Posts by Hoekstra Trading LLC

Modeling RINs As An Option – Part 2

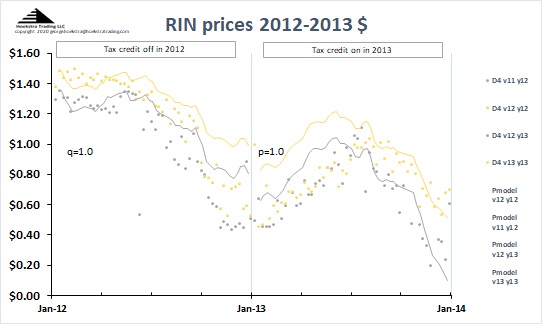

Also see Part 1 of this series In Figure 1, the silver points represent the price of D4 RINs that expire at the end of that trading year (2012), and the gold points represent RINs that expire at the end of the next trading year (2013). The lines are calculated by the Hoekstra Trading RIN…

Read MoreEconomics of Octane Loss In Gasoline Desulfurizers

With gasoline margins surprisingly strong, refiners are focusing on economic costs and opportunities in cracked gasoline desulfurization. These opportunities come in the categories: feed, catalyst, process, sulfur credits, laboratory tools, revamps, and new investment opportunities. Many of them can be captured quickly with no capital investment. This segment of the RefComm 2023 FCC program will…

Read MoreWhat Has Quintupled? Multiple Choice:

A. Octane value B. Gasoline sulfur credit price C. U.S. gasoline exports D. Octane-barrel destruction in U.S. gasoline desulfurizers E. Reformate price premium F. All the above The answer is F, all the above. The hidden cause that links them is the Tier 3 gasoline sulfur specification. Recommendation: Read this short book to quickly become…

Read MoreInvestment alternatives for clean gasoline production in a volatile fuels market

This economic analysis presents investment costs and returns for a hypothetical refinery with a 55,000 barrel/day fluid catalytic cracker (FCC) in a market that will adopt a new 30-ppm clean sulfur gasoline specification. The refinery’s current FCC naphtha, which has been suitable for use in gasoline, will then be too high in sulfur for that…

Read MoreNo let-up in rising U.S. octane values

The relentless rise in octane value is seen in the U.S. average retail premium-regular pump price differential, expressed here in units of $ per octane-gallon, up to date through today: To convert this number to actual pump price differential in $/gallon, multiply by 6 octane (=93-87). The building pressure on octane cost is also seen…

Read MoreModeling RINs as an option – Part 1

Also see Part 2 of this series This chart shows the price of D4 Renewable Identification Numbers (RINs) traded in 2012 and 2013. The data is from the EPA’s Moderated Transaction System. RINs expire at the end of the year following the calendar year of their creation. In Figure 2, the silver data points represent…

Read MoreQuantifying investment options for Tier 3 ultra-low sulfur gasoline

Hoekstra Trading LLC collaborated with Dr. Marcio Wagner Da Silva of Petrobras and Dr. Thomas Murphy of Valuation Risk & Strategy LLC in this article on economics of investment options for Tier 3 gasoline. Read the article in Hydrocarbon Processing February 2023 Recommendation Every refining executive should have a comprehensive understanding of the technical, regulatory,…

Read MoreThe MPC-PSX stock price spread continues growing

This chart shows a steadily growing gap between the price of Marathon Petroleum Company stock (MPC, in green) and Phillips 66 stock (PSX, in red) since the first trading day of 2021. Since the summer of 2021, I have been pointing to this gap and saying it will continue to grow because it is caused…

Read MoreBreaking the chains part 3 – Late demand for Tier 3 credits drives credit price up 5-fold in 2022

If you buy premium gasoline you’ve probably noticed its price differential versus regular has been increasing. That is a sign of the rising value of octane which is the primary yardstick of gasoline quality and price. This blog series is about a new gasoline sulfur specification called Tier 3 which is causing lower octane quality…

Read MoreBreaking the Chains Part 2 – solutions for the Tier 3 gasoline octane-sulfur bottleneck

A meeting in Washington D.C. In June 2022, U.S. Secretary of Energy Jennifer Granholm called senior refining executives to Washington DC asking for their recommendations on how to increase gasoline supply from U.S. refineries. To our knowledge, the only recommendation coming from that meeting was to relax sulfur specifications on fuels, including the new Tier 3…

Read More