RIN Price Nosedive Part 2 — Was it Foreseen? What Was The Cause? Will It Continue?

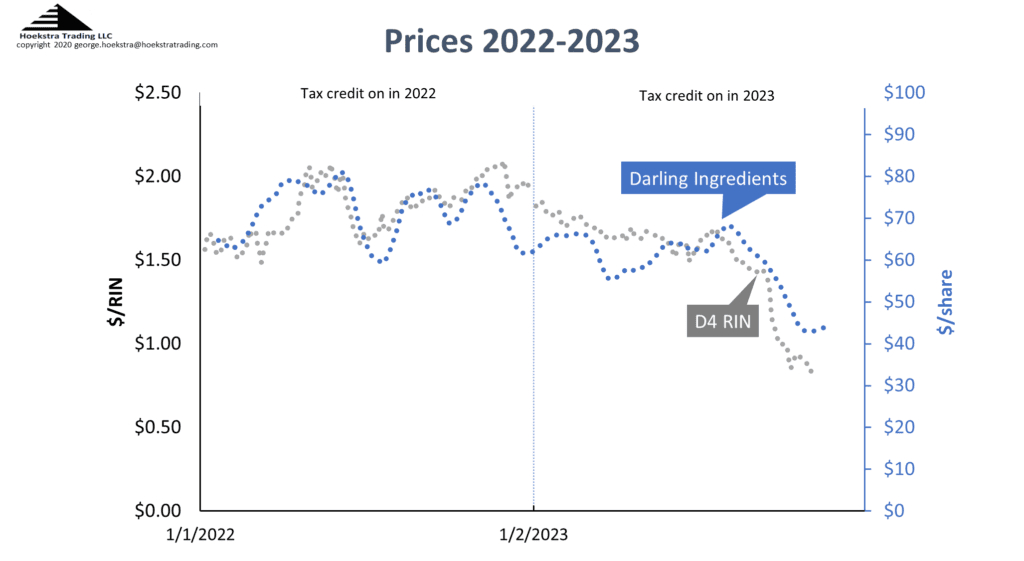

The question and answer segment of Darling Ingredients’ Nov 8, 2023 earnings conference call was dominated by questions about the outlook for renewable diesel margins. This focus was triggered by last quarter’s 50% D4 RIN price nosedive and a corresponding nosedive in Darling’s stock price as seen on the right hand side of this 2-year price chart:

Read Other Blogs In This Series

- Part 1 C-Suites Questioned On RIN Price Nosedive

- Part 2 Was It Foreseen, What Was The Cause, Will It Continue?

- Part 3 It Was Foreseen, It’s Cause Was Competition, And it Will Continue

- Part 4 A Nosedive Is One Thing, A Cliff Is Another

- Part 5 Dissecting the 2023 RIN Price Nosedive

Darling’s conference calls are rich with insight about the fundamentals of their very interesting business. They thoroughly understand the global supply chains for renewable diesel feedstocks like soybean oil, used cooking oil, distillers corn oil, fats and greases. Darling’s deep experience and insights on the fundamental technical and economic aspects of these supply chains are very interesting to those of us bored by the humdrum pipes that have fed black oil to our refineries for 100 years.

Factors affecting renewable diesel margin are the value of the renewable diesel product, the costs of the different feedstocks, the yields and operating costs for converting those feeds to renewable diesel, the costs to deliver the product to different markets and the constantly changing federal, state, and local tax credits and subsidies which underpin the profitability of the business.

Because the feed supply and and product distribution chains are global, a seaport location with access to global shipping is a big competitive advantage. The Diamond Green Diesel partnership between Darling and Valero integrates Darling’s feedstock supply with Valero’s refining and fuels capabilities, providing economies of scale and reducing technical and financial risks.

The ability to supply and convert many different feeds enables optimization as markets, feed supplies and price differentials change. Darling, Valero, and Diamond Green Diesel have learned that processing of high margin feeds is difficult, causing frequent process disruptions.

Quarterly margins fluctuate with volatile, lagging feed and product prices. Government subsidies are constantly changing. These variations cause volatility in the factors affecting margins and quarterly results. Futures markets are used to hedge against this volatility.

Billions of dollars have been invested in new and converted plants to grow renewable diesel and sustainable aviation fuel production. The new plants are unlikely to all start up and come to full capacity as quickly as originally expected. Some new producers purchased feed volumes they had to resell because the plants were not ready. Some over-promised and/or cut corners and have stumbled.

All the above points are relevant and interesting takeaways from discussions of the renewable diesel business that occured in this quarter’s round of refining earnings conference calls.

But one thing missing was a good answer to a 3-part question of immediate interest to investors:

- Were you surprised by last quarter’s 50% collapse of the D4 RIN price?

- What caused that collapse?

- What assurance can you provide it won’t collapse further?

The executive teams have deep knowledge of the fundamental aspects of their business which enables them to confidently explain performance volatility and foresee coming risks. But there is one glaring weakness – they lack deep knowledge of the fundamental economics of RIN pricing, and that weakness keeps blindsiding them.

Conclusions

From responses to questions in earnings conference calls since July:

- There is no evidence refining executives anticipated the 3rd quarter D4 RIN price nosedive

- Their efforts to explain the D4 RIN price nosedive are weak

- There is no basis for investor confidence in refiners’ ability to anticipate future RIN price stability

Recommendation

Time for a second opinion on what drives RIN prices. Better answers to the 3-part question can be given. Anyone with a stake in RINs pricing and economics should get Hoekstra Research Report 10 which includes the Hoekstra IMS RIN pricing spreadsheet that calculates theoretical D4 RIN values using the Irwin-McCormack-Stock (IMS) RIN price model (black line on chart below) based on economic fundamentals, tracks them versus actual prices (silver and gold data points), predicts how the D4 RIN price will change with the variables that affect it, includes 6 months of unlimited consultation by phone and E-mail, and is available to anyone immediately at negligible cost.

It is not a monthly newsletter, it is a research report based on millions of dollars of academic work on RIN fundamentals that will give you a new perspective on RIN pricing and economics, unique insights and practical tools your company can use to better track, interpret and anticipate RIN price movements. Here’s the offer letter including the Table of Contents and a sample invoice with all the information needed to prepare a purchase order. Why not send a purchase order today?

Reliable Attractor

The Hoekstra IMS RINs pricing spreadsheet shows the D4 RIN market price (gold and silver points) and the theoretical D4 RIN value updated through Friday November 10, 2023. The theoretical value of a hypothetical D4 RIN with 1 year remaining life is $0.75.

Hoekstra Trading clients use this spreadsheet to compare theoretical and market prices, analyze departures from theoretical value, and identify trading opportunities on the premise RIN market prices will be attracted toward their fundamental economic values.

George Hoekstra george.hoekstra@hoekstratrading.com +1 630 330-8159