Posts by Hoekstra Trading LLC

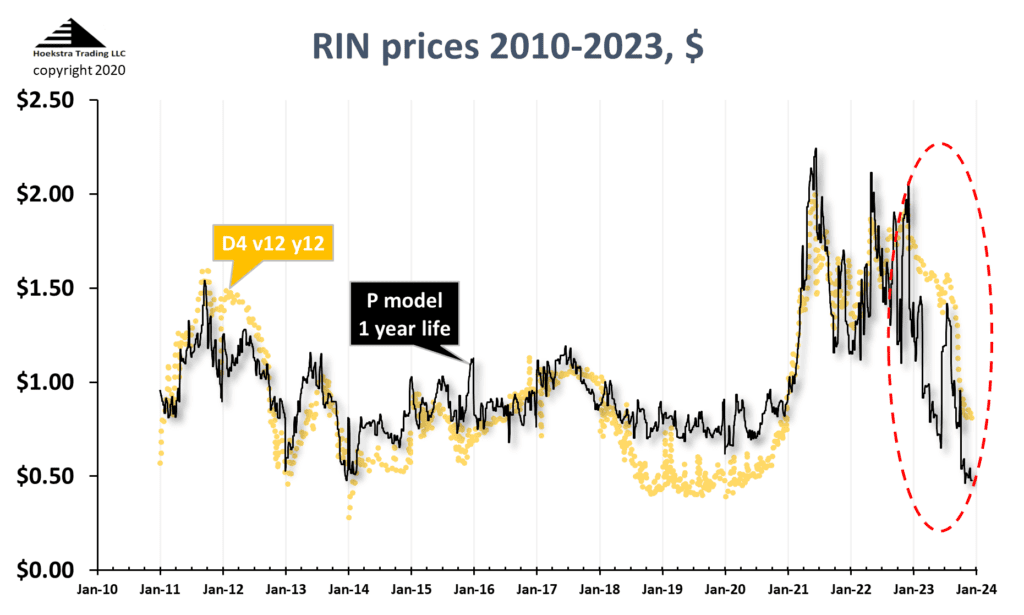

D4 Renewable Identification Number (RIN) Theoretical Price Drops To 66 cents

The Attractor RIN price model is a spreadsheet that calculates the theoretical value of the D4 Renewable Identification Number (RIN) using Hoekstra Trading’s spreadsheet application of the Irwin-McCormack-Stock (IMS) pricing model and our best estimates of the values of the fundamental economic variables that determine the D4 RIN value. Figure 1. Attractor D4 RIN Price…

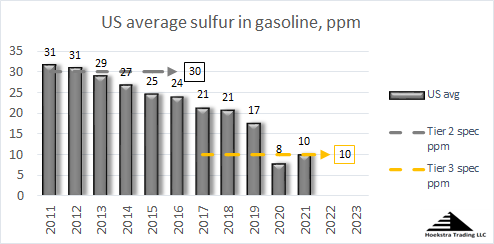

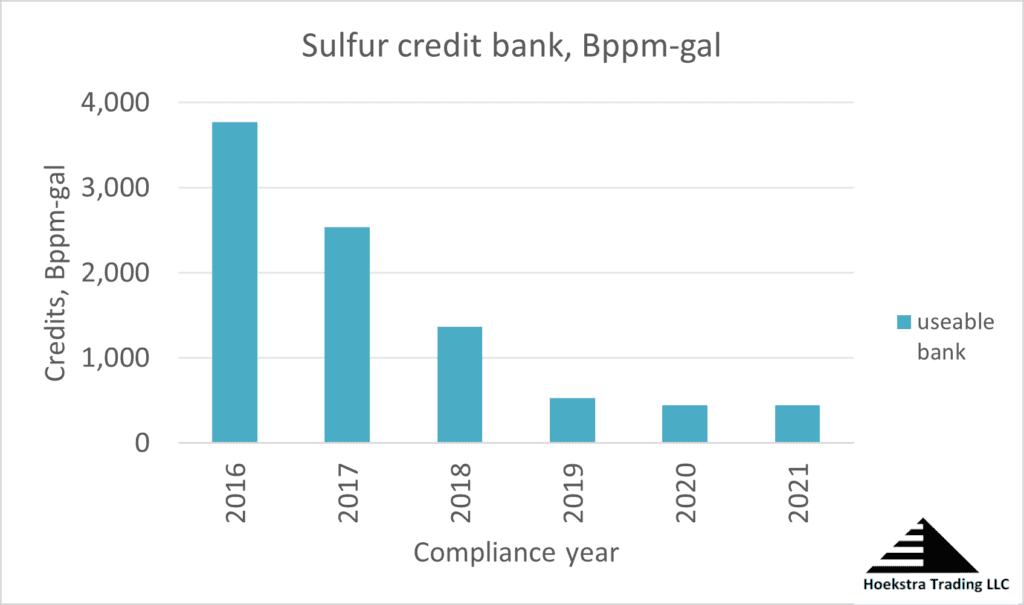

Read MoreWelcome to the Future – Part 2 – High cost of gasoline sulfur specification draws attention from refiners and financial analysts

The price of the Tier 3 gasoline sulfur credit hit $3,600 in October, up by a factor of 10 since 2022. The high price of this credit is a direct indicator of the true cost of compliance with the Tier 3 gasoline sulfur standard and has raised attention recently in refining and financial circles. In today’s…

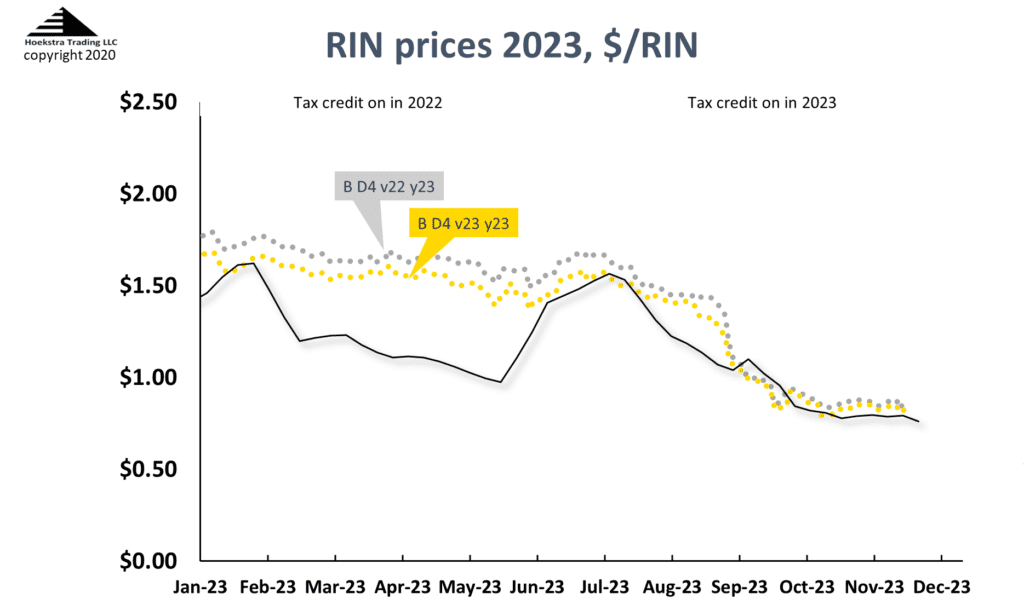

Read MoreRIN Price Nosedive Part 5 – Dissecting The 2023 RIN Price Nosedive

The ATTRACTOR RIN price model is a spreadsheet that calculates the theoretical value of the D4 Renewable Identification Number (RIN) and enables users to study theoretical vs. market RIN prices. The theoretical value is calculated using Hoekstra Trading’s spreadsheet application of the Irwin-McCormack-Stock (IMS) pricing model which is based on fundamental economic theory. Read other…

Read MoreRIN Price Nosedive Part 4 – A Nosedive Is One Thing, A Cliff Is Another

In theory, a higher price for a commodity will attract new suppliers into the market who would not be profitable at a lower price. For that reason, a chart of “supply price” versus “quantity supplied” is upward sloping from left to right. Conversely, a higher price will chase away some consumers for whom the product…

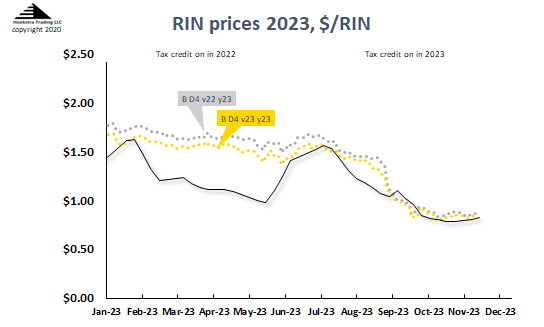

Read MoreRIN Price Nosedive Part 3 – It WAS Foreseen, It’s Cause Was COMPETITION, And It WILL Continue

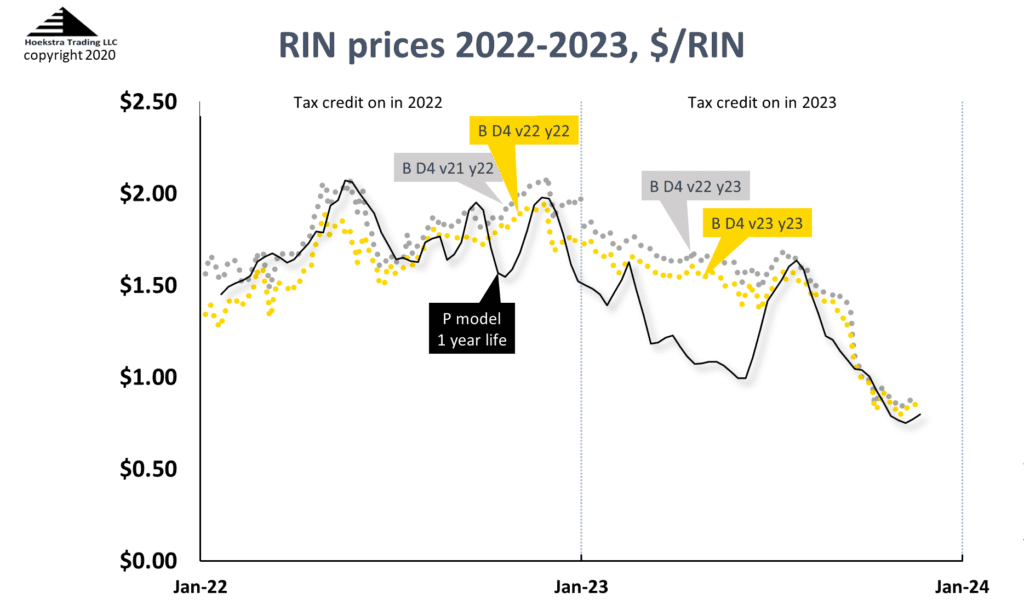

From January 2023, Hoekstra Trading clients were analyzing and acting on the growing gap between the D4 RIN theoretical value and its quoted market price. Starting in February, a series of 12 articles on renewable diesel supply was published by University of Illinois economists with quantitative supply/demand analyses and explanations of the theory behind a…

Read MoreWelcome to the Future – Part 1 – Sulfur credit Investments Pay Off 10-Fold For Forward-Looking Refiners

Last month, the price of the Tier 3 gasoline sulfur credit hit a new high of $3,600 per credit, up by a factor of 10 from 2 years ago. This tradable credit allows refiners to sell gasoline that exceeds the 10 ppm sulfur specification on gasoline sold in the United States. In today’s blog, we…

Read MoreSREs = Sustainable Revenues for Expensive lawyers

Will it ever end? What’s the effect on RIN prices? What’s the cost? The acronym SRE is something you will see a lot if you follow the world of renewable fuels and Renewable Identification Numbers (RINs). SRE means Sustainable Revenues for Expensive lawyers. It involves a dispute about Small Refinery Exemptions granted during the Trump…

Read MoreAttractor – A RIN Price Model That Accurately Calculates RIN Prices

Hoekstra Trading’s Attractor RIN price model is a spreadsheet that calculates the theoretical value of the D4 Renewable Identification Number (RIN) and enables the user to study theoretical vs. market RIN prices. The theoretical value is calculated using Hoekstra Trading’s spreadsheet application of the Irwin-McCormack-Stock (IMS) equation which is based on fundamental economic theory The…

Read MoreRIN Price Nosedive Part 2 — Was it Foreseen? What Was The Cause? Will It Continue?

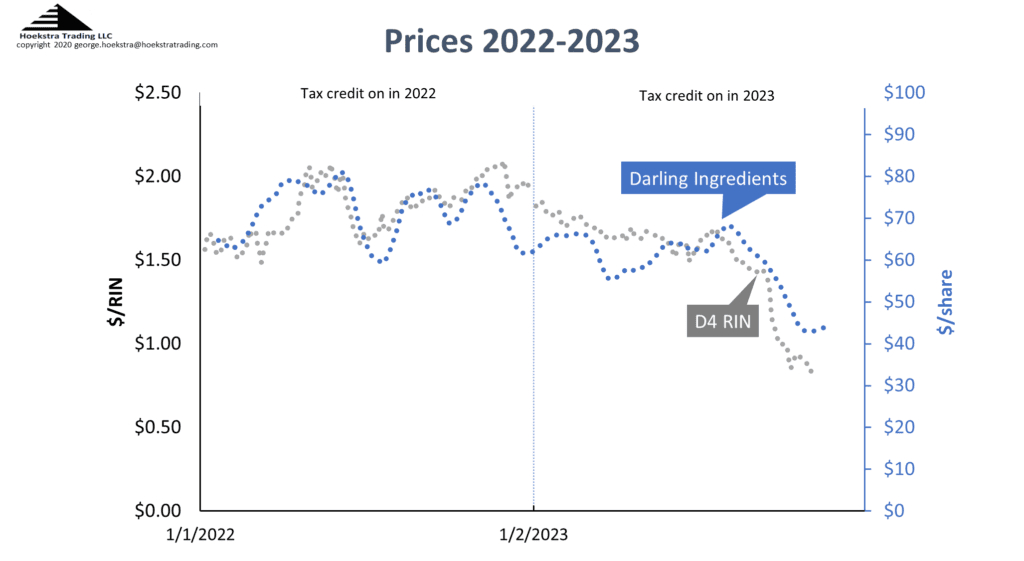

The question and answer segment of Darling Ingredients’ Nov 8, 2023 earnings conference call was dominated by questions about the outlook for renewable diesel margins. This focus was triggered by last quarter’s 50% D4 RIN price nosedive and a corresponding nosedive in Darling’s stock price as seen on the right hand side of this 2-year…

Read MoreRINs and Stock Prices – Financial Analysts Grill C-Suite Executives

The recent nosedive in the price of Renewable Identification Number (RIN) credits, from $1.60 to 80 cents, has financial analysts asking refining executives how falling RIN prices might affect their future profits. For example, from last week: How do you see the RIN dynamics impacting your renewable product sales margin considering the renewable volume obligation…

Read More