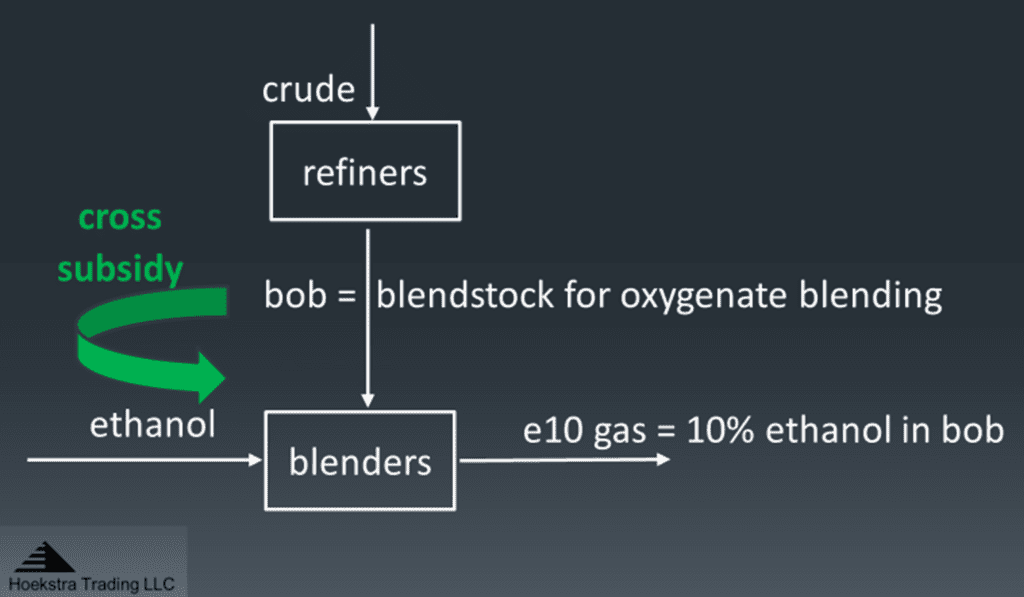

The Renewable Identification Number (RIN) is a nested structure. Anatomy noun, anat·o·my ə-ˈna-tə-mē a study of the structure or inner workings of something This series has described the RIN as a subsidy, a tax, a mandate, an asset, and an option, all in one package. That makes the RIN by far the most complex environmental…

Read MoreRINatomy Part 5 – The RIN As A Contingent Claim

The Renewable Identification Number (RIN) is an option. Anatomy noun, anat·o·my ə-ˈna-tə-mē a study of the structure or inner workings of something Read other posts in this series RINatomy – Quoting Wikipedia, In finance, a contingent claim is a derivative whose future payoff depends on the value of another “underlying” asset. Wikipedia It is a…

Read MoreRINatomy Part 4 – The RIN As An Asset

A Renewable Identification Number (RIN), in addition to being a subsidy, a tax, and a mandate, is a financial asset. Anatomy noun, anat·o·my ə-ˈna-tə-mē a study of the structure or inner workings of something Read other posts in this series RINatomy – A coupon is not considered an asset. Neither is a sales tax, or…

Read MoreRINatomy Part 3 – The RIN As A Mandate

RINs come in different categories, some of which have associated with them a mandated annual volume of biofuel that, by law, must be supplied to the U.S. market. Anatomy noun, anat·o·my ə-ˈna-tə-mē a study of the structure or inner workings of something Read other blogs in this series: RINatomy: The D4 RIN is designed to…

Read MoreBaby the RIN Must Fall Part 3 – The Odds and Timing of a Potential RIN Price Crash

An edited version of this post was published on the RBN Energy Daily Blog Aug 30, 2023. Read other blogs in this series Baby The RIN Must Fall – U.S. production of hydrogenated renewable diesel (RD), which is made from soybean oil, animal fats and used cooking oil, is growing faster than expected. That may…

Read MoreWelcome to the Future – Part 3, With Tier 3 Costs Sky-High, U.S. Refiners Consider Investments, Alternatives

When the price of the Tier 3 sulfur credit hit a new high of $3,600 in October 2023, this tradable sulfur credit moved from the background to center stage in refining circles. That’s because the $3,600 price marked a 10-fold increase over 2 years and translated to a Tier 3 compliance cost of $3/barrel for…

Read MoreRINatomy Part 2 – The RIN As A Tax

A Renewable Identification Number (RIN) is an environmental credit that is part of a price control system that manipulates the prices of fuel components to force otherwise non-economic biofuels into the US fuel supply. Anatomy noun, anat·o·my ə-ˈna-tə-mē a study of the structure or inner workings of something Read other blogs in this series RINatomy:…

Read More